Name

移动平均均线交易策略Moving-Average-Trading-Strategy

Author

ChaoZhang

Strategy Description

该策略是一个基于移动平均线的趋势跟踪交易策略。它使用14日简单移动平均线来判断市场趋势方向,并在价格接近移动平均线时进行买入或卖出。

该策略的核心逻辑是:

- 计算14日简单移动平均线(SMA)

- 当收盘价低于移动平均线的99%时,认为处于超卖状态,产生买入信号

- 入场后设置止损和止盈价格

- 止损价格为入场价格再向下10个点

- 止盈价格为入场价格再向上60个点

该策略属于趋势跟踪策略,通过移动平均线判断市场总体走势,在超卖时段介入,随大趋势运行止损止盈。

该策略有以下主要优势:

- 策略逻辑简单清晰,容易理解和实现

- 利用移动平均线判断市场走势,可以过滤掉部分噪音

- 只在超卖阶段介入,可以避开大幅下跌的风险

- 止损和止盈设置合理,避免亏损扩大

- 回撤和损失可以控制在一定范围内

该策略也存在一些风险:

- 移动平均线存在滞后,可能错过短线交易机会

- 止损设置过于激进,可能被秒出

- 市场出现大幅跳空或重大消息导致方向反转

- 机器人套利或高频交易干扰

可以通过适当放宽入场条件、调整止损位置等方法来规避部分风险。

该策略还可以从以下几个方面进行优化:

- 优化移动平均线的参数,适配更多市场环境

- 增加多个时间周期的移动平均线,进行组合判断

- 在特定时间段使用不同的止损止盈比率

- 利用波动率指标过滤入场时机

- 增加机器学习等算法判断趋势和关键点

该策略整体来说是一种简单实用的趋势跟踪策略。它利用移动平均线判断趋势方向,在超卖点位介入,并设置合理的止损止盈,可以有效控制风险。通过一定的优化和组合,可以适配更多的市场情况,进一步提高策略的稳定性和盈利能力。

||

This is a trend-following trading strategy based on moving average lines. It uses a 14-day simple moving average (SMA) to determine market trend direction and enter trades when price approaches the moving average line.

The core logic of this strategy is:

- Calculate the 14-day simple moving average (SMA)

- When close price is below 99% of moving average, market is considered oversold, generating buy signals

- After entering, set stop loss and take profit price

- Stop loss price is set at 10 pips below entry price

- Take profit price is set at 60 pips above entry price

This is a trend-following strategy. It identifies overall market trend using the moving average line and enters oversold stages along the major trend. Stop loss and take profit are used to exit trades.

The main advantages of this strategy are:

- Simple and clear strategy logic, easy to understand and implement

- Moving average filters out some noise and determines market trend

- Only taking oversold setups avoids large drawdowns

- Reasonable stop loss and take profit controls risk

- Drawdown and loss can be limited to reasonable range

There are also some risks associated with this strategy:

- Moving average has lagging effect, possibly missing short-term opportunities

- Stop loss may be too aggressive leading to premature exit

- Significant price gaps or trend reversals on major news events

- Interference from algorithmic and high-frequency trades

Some methods to mitigate risks include allowing wider entry range, adjusting stop loss position etc.

Some ways to optimize this strategy:

- Optimize moving average parameters for more market regimes

- Add multiple time frame moving averages for combo assessment

- Use dynamic stop loss/take profit ratios for certain sessions

- Utilize volatility metrics to time entries

- Incorporate machine learning for enhanced trend and key points prediction

In summary, this is a simple and practical trend-following strategy. It identifies trend direction using moving average, enters oversold stages, and sets reasonable stop loss and take profit to control risk. With proper enhancements and combinations, it can be adapted to more market conditions and further improve stability and profitability.

[/trans]

Source (PineScript)

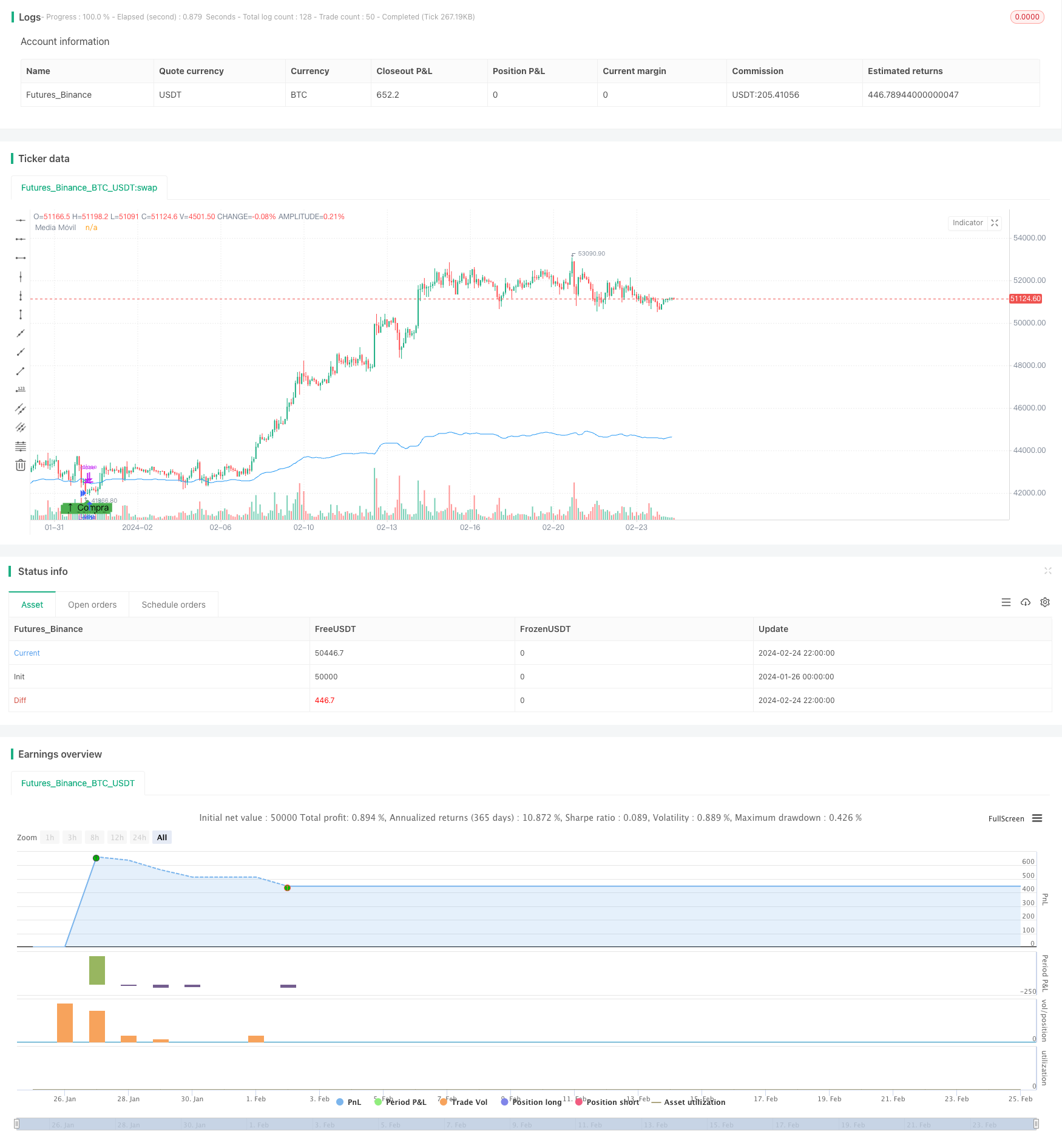

/*backtest

start: 2024-01-26 00:00:00

end: 2024-02-25 00:00:00

period: 2h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Estrategia MA - mejor", overlay=true)

// Parámetros de la estrategia

initialCapital = 1000 // Inversión inicial

riskPerTrade = 0.02 // Riesgo por operación (2% del capital por operación)

lengthMA = 14 // Período de la media móvil

pipValue = 20 / 10 // Valor de un pip (30 euros / 10 pips)

// Apalancamiento

leverage = 10

// Cálculo de la media móvil en el marco temporal de 30 minutos

ma = request.security(syminfo.tickerid, "30", ta.sma(close, lengthMA))

// Condiciones de Entrada en Sobreventa

entryCondition = close < ma * 0.99 // Ejemplo: 1% por debajo de la MA

// Lógica de entrada y salida

if entryCondition

riskAmount = initialCapital * riskPerTrade // Cantidad de euros a arriesgar por operación

size = 1 // Tamaño de la posición con apalancamiento

strategy.entry("Long", strategy.long, qty=size)

stopLossPrice = close - (10 * pipValue / size)

takeProfitPrice = close + (60 * pipValue / size)

strategy.exit("Exit Long", "Long", stop=stopLossPrice, limit=takeProfitPrice)

// Gráficos

plot(ma, color=color.blue, title="Media Móvil")

plotshape(series=entryCondition, title="Entrada en Sobreventa", location=location.belowbar, color=color.green, style=shape.labelup, text="↑ Compra")

Detail

https://www.fmz.com/strategy/442820

Last Modified

2024-02-26 11:36:37