Name

Ichimoku云带策略优化A-Trend-Strategy-Optimization-Based-On-Ichimoku-Cloud-Chart

Author

ChaoZhang

Strategy Description

该策略是一个结合一云图指标和多种辅助指标的趋势跟踪策略。主要使用一云图判断趋势方向,辅以MACD,CMF,TSI等指标进行过滤,以提高信号质量。这是一个多因素综合判断的强势趋势策略。

该策略主要利用一云图的变换来判断趋势方向。当天线上穿云带时做多,下穿云带时做空。同时结合备胎线、MACD柱形图、资金流指标CMF和真实力指数TSI来进行多层过滤,确保信号质量。

具体来说,做多信号的触发条件是:

- 天线上穿云带

- 云带较宽,转向线在基准线之上

- 延迟线在0轴之上

- 收盘价在云带之上

- MACD柱形图在0轴之上

- CMF大于0.1

- TSI在0轴之上

做空信号的触发条件则为上述条件的相反。这样通过多种指标的综合判断,能有效过滤掉大部分假信号,锁定市场的主要趋势。

该策略最大的优势在于多指标组合滤掉假信号,抓住强势趋势。具体来说,主要有以下几个优势:

- 一云图判断主趋势方向,确保大方向正确

- 辅助指标进一步过滤信号,减少交易风险

- 全面考量多时间周期因素,信号更加可靠

- 条件严格,只交易高质量信号,避免平淡市

- 结合趋势跟踪,最大限度锁定趋势利润

通过上述综合判断,策略可以有效抓住股市的中长线热点板块,进行趋势跟踪套利,获得丰厚的超额收益。

该策略主要面临以下几个方面的风险:

- 假突破风险。当价格出现假突破时候,容易产生错误信号。

- 趋势反转风险。股票运行具有规律性,长跑必有回头,存在损失全部盈利的可能。

- 交易频率偏低风险。条件较为严格,可能错过部分机会。

对应降低风险的方法有:

- 适当放宽过滤条件,增加交易频率。

- 增加止损条件,避免亏损扩大。

- 优化参数,提高信号准确率。

该策略主要可以从以下几个方面进行优化:

-

参数优化。可以通过更多回测数据对参数进行优化,找到更佳参数组合。

-

增加止损机制。适当放宽入场条件,但设置止损来控制风险。

-

增加移动止损。利用趋势跟踪止损来锁定利润,避免反转损失。

-

优化过滤指标。可以测试更多指标,找到更好的组合过滤信号。

-

增加自动识别突破真伪的规则。避免追高杀跌的风险。

该策略综合运用一云图与多种辅助指标判断效果显著。通过参数优化、止损机制改进、指标优化等手段,可以进一步增强策略稳定性,提高信号质量,获得更高的稳定收益。该策略具有较强的实用性。

||

This strategy combines Ichimoku cloud chart with various auxiliary indicators to track the trends. It mainly uses Ichimoku cloud to determine the trend direction and MACD, CMF, TSI and other indicators for filtering to improve the signal quality. This is a strong trend strategy based on comprehensive judgments of multiple factors.

This strategy mainly utilizes the transformation of Ichimoku cloud to judge the trend direction. It goes long when the Tenkan-sen crosses above the cloud and goes short when the Tenkan-sen crosses below. Meanwhile, it uses Chikou Span, MACD histogram, CMF and TSI for multi-layer filtering to ensure the signal quality.

Specifically, the long signal is triggered when:

- Tenkan-sen crosses above the cloud

- The cloud is wide and Tenkan-sen is above Kijun-sen

- Chikou Span is above the 0-line

- The closing price is above the cloud

- MACD histogram is above 0

- CMF is greater than 0.1

- TSI is above 0

The short signal is triggered when the above conditions are reversed. By such comprehensive criteria, most of the false signals can be filtered out and the major trends in the market are captured.

The biggest advantage of this strategy is filtering out false signals and catching strong trends by combining multiple indicators. Specifically:

- Ichimoku cloud determines the major trend direction

- Auxiliary indicators further filter out signals and reduce risks

- Comprehensively considers multiple timeframes for more reliable signals

- Strict rules to trade only high quality setups and avoid choppy markets

- Trend following mechanism to maximize trend profits

Through such judgments, the strategy can effectively identify the mid-long term hot sectors and profit from trend trading.

The main risks of this strategy include:

- False breakout risk causing wrong signals

- Trend reversal risk leading to the loss of all profits

- Relatively low trading frequency missing opportunities

Solutions:

- Relax filtering criteria properly to increase trade frequency

- Add stop loss condition to limit loss size

- Optimize parameters to improve signal accuracy

The main optimization directions:

-

Parameter optimization through more backtests to find better parameter combination

-

Add stop loss mechanism to control risks

-

Add trailing stop loss to lock in profits

-

Test more indicators to find better filter combination

-

Add rules to distinguish real breakout

This strategy effectively combines Ichimoku cloud and multiple auxiliary indicators. Further improvements on parameter optimization, stop loss mechanism, indicator selection can enhance the stability and signal quality for higher steady returns. The strategy has strong practical value.

[/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_1 | 10 | Tenkan-Sen Bars |

| v_input_2 | 30 | Kijun-Sen Bars |

| v_input_3 | 52 | Senkou-Span B Bars |

| v_input_4 | 26 | Chikou-Span Offset |

| v_input_5 | 26 | Senkou-Span Offset |

| v_input_6 | true | Long Entry |

| v_input_7 | true | Short Entry |

| v_input_8 | 17 | Fast Length |

| v_input_9 | 28 | Slow Length |

| v_input_10_close | 0 | Source: close |

| v_input_11 | 5 | Signal Smoothing |

| v_input_12 | true | Simple MA(Oscillator) |

| v_input_13 | true | Simple MA(Signal Line) |

| v_input_14 | 8 | CMF Length |

| v_input_15 | 8 | Long Length |

| v_input_16 | 8 | Short Length |

Source (PineScript)

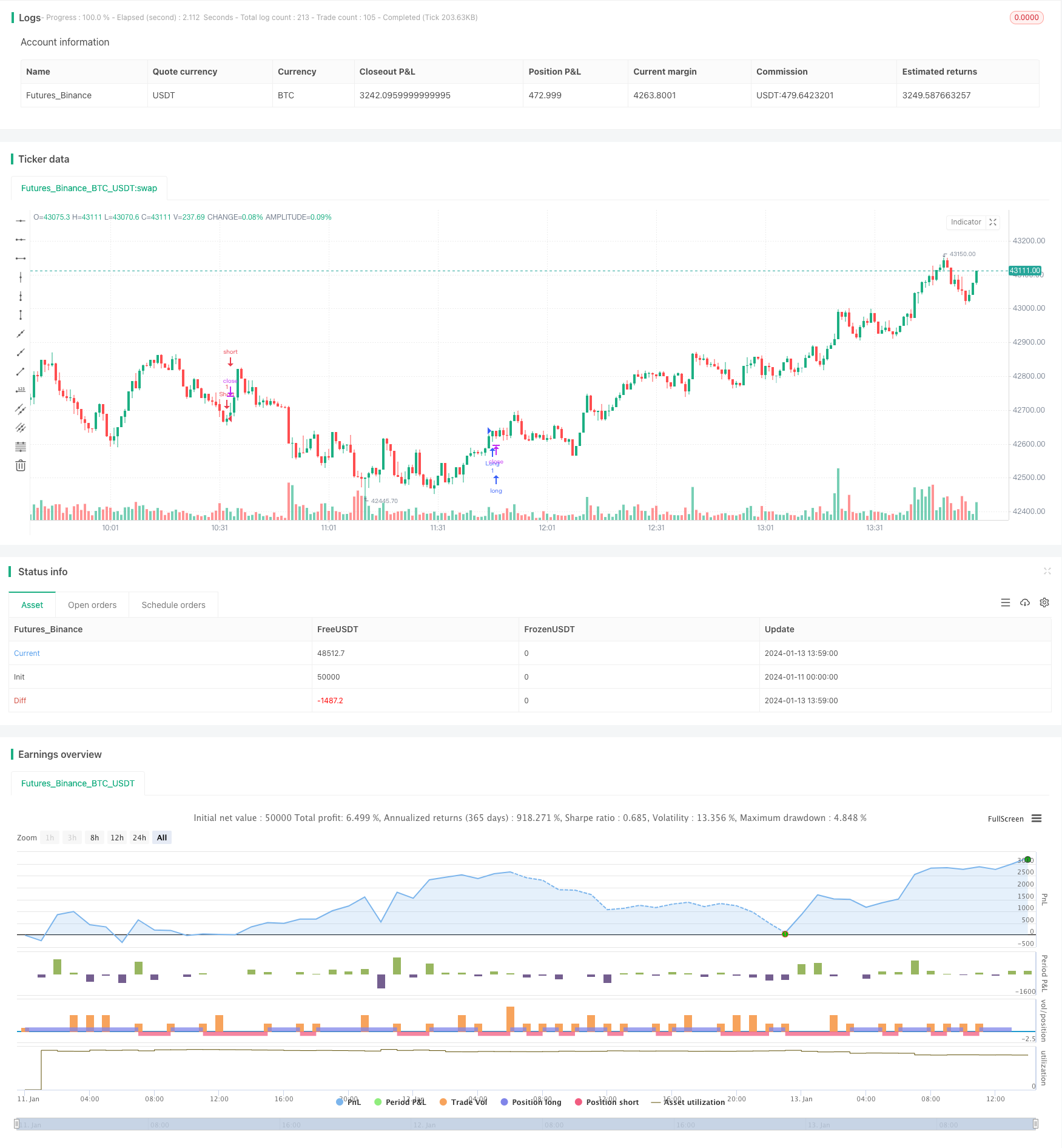

/*backtest

start: 2024-01-11 00:00:00

end: 2024-01-13 14:00:00

period: 1m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © exlux99

//@version=4

strategy("Ichimoku with MACD/ CMF/ TSI", overlay=true, margin_long=0, margin_short=0)

//Inputs

ts_bars = input(10, minval=1, title="Tenkan-Sen Bars")

ks_bars = input(30, minval=1, title="Kijun-Sen Bars")

ssb_bars = input(52, minval=1, title="Senkou-Span B Bars")

cs_offset = input(26, minval=1, title="Chikou-Span Offset")

ss_offset = input(26, minval=1, title="Senkou-Span Offset")

long_entry = input(true, title="Long Entry")

short_entry = input(true, title="Short Entry")

middle(len) => avg(lowest(len), highest(len))

// Ichimoku Components

tenkan = middle(ts_bars)

kijun = middle(ks_bars)

senkouA = avg(tenkan, kijun)

senkouB = middle(ssb_bars)

ss_high = max(senkouA[ss_offset-1], senkouB[ss_offset-1])

ss_low = min(senkouA[ss_offset-1], senkouB[ss_offset-1])

// Entry/Exit Signals

fast_length = input(title="Fast Length", type=input.integer, defval=17)

slow_length = input(title="Slow Length", type=input.integer, defval=28)

src = input(title="Source", type=input.source, defval=close)

signal_length = input(title="Signal Smoothing", type=input.integer, minval = 1, maxval = 50, defval = 5)

sma_source = input(title="Simple MA(Oscillator)", type=input.bool, defval=true)

sma_signal = input(title="Simple MA(Signal Line)", type=input.bool, defval=true)

// Calculating

fast_ma = sma_source ? sma(src, fast_length) : ema(src, fast_length)

slow_ma = sma_source ? sma(src, slow_length) : ema(src, slow_length)

macd = fast_ma - slow_ma

signal = sma_signal ? sma(macd, signal_length) : ema(macd, signal_length)

hist = macd - signal

tk_cross_bull = tenkan > kijun

tk_cross_bear = tenkan < kijun

cs_cross_bull = mom(close, cs_offset-1) > 0

cs_cross_bear = mom(close, cs_offset-1) < 0

price_above_kumo = close > ss_high

price_below_kumo = close < ss_low

//CMF

lengthA = input(8, minval=1, title="CMF Length")

ad = close==high and close==low or high==low ? 0 : ((2*close-low-high)/(high-low))*volume

mf = sum(ad, lengthA) / sum(volume, lengthA)

//TSI

long = input(title="Long Length", type=input.integer, defval=8)

short = input(title="Short Length", type=input.integer, defval=8)

price = close

double_smooth(src, long, short) =>

fist_smooth = ema(src, long)

ema(fist_smooth, short)

pc = change(price)

double_smoothed_pc = double_smooth(pc, long, short)

double_smoothed_abs_pc = double_smooth(abs(pc), long, short)

tsi_value = 100 * (double_smoothed_pc / double_smoothed_abs_pc)

bullish = tk_cross_bull and cs_cross_bull and price_above_kumo and hist > 0 and mf > 0.1 and tsi_value > 0

bearish = tk_cross_bear and cs_cross_bear and price_below_kumo and hist < 0 and mf < -0.1 and tsi_value < 0

strategy.entry("Long", strategy.long, when=bullish and long_entry)

strategy.entry("Short", strategy.short, when=bearish and short_entry)

strategy.close("Long", when=bearish and not short_entry)

strategy.close("Short", when=bullish and not long_entry)

Detail

https://www.fmz.com/strategy/439352

Last Modified

2024-01-19 14:45:21