Name

Ichimoku云图量化策略Ichimoku-Clouds-Quant-Strategy

Author

ChaoZhang

Strategy Description

本策略基于Ichimoku云图指标,结合Tenkan线、Kijun线、先行线和云图,识别多空信号,实现自动化交易。该策略同时结合了标准Ichimoku模型和TradingView策略测试器的自定义功能,适用于新手和有经验的交易者。

该策略使用标准的Ichimoku模型,包括Tenkan线、Kijun线、先行线、云图A线和云图B线。策略通过比较这些线的交叉来判断多空信号。

具体来说,当Tenkan线上穿Kijun线时产生多头信号;当Tenkan线下穿Kijun线时产生空头信号。此外,还会判断交叉时Tenkan线与云图的相对位置,分为强势信号、中性信号和弱势信号三种类型。例如Tenkan线交叉时高于云图两条线,就是强势多头信号。

该策略提供丰富的自定义参数,用户可以自由选择入场和出场信号组合,实现自己的交易策略。

- 结合了Ichimoku模型的先进技术分析功能和TradingView策略测试器的自定义能力

- 提供多种参数设置选择,适合不同风格的交易者

- 实时更新和可视化的云图,清晰判断趋势方向

- 可通过回测数据优化参数,测试策略效果

- Ichimoku模型容易产生假信号,需要结合价格实体判断

- Parameters选项太多,新手容易把自己绕进去

- 云图有滞后性,不适合追涨杀跌

- 回测数据不等于实盘表现,实盘时保持谨慎

- 优化参数,找到最佳参数组合

- 结合其他指标过滤假信号

- 增加止损止盈逻辑,控制单笔交易风险

- 考虑交易品种、周期等条件的影响

- 实盘验证,根据实盘调整参数

Ichimoku云图模型作为新一代技术分析工具,结合TradingView平台的可视化和策略开发功能,为量化交易者提供了强有力的技术支持。本策略充分利用两者优势,建立自动化交易体系。虽然仍需优化空间,但已显示出巨大应用潜力。随着参数调整和功能扩展的不断完善,本策略有望成为主流量化交易策略之一。

||

This strategy is based on the Ichimoku Clouds indicator, combining the Tenkan line, Kijun line, leading line and cloud charts to identify trading signals and automate trading. It integrates both the standard Ichimoku model and the customization functionality of the TradingView strategy tester, suitable for both novice and experienced traders.

The strategy utilizes the standard Ichimoku model, including the Tenkan line, Kijun line, leading line, Senkou A and Senkou B. It identifies trading signals by comparing crosses between these lines.

Specifically, a bullish signal is generated when the Tenkan line crosses above the Kijun line, and a bearish signal when the Tenkan crosses below. Additionally, the relative position of the crossing Tenkan line to the cloud charts is checked to categorize the signals as strong, neutral or weak. For example, if the Tenkan is above both Senkou lines during the cross, it is a strong bullish signal.

The strategy provides extensive customization parameters for users to freely combine entry and exit signals to build their own trading systems.

- Combines the advanced technical analysis of Ichimoku with the customizability of TradingView strategy tester

- Provides various parameter settings for different trading styles

- Real-time visualized cloud charts for clear trend identification

- Parameters can be optimized through backtesting for better performance

- Ichimoku models tend to generate false signals, needs confirmation from candlesticks

- Too many parameter options, easy to confuse novice traders

- Cloud charts have lagging nature, not ideal for chasing surges

- Backtest ≠ live performance, remain cautious when live trading

- Optimize parameters to find best combination

- Add filters with other indicators to screen false signals

- Incorporate stop loss/profit taking to control risk per trade

- Consider impacts of products, timeframes etc.

- Real-trade validation and parameter tuning

As a new generation of technical analysis tools, Ichimoku combined with TradingView's visualization and strategy development capabilities provides powerful support for quant trading. This strategy fully utilizes both to build an automated trading system. Despite needing further enhancements, it has already demonstrated great application potential. With continuous improvements in parameter tuning and functionality expansion, it is likely to become one of the mainstream quant strategies.

[/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_string_1 | yourBotSourceUuid | (?Trading Bot Settings)sourceUuid: |

| v_input_string_2 | yourBotSecretToken | secretToken: |

| v_input_1 | timestamp(2023-01-01T00:00:00) | (?Trading Period Settings)Trade Start Date/Time |

| v_input_2 | timestamp(2025-01-01T00:00:00) | Trade Stop Date/Time |

| v_input_string_3 | 0 | (?Trading Mode Settings)Trading Mode: Long |

| v_input_string_4 | 0 | (?Long Mode Signals - set up if Trading Mode: Long)Select Entry Signal (Long): Bullish All |

| v_input_string_5 | 0 | Select Exit Signal (Long): Bearish Weak |

| v_input_string_6 | 0 | (?Short Mode Signals - set up if Trading Mode: Short)Select Entry Signal (Short): None |

| v_input_string_7 | 0 | Select Exit Signal (Short): None |

| v_input_float_1 | false | (?Risk Management)Take Profit, % (0 - disabled) |

| v_input_float_2 | false | Stop Loss, % (0 - disabled) |

| v_input_int_1 | 9 | (?Indicator Settings)Tenkan |

| v_input_int_2 | 26 | Kijun |

| v_input_int_3 | 52 | Chikou |

| v_input_int_4 | 26 | Offset |

| v_input_3 | false | (?Display Settings)Show Tenkan Line |

| v_input_4 | false | Show Kijun Line |

| v_input_5 | true | Show Senkou A Line |

| v_input_6 | true | Show Senkou B Line |

| v_input_7 | false | Show Chikou Line |

Source (PineScript)

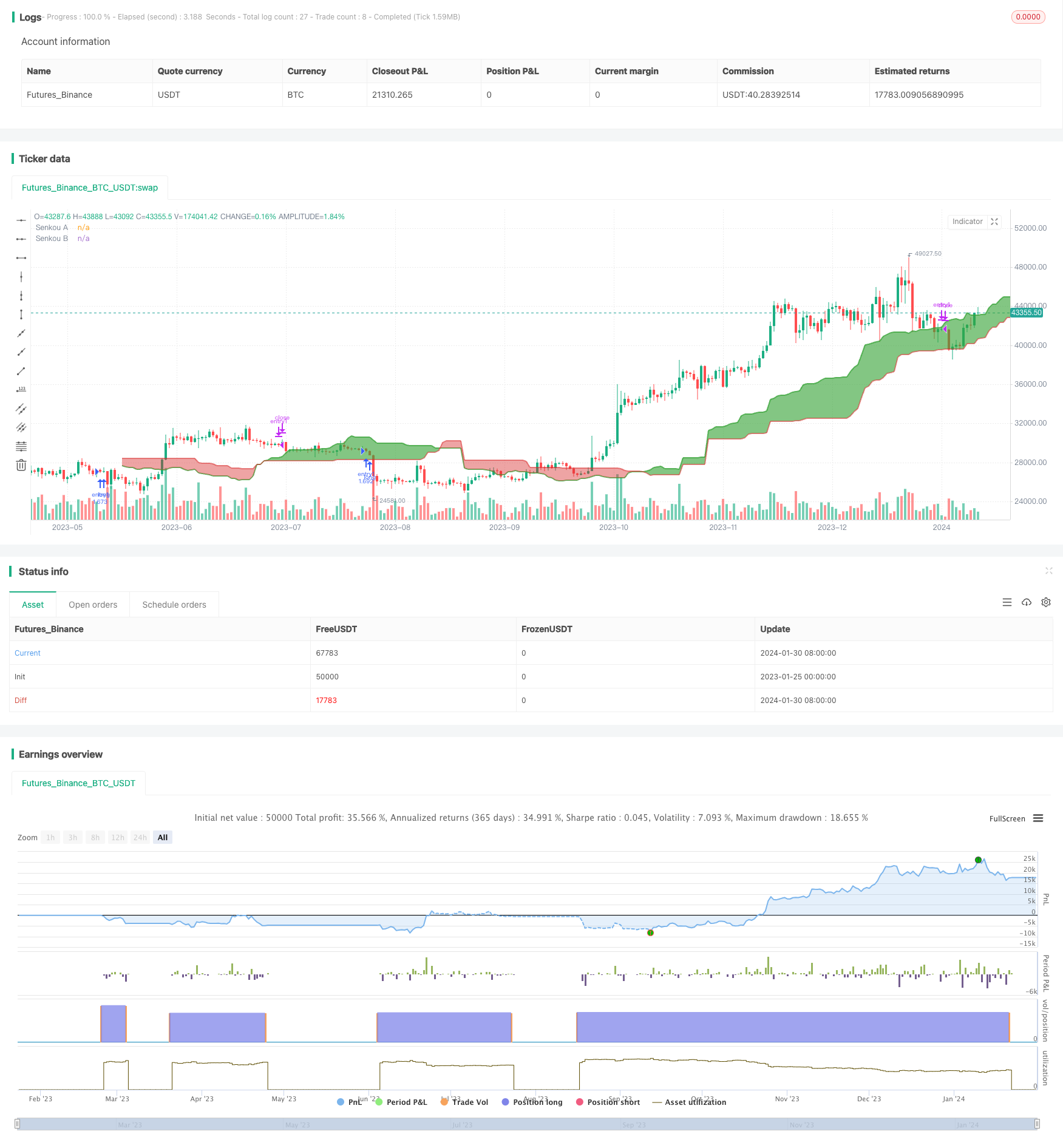

/*backtest

start: 2023-01-25 00:00:00

end: 2024-01-31 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

// -----------------------------------------------------------------------------

// Copyright © 2024 Skyrex, LLC. All rights reserved.

// -----------------------------------------------------------------------------

// Version: v2.1

// Release: Jan 22, 2024

strategy(title = "Advanced Ichimoku Clouds Strategy Long and Short",

shorttitle = "Ichimoku Strategy Long and Short",

overlay = true,

format = format.inherit,

pyramiding = 1,

calc_on_order_fills = false,

calc_on_every_tick = true,

default_qty_type = strategy.percent_of_equity,

default_qty_value = 100,

initial_capital = 10000,

currency = currency.NONE,

commission_type = strategy.commission.percent,

commission_value = 0.1,

slippage = 5)

// Trading bot settings

sourceUuid = input.string(title = "sourceUuid:", defval = "yourBotSourceUuid", group = "Trading Bot Settings")

secretToken = input.string(title = "secretToken:", defval = "yourBotSecretToken", group = "Trading Bot Settings")

// Trading Period Settings

lookBackPeriodStart = input(title = "Trade Start Date/Time", defval = timestamp('2023-01-01T00:00:00'), group = "Trading Period Settings")

lookBackPeriodStop = input(title = "Trade Stop Date/Time", defval = timestamp('2025-01-01T00:00:00'), group = "Trading Period Settings")

// Trading Mode settings

tradingMode = input.string("Long", "Trading Mode", options = ["Long", "Short"], group = "Trading Mode Settings")

// Long Mode Signal Options

entrySignalOptionsLong = input.string("Bullish All", "Select Entry Signal (Long)", options = ["None", "Bullish Strong", "Bullish Neutral", "Bullish Weak", "Bullish Strong and Neutral", "Bullish Neutral and Weak", "Bullish Strong and Weak", "Bullish All"], group = "Long Mode Signals - set up if Trading Mode: Long")

exitSignalOptionsLong = input.string("Bearish Weak", "Select Exit Signal (Long)", options = ["None", "Bearish Strong", "Bearish Neutral", "Bearish Weak", "Bearish Strong and Neutral", "Bearish Neutral and Weak", "Bearish Strong and Weak", "Bearish All"], group = "Long Mode Signals - set up if Trading Mode: Long")

// Short Mode Signal Options

entrySignalOptionsShort = input.string("None", "Select Entry Signal (Short)", options = ["None", "Bearish Strong", "Bearish Neutral", "Bearish Weak", "Bearish Strong and Neutral", "Bearish Neutral and Weak", "Bearish Strong and Weak", "Bearish All"], group = "Short Mode Signals - set up if Trading Mode: Short")

exitSignalOptionsShort = input.string("None", "Select Exit Signal (Short)", options = ["None", "Bullish Strong", "Bullish Neutral", "Bullish Weak", "Bullish Strong and Neutral", "Bullish Neutral and Weak", "Bullish Strong and Weak", "Bullish All"], group = "Short Mode Signals - set up if Trading Mode: Short")

// Risk Management Settings

takeProfitPct = input.float(0, "Take Profit, % (0 - disabled)", minval = 0, step = 0.1, group = "Risk Management")

stopLossPct = input.float(0, "Stop Loss, % (0 - disabled)", minval = 0, step = 0.1, group = "Risk Management")

// Indicator Settings

tenkanPeriods = input.int(9, "Tenkan", minval=1, group="Indicator Settings")

kijunPeriods = input.int(26, "Kijun", minval=1, group="Indicator Settings")

chikouPeriods = input.int(52, "Chikou", minval=1, group="Indicator Settings")

displacement = input.int(26, "Offset", minval=1, group="Indicator Settings")

// Display Settings

showTenkan = input(false, "Show Tenkan Line", group = "Display Settings")

showKijun = input(false, "Show Kijun Line", group = "Display Settings")

showSenkouA = input(true, "Show Senkou A Line", group = "Display Settings")

showSenkouB = input(true, "Show Senkou B Line", group = "Display Settings")

showChikou = input(false, "Show Chikou Line", group = "Display Settings")

// Function to convert percentage to price points based on entry price

pctToPoints(pct) =>

strategy.position_avg_price * pct / 100

// Colors and Transparency Level

transparencyLevel = 90

colorGreen = color.new(#36a336, 23)

colorRed = color.new(#d82727, 47)

colorTenkanViolet = color.new(#9400D3, 0)

colorKijun = color.new(#fdd8a0, 0)

colorLime = color.new(#006400, 0)

colorMaroon = color.new(#8b0000, 0)

colorGreenTransparent = color.new(colorGreen, transparencyLevel)

colorRedTransparent = color.new(colorRed, transparencyLevel)

// Ichimoku Calculations

donchian(len) => math.avg(ta.lowest(len), ta.highest(len))

tenkan = donchian(tenkanPeriods)

kijun = donchian(kijunPeriods)

senkouA = math.avg(tenkan, kijun)

senkouB = donchian(chikouPeriods)

displacedSenkouA = senkouA[displacement - 1]

displacedSenkouB = senkouB[displacement - 1]

// Plot Ichimoku Lines

plot(showTenkan ? tenkan : na, color=colorTenkanViolet, title = "Tenkan", linewidth=2)

plot(showKijun ? kijun : na, color=colorKijun, title = "Kijun", linewidth=2)

plot(showChikou ? close : na, offset=-displacement, color = colorLime, title = "Chikou", linewidth=1)

p1 = plot(showSenkouA ? senkouA : na, offset=displacement - 1, color=colorGreen, title = "Senkou A", linewidth=2)

p2 = plot(showSenkouB ? senkouB : na, offset=displacement - 1, color=colorRed, title = "Senkou B", linewidth=2)

fill(p1, p2, color=senkouA > senkouB ? colorGreenTransparent : colorRedTransparent)

// Signal Calculations

bullishSignal = ta.crossover(tenkan, kijun)

bearishSignal = ta.crossunder(tenkan, kijun)

bullishSignalValues = bullishSignal ? tenkan : na

bearishSignalValues = bearishSignal ? tenkan : na

strongBullishSignal = bullishSignalValues > displacedSenkouA and bullishSignalValues > displacedSenkouB

neutralBullishSignal = ((bullishSignalValues > displacedSenkouA and bullishSignalValues < displacedSenkouB) or (bullishSignalValues < displacedSenkouA and bullishSignalValues > displacedSenkouB))

weakBullishSignal = bullishSignalValues < displacedSenkouA and bullishSignalValues < displacedSenkouB

strongBearishSignal = bearishSignalValues < displacedSenkouA and bearishSignalValues < displacedSenkouB

neutralBearishSignal = ((bearishSignalValues > displacedSenkouA and bearishSignalValues < displacedSenkouB) or (bearishSignalValues < displacedSenkouA and bearishSignalValues > displacedSenkouB))

weakBearishSignal = bearishSignalValues > displacedSenkouA and bearishSignalValues > displacedSenkouB

// Functions to determine entry and exit conditions for Long and Short

isEntrySignalLong() =>

entryCondition = false

if entrySignalOptionsLong == "None"

entryCondition := false

else if entrySignalOptionsLong == "Bullish Strong"

entryCondition := strongBullishSignal

else if entrySignalOptionsLong == "Bullish Neutral"

entryCondition := neutralBullishSignal

else if entrySignalOptionsLong == "Bullish Weak"

entryCondition := weakBullishSignal

else if entrySignalOptionsLong == "Bullish Strong and Neutral"

entryCondition := strongBullishSignal or neutralBullishSignal

else if entrySignalOptionsLong == "Bullish Neutral and Weak"

entryCondition := neutralBullishSignal or weakBullishSignal

else if entrySignalOptionsLong == "Bullish Strong and Weak"

entryCondition := strongBullishSignal or weakBullishSignal

else if entrySignalOptionsLong == "Bullish All"

entryCondition := strongBullishSignal or neutralBullishSignal or weakBullishSignal

entryCondition

isExitSignalLong() =>

exitCondition = false

if exitSignalOptionsLong == "None"

exitCondition := false

else if exitSignalOptionsLong == "Bearish Strong"

exitCondition := strongBearishSignal

else if exitSignalOptionsLong == "Bearish Neutral"

exitCondition := neutralBearishSignal

else if exitSignalOptionsLong == "Bearish Weak"

exitCondition := weakBearishSignal

else if exitSignalOptionsLong == "Bearish Strong and Neutral"

exitCondition := strongBearishSignal or neutralBearishSignal

else if exitSignalOptionsLong == "Bearish Neutral and Weak"

exitCondition := neutralBearishSignal or weakBearishSignal

else if exitSignalOptionsLong == "Bearish Strong and Weak"

exitCondition := strongBearishSignal or weakBearishSignal

else if exitSignalOptionsLong == "Bearish All"

exitCondition := strongBearishSignal or neutralBearishSignal or weakBearishSignal

exitCondition

isEntrySignalShort() =>

entryCondition = false

if entrySignalOptionsShort == "None"

entryCondition := false

else if entrySignalOptionsShort == "Bearish Strong"

entryCondition := strongBearishSignal

else if entrySignalOptionsShort == "Bearish Neutral"

entryCondition := neutralBearishSignal

else if entrySignalOptionsShort == "Bearish Weak"

entryCondition := weakBearishSignal

else if entrySignalOptionsShort == "Bearish Strong and Neutral"

entryCondition := strongBearishSignal or neutralBearishSignal

else if entrySignalOptionsShort == "Bearish Neutral and Weak"

entryCondition := neutralBearishSignal or weakBearishSignal

else if entrySignalOptionsShort == "Bearish Strong and Weak"

entryCondition := strongBearishSignal or weakBearishSignal

else if entrySignalOptionsShort == "Bearish All"

entryCondition := strongBearishSignal or neutralBearishSignal or weakBearishSignal

entryCondition

isExitSignalShort() =>

exitCondition = false

if exitSignalOptionsShort == "None"

exitCondition := false

else if exitSignalOptionsShort == "Bullish Strong"

exitCondition := strongBullishSignal

else if exitSignalOptionsShort == "Bullish Neutral"

exitCondition := neutralBullishSignal

else if exitSignalOptionsShort == "Bullish Weak"

exitCondition := weakBullishSignal

else if exitSignalOptionsShort == "Bullish Strong and Neutral"

exitCondition := strongBullishSignal or neutralBullishSignal

else if exitSignalOptionsShort == "Bullish Neutral and Weak"

exitCondition := neutralBullishSignal or weakBullishSignal

else if exitSignalOptionsShort == "Bullish Strong and Weak"

exitCondition := strongBullishSignal or weakBullishSignal

else if exitSignalOptionsShort == "Bullish All"

exitCondition := strongBullishSignal or neutralBullishSignal or weakBullishSignal

exitCondition

// Strategy logic for entries and exits

if true

if tradingMode == "Long"

takeProfitLevelLong = strategy.position_avg_price * (1 + takeProfitPct / 100)

stopLossLevelLong = strategy.position_avg_price * (1 - stopLossPct / 100)

if isEntrySignalLong()

strategy.entry(id = "entry1", direction = strategy.long, alert_message = '{\n"base": "' + syminfo.basecurrency + '",\n"quote": "' + syminfo.currency + '",\n"position": "entry1",\n"price": "' + str.tostring(close) + '",\n"sourceUuid": "' + sourceUuid + '",\n"secretToken": "' + secretToken + '"\n}')

if (takeProfitPct > 0 and close >= takeProfitLevelLong) or (stopLossPct > 0 and close <= stopLossLevelLong) or (exitSignalOptionsLong != "None" and isExitSignalLong())

strategy.close(id = "entry1", alert_message = '{\n"base": "' + syminfo.basecurrency + '",\n"quote": "' + syminfo.currency + '",\n"position": "close",\n"price": "' + str.tostring(close) + '",\n"sourceUuid": "' + sourceUuid + '",\n"secretToken": "' + secretToken + '"\n}')

else if tradingMode == "Short"

takeProfitLevelShort = strategy.position_avg_price * (1 - takeProfitPct / 100)

stopLossLevelShort = strategy.position_avg_price * (1 + stopLossPct / 100)

if isEntrySignalShort()

strategy.entry(id = "entry1", direction = strategy.short, alert_message = '{\n"base": "' + syminfo.basecurrency + '",\n"quote": "' + syminfo.currency + '",\n"position": "entry1",\n"price": "' + str.tostring(close) + '",\n"sourceUuid": "' + sourceUuid + '",\n"secretToken": "' + secretToken + '"\n}')

if (takeProfitPct > 0 and close <= takeProfitLevelShort) or (stopLossPct > 0 and close >= stopLossLevelShort) or (exitSignalOptionsShort != "None" and isExitSignalShort())

strategy.close(id = "entry1", alert_message = '{\n"base": "' + syminfo.basecurrency + '",\n"quote": "' + syminfo.currency + '",\n"position": "close",\n"price": "' + str.tostring(close) + '",\n"sourceUuid": "' + sourceUuid + '",\n"secretToken": "' + secretToken + '"\n}')

Detail

https://www.fmz.com/strategy/440712

Last Modified

2024-02-01 14:25:49