Name

移动平均线和偏差指标多周期交易策略A-Multi-Period-Trading-Strategy-Based-on-Moving-Averages

Author

ChaoZhang

Strategy Description

该策略结合移动平均线、布林带和相对强弱指标三个指标,进行多周期的股票交易。它在买入时会同时考虑快速移动平均线上穿慢速移动平均线、相对强弱指标低于50和收盘价低于布林带中轨这三个条件。在卖出时则会考虑相对强弱指标高于70和收盘价高于布林带上轨这两个条件。

该策略主要利用三个指标进行判断。首先是MACD指标,它由一快一慢两个不同周期的移动平均线构成,当快线上穿慢线时产生买入信号。第二个指标是布林带,它由中轨、上轨和下轨三条线组成。当价格接近下轨时为振荡的谷部买入点,而当价格接近上轨时为须要止损的峰部。第三个指标是RSI,它反映了证券价格运动的速度和变化程度,可以找到买入谷点和卖出峰点。

在具体交易时,该策略首先要求快速移动平均线上穿慢速移动平均线,表示股价上涨势头增强,可以买入。同时要求RSI低于50,显示股价可能处于超卖区,进入买入时机。此外,还要求收盘价低于布林带中轨,表明股价处于谷部,也是比较好的买入点位。

在止盈和止损方面,当RSI高于70时,表示股价可能处于超买区,显示上涨势头减弱,应该考虑止盈了。此外,当收盘价高于布林带上轨时,也显示股价可能过高,有回落的风险,应适当止盈。

该策略综合运用了移动平均线、布林带和RSI三个指标的优势,可以更加准确地判断买入和卖出的时机。具体优势如下:

-

移动平均线可以判断股价的上涨势头,布林带中轨可以找到股价的谷部买入点位,RSI可以防止买入股票高点。三者结合可以在股价上涨中期确定比较好的买入时机。

-

RSI和布林带上轨的结合可以很好地把握股价的峰部,避免超买现象,及时止盈。

-

应用多周期判断,可以在不同级别抓住交易机会,扩大获利空间。

-

该策略交易逻辑简单清晰,容易理解,适合中长线投资。

尽管该策略综合多个指标判断,增加了交易决策的准确性。但仍有以下主要风险:

-

参数设置风险。移动平均线、布林带和RSI的参数都需要根据实际情况调整,如果参数设置不当,会影响交易效果。

-

多头行情适用性更好。在熊市中,股价的下跌速度更快,该策略的止损措施可能来不及起效。

-

单一股票风险。该策略更适合投资组合,单一股票风险依然存在,需要分散投资。

-

交易频率可能过高。如果参数设置得当,该策略可能会频繁交易。这会增加交易成本和税费。

对应解决方法:

-

应根据回测数据调整参数,使指标发出信号的频率更加合适。

-

可以适当调整移动平均线周期,降低买入频率,减小亏损。

-

增加投资品种,通过分散投资降低单一股票风险。

-

适当放宽买入和止盈条件,降低交易频率。

该策略仍有进一步优化的空间:

-

可以引入更多指标过滤,如成交量指标,确保买入时成交量放大,增加决策准确性。

-

可以添加仓位管理模块,根据市场情况动态调整仓位。

-

可以结合深度学习算法,通过对大量数据的训练,自动优化参数设置。

-

可以加入更多时间周期判断,扩大适用面。

该策略总体来说逻辑清晰、易于理解,综合运用多个指标判断,在一定程度上减少了假信号。通过参数优化和加入更多技术指标,可以进一步提高决策准确性,增强策略健壮性。该策略比较适合中长线投资,也可用于量化交易。但任何策略都不能完全规避市场风险,需要控制好仓位大小和止损点位。

||

This strategy combines three indicators - moving averages, Bollinger Bands and the Relative Strength Index (RSI) for multi-period stock trading. It considers crossovers of fast and slow moving averages, RSI below 50 and close price below BB middle band when buying. It considers RSI above 70 and close price above BB upper band when selling.

The strategy mainly utilizes three indicators for decision making. Firstly, the MACD indicator comprised of fast and slow moving averages. Crossovers of the fast line above the slow line generate buy signals. Secondly, the Bollinger Bands with middle, upper and lower bands. Prices near the lower band present buying opportunities in swing lows, while prices near the upper band present selling opportunities at swing highs. Lastly, the RSI reflects the velocity and rate of change of the price action and identifies potential swing highs and swing lows.

Specifically, the strategy first requires the fast moving average crossing above the slow moving average, indicating strengthening uptrend that suggests buying. It also requires RSI below 50, showing the price may be in oversold levels and presenting buying opportunities. In addition, it requires the close price below BB middle band, indicating the price swing low and a good entry point.

For profit taking and stop loss, when RSI rises above 70, it indicates the price may be in overbought levels and uptrend momentum is waning, suitable for taking profit. Also when close price rises above BB upper band, it signals elevated risk of pullback, appropriate for profit taking.

The strategy combines the strengths of moving averages, Bollinger Bands and RSI to more precisely decide entry and exit points. The main advantages are:

-

Moving averages determine price uptrend momentum. BB middle band pinpoints swing lows for entry. RSI avoids buying at price peaks. The three together provide relatively ideal buying opportunities during price uptrends.

-

The combination of RSI and BB upper band captures price swing highs well for taking profit to avoid overbought conditions.

-

Multi-period assessments allow capturing trading opportunities across timeframes to maximize profits.

-

The logical trading rules make the strategy easily understandable for medium to long term investments.

Despite combining indicators to improve decision accuracy, key risks exist:

-

Parameter setting risks. The parameters for the indicators need empirical adjustment. Inadequate tuning impacts strategy performance.

-

More suitable for bull markets. In bear markets, speed of price falls may make stop losses ineffective.

-

Single stock risks remain despite portfolio. Need to diversify investments across assets.

-

Potentially excessive trading frequency. Optimal parameter setting may result in frequent trades, incurring higher transaction costs and taxes.

Solutions:

-

Adjust parameters based on backtests to achieve suitable signal frequency.

-

Tune moving average periods to moderate entry frequency and minimize losses.

-

Diversify investments across more assets to minimize single stock risks.

-

Relax buying and profit-taking criteria moderately to reduce trade frequency.

There remains further room for optimizations:

-

Add more filters like volume to ensure amplified volumes on buys, improving decision accuracy.

-

Incorporate position sizing modules to dynamically size positions based on market conditions.

-

Utilize deep learning algorithms to auto-tune parameters through training across large datasets.

-

Introduce more timeframes for judgments to expand applicability.

Overall the strategy has clear, easy-to-understand logic, synergizing indicators to reduce false signals. Further parameter tuning and adding indicators can continue enhancing robustness and decision precision. It suits medium to long term investments and quantitative trading. Nonetheless, no strategy eliminates market risks fully. Appropriate position sizing and stop loss levels are always necessary.

[/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_1 | 0 | Version: 1.0.1 |

| v_input_2_close | 0 | Source: close |

| v_input_3 | 12 | (?MACD)Fast Length |

| v_input_4 | 26 | Slow Length |

| v_input_5 | 9 | Signal Smoothing |

| v_input_6 | 0 | Oscillator MA Type: EMA |

| v_input_7 | 0 | Signal Line MA Type: EMA |

| v_input_8 | 20 | (?Bollindger Bands)Length |

| v_input_9 | 2 | StdDev |

| v_input_10 | 14 | (?RSI)Length |

| v_input_11 | false | (?Stop Loss)╔══════ Enable ══════╗ |

| v_input_12 | 0 | Based on: Percent |

| v_input_13 | 10 | ATR Mult |

| v_input_14 | 14 | Length |

| v_input_15 | 10 | Percent |

Source (PineScript)

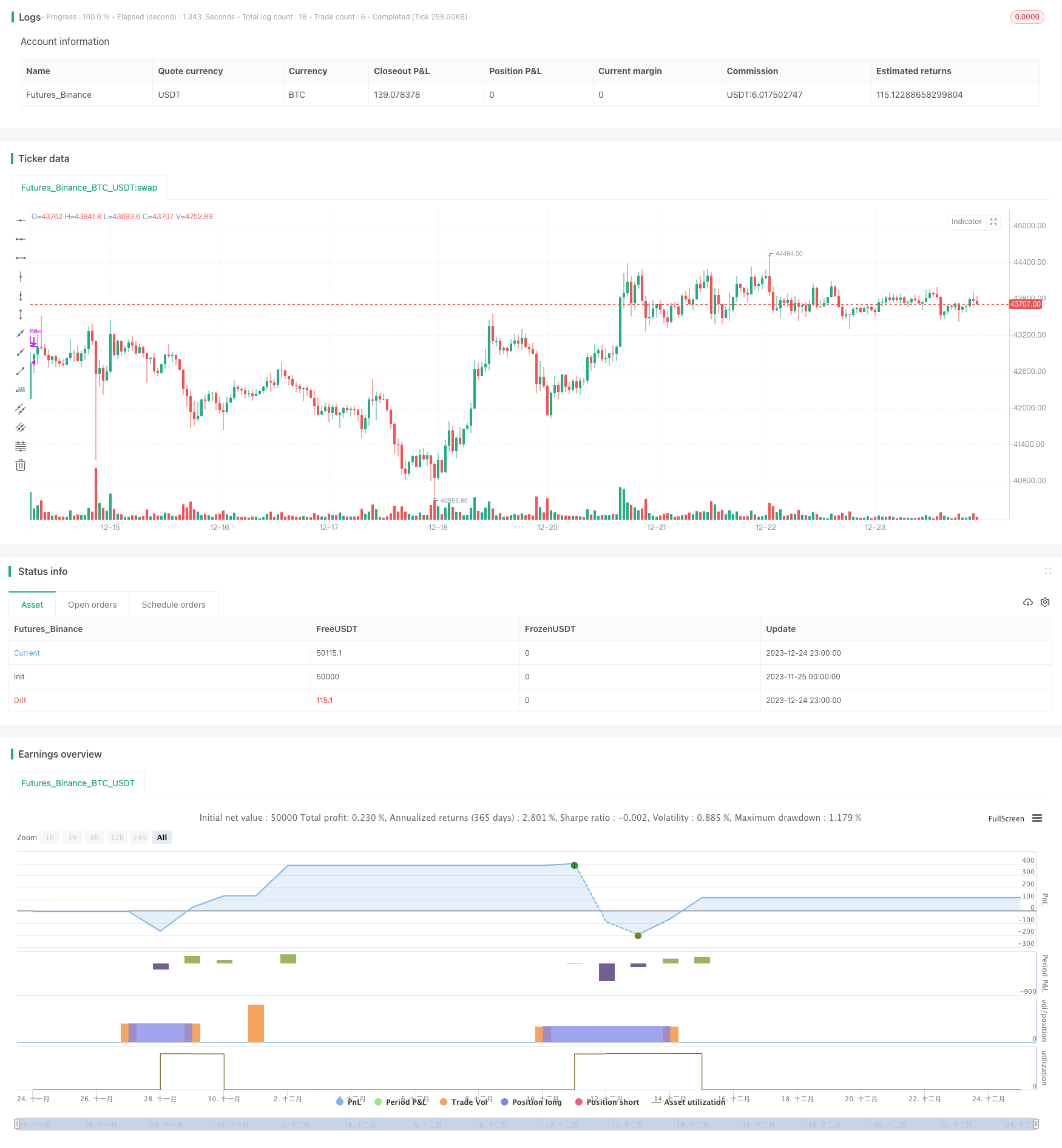

/*backtest

start: 2023-11-25 00:00:00

end: 2023-12-25 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//

//@author Alorse

//@version=4

strategy("MACD + BB + RSI [Alorse]", shorttitle="BB + MACD + RSI [Alorse]", overlay=true, pyramiding=0, currency=currency.USD, default_qty_type=strategy.percent_of_equity, initial_capital=1000, default_qty_value=20, commission_type=strategy.commission.percent, commission_value=0.01)

txtVer = "1.0.1"

version = input(title="Version", type=input.string, defval=txtVer, options=[txtVer], tooltip="This is informational only, nothing will change.")

src = input(title="Source", type=input.source, defval=close)

// MACD

fast_length = input(title="Fast Length", type=input.integer, defval=12, group="MACD")

slow_length = input(title="Slow Length", type=input.integer, defval=26, group="MACD")

signal_length = input(title="Signal Smoothing", type=input.integer, minval = 1, maxval = 50, defval = 9, group="MACD")

sma_source = input(title="Oscillator MA Type", type=input.string, defval="EMA", options=["SMA", "EMA"], group="MACD")

sma_signal = input(title="Signal Line MA Type", type=input.string, defval="EMA", options=["SMA", "EMA"], group="MACD")

fast_ma = sma_source == "SMA" ? sma(src, fast_length) : ema(src, fast_length)

slow_ma = sma_source == "SMA" ? sma(src, slow_length) : ema(src, slow_length)

macd = fast_ma - slow_ma

signal = sma_signal == "SMA" ? sma(macd, signal_length) : ema(macd, signal_length)

// Bollinger Bands

bbGroup = "Bollindger Bands"

length = input(20, title="Length", group=bbGroup)

mult = input(2.0, title="StdDev", minval=0.001, maxval=5, group=bbGroup)

basis = sma(src, length)

dev = mult * stdev(src, length)

upper = basis + dev

lower = basis - dev

// RSI

rsiGroup = "RSI"

lenRSI = input(14, title="Length", minval=1, group=rsiGroup)

// lessThan = input(50, title="Less than", minval=1 , maxval=100, group=rsiGroup)

RSI = rsi(src, lenRSI)

// Strategy Conditions

buy = crossover(macd, signal) and RSI < 50 and close < basis

sell = RSI > 70 and close > upper

// Stop Loss

slGroup = "Stop Loss"

useSL = input(false, title="╔══════ Enable ══════╗", group=slGroup, tooltip="If you are using this strategy for Scalping or Futures market, we do not recommend using Stop Loss.")

SLbased = input(title="Based on", type=input.string, defval="Percent", options=["ATR", "Percent"], group=slGroup, tooltip="ATR: Average True Range\nPercent: eg. 5%.")

multiATR = input(10.0, title="ATR Mult", type=input.float, group=slGroup, inline="atr")

lengthATR = input(14, title="Length", type=input.integer, group=slGroup, inline="atr")

SLPercent = input(10, title="Percent", type=input.float, group=slGroup) * 0.01

longStop = 0.0

shortStop = 0.0

if SLbased == "ATR"

longStop := valuewhen(buy, low, 0) - (valuewhen(buy, rma(tr(true), lengthATR), 0) * multiATR)

longStopPrev = nz(longStop[1], longStop)

longStop := close[1] > longStopPrev ? max(longStop, longStopPrev) : longStop

shortStop := (valuewhen(sell, rma(tr(true), lengthATR), 0) * multiATR) + valuewhen(sell, high, 0)

shortStopPrev = nz(shortStop[1], shortStop)

shortStop := close[1] > shortStopPrev ? max(shortStop, shortStopPrev) : shortStop

if SLbased == "Percent"

longStop := strategy.position_avg_price * (1 - SLPercent)

shortStop := strategy.position_avg_price * (1 + SLPercent)

strategy.entry("Long", true, when=buy)

strategy.close("Long", when=sell, comment="Exit")

if useSL

strategy.exit("Stop Loss", "Long", stop=longStop)

Detail

https://www.fmz.com/strategy/436593

Last Modified

2023-12-26 10:13:34