主要介绍基于回测框架实现格雷厄姆模型。格雷厄姆模型分为两步,首先是条件选股,其次按照市值从小到大排序,选出排名前五的股票。 可在这里直接下载策略源代码。

我们选择如下指标,对全市场的股票进行筛选,实现过程如下: a. 首先在数据准备模块save_dataview()中通过props设置数据起止日期,股票版块,以及所需变量

props = {

'start_date': 20150101,

'end_date': 20170930,

'universe':'000905.SH',

'fields': ('tot_cur_assets,tot_cur_liab,inventories,pre_pay,deferred_exp, eps_basic,ebit,pe,pb,float_mv,sw1'),

'freq': 1

}b. 接着创建0-1变量表示某只股票是否被选中,并通过add_formula将变量添加到dataview中

- 市盈率(pe ratio)低于 20

- 市净率(pb ratio)低于 2

- 同比每股收益增长率(inc_earning_per_share)大于 0

- 税前同比利润增长率(inc_profit_before_tax)大于 0

- 流动比率(current_ratio)大于 2

- 速动比率(quick_ratio)大于 1

factor_formula = 'pe < 20'

dv.add_formula('pe_condition', factor_formula, is_quarterly=False)

factor_formula = 'pb < 2'

dv.add_formula('pb_condition', factor_formula, is_quarterly=False)

factor_formula = 'Return(eps_basic, 4) > 0'

dv.add_formula('eps_condition', factor_formula, is_quarterly=True)

factor_formula = 'Return(ebit, 4) > 0'

dv.add_formula('ebit_condition', factor_formula, is_quarterly=True)

factor_formula = 'tot_cur_assets/tot_cur_liab > 2'

dv.add_formula('current_condition', factor_formula, is_quarterly=True)

factor_formula = '(tot_cur_assets - inventories - pre_pay - deferred_exp)/tot_cur_liab > 1'

dv.add_formula('quick_condition', factor_formula, is_quarterly=True)需要注意的是,涉及到的财务数据若不在secDailyIndicator表中,需将is_quarterly设置为True,表示该变量为季度数据。 c. 由于第二步中需要按流通市值排序,我们将这一变量也放入dataview中

dv.add_formula('mv_rank', 'Rank(float_mv)', is_quarterly=False)条件选股在my_selector函数中完成:

- 首先我们将上一步计算出的0/1变量提取出来,格式为Series

- 接着我们对所有变量取交集,选中的股票设为1,未选中的设为0,并将结果通过DataFrame形式返回

def my_selector(context, user_options=None):

#

pb_selector = context.snapshot['pb_condition']

pe_selector = context.snapshot['pe_condition']

eps_selector = context.snapshot['eps_condition']

ebit_selector = context.snapshot['ebit_condition']

current_selector = context.snapshot['current_condition']

quick_selector = context.snapshot['quick_condition']

#

merge = pd.concat([pb_selector, pe_selector, eps_selector, ebit_selector, current_selector, quick_selector], axis=1)

result = np.all(merge, axis=1)

mask = np.all(merge.isnull().values, axis=1)

result[mask] = False

return pd.DataFrame(result, index=merge.index, columns=['selector'])按市值排序功能在signal_size函数中完成。我们根据流通市值排序变量'mv_rank'对所有股票进行排序,并选出市值最小的5只股票。

def signal_size(context, user_options = None):

mv_rank = context.snapshot_sub['mv_rank']

s = np.sort(mv_rank.values)[::-1]

if len(s) > 0:

critical = s[-5] if len(s) > 5 else np.min(s)

mask = mv_rank < critical

mv_rank[mask] = 0.0

mv_rank[~mask] = 1.0

return mv_rank我们在test_alpha_strategy_dataview()模块中实现回测功能

该模块首先载入dataview并允许用户设置回测参数,比如基准指数,起止日期,换仓周期等。

dv = DataView()

fullpath = fileio.join_relative_path('../output/prepared', dv_subfolder_name)

dv.load_dataview(folder=fullpath)

props = {

"benchmark": "000905.SH",

"universe": ','.join(dv.symbol),

"start_date": dv.start_date,

"end_date": dv.end_date,

"period": "week",

"days_delay": 0,

"init_balance": 1e8,

"position_ratio": 1.0,

}接着我们使用StockSelector选股模块,将之前定义的my_selector载入

stock_selector = model.StockSelector(context)

stock_selector.add_filter(name='myselector', func=my_selector)在进行条件选股后,使用FactorRevenueModel模块对所选股票进行排序

signal_model = model.FactorRevenueModel(context)

signal_model.add_signal(name='signalsize', func = signal_size)将上面定义的stockSelector和FactorRevenueModel载入AlphaStrategy函数进行回测

strategy = AlphaStrategy(

stock_selector=stock_selector,

revenue_model=signal_model,

pc_method='factor_value_weight')t_start = time.time()

test_save_dataview()

test_alpha_strategy_dataview()

test_backtest_analyze()

t3 = time.time() - t_start

print "\n\n\nTime lapsed in total: {:.1f}".format(t3)回测的参数如下:

| 指标 | 值 |

|---|---|

| Beta | 0.87 |

| Annual Return | 0.08 |

| Annual Volatility | 0.29 |

| Sharpe Ratio | 0.28 |

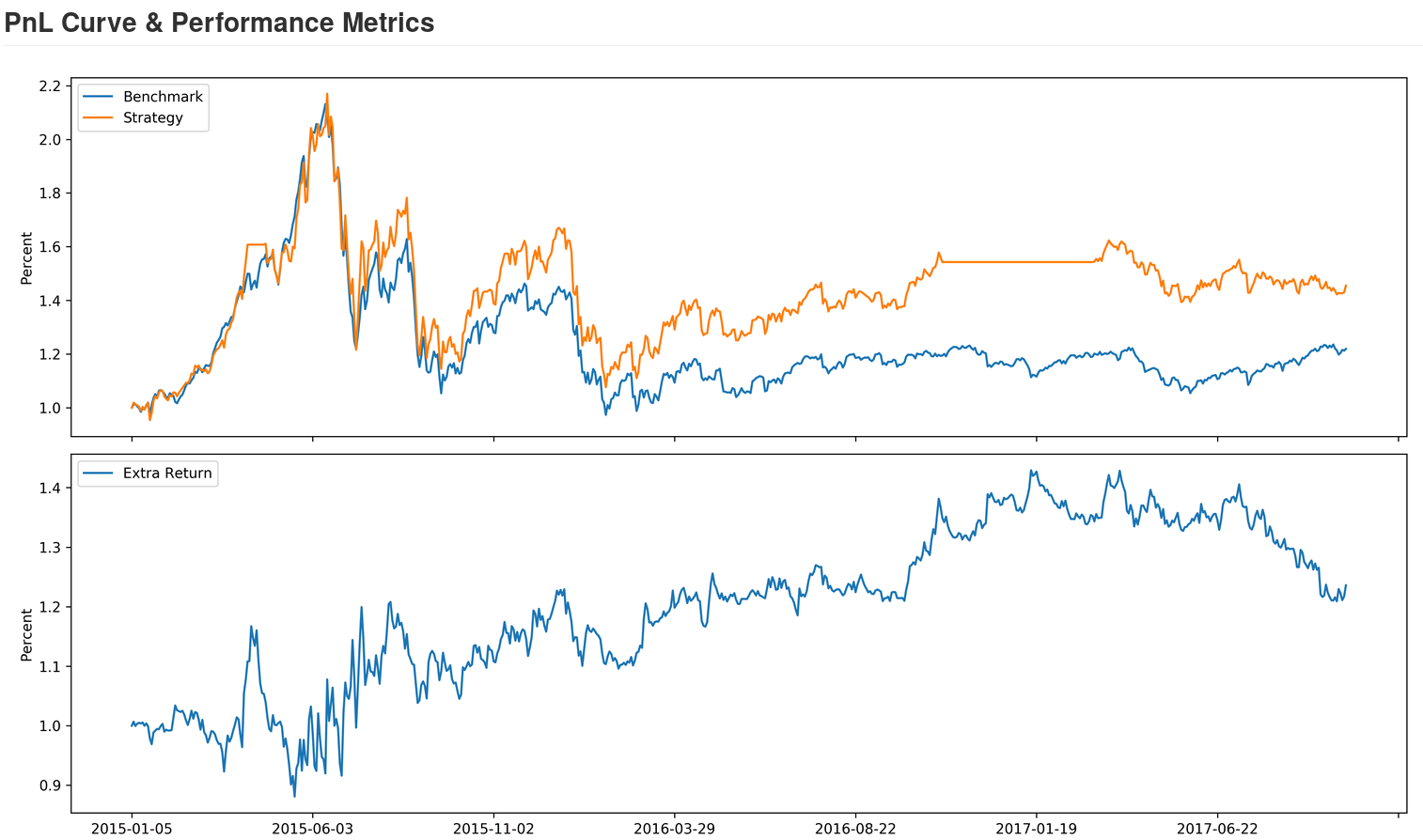

回测的净值曲线图如下: