Name

比特币和黄金双跳空策略Bitcoin-and-Gold-Double-Gap-Strategy

Author

ChaoZhang

Strategy Description

双跳空策略是一种用于比特币和黄金短线交易的量化策略。它结合使用了移动平均线、布林带和ATR止损来识别突破信号并管理风险。

双跳空策略使用快速EMA和慢速EMA的交叉来判断趋势方向。当快速EMA向上突破慢速EMA时生成买入信号;当快速EMA向下突破慢速EMA时生成卖出信号。为了避免假突破,策略要求突破信号必须发生在布林带上轨或中轨附近,这就是“双跳空”的由来。

具体来说,在判断买入信号时,需要满足以下两个条件:1)快速EMA上穿慢速EMA;2)收盘价接近或低于布林带上轨或中轨。判断卖出信号也是类似,需要快速EMA下穿慢速EMA并且接近布林带下轨或中轨。

此外,双跳空策略还使用ATR指标计算动态止损,以控制单笔交易的风险。具体的止损位置为最近两根K线的最低点再减去N倍ATR。

- 利用双重过滤条件识别高概率突破信号

- 快速EMA crossover判断主要趋势,布林带过滤假突破

- 动态ATR止损有效控制单笔交易风险

- 适合比特币等高波动标的的短线交易

- 快速EMA和慢速EMA参数设置不当可能产生大量假信号

- 布林带参数不当也会使过滤效果大打折扣

- 止损位置设定过tight可能增加止损被触发概率

- 短线交易需要较高的交易频次,不适合资金量小的投资者

双跳空策略可以从以下几个方面进行优化:

- 优化移动平均线的参数,寻找最佳的快慢EMA长度组合

- 优化布林带参数,降低假突破率

- 根据不同交易品种和市场环境调整ATR止损的倍数

- 增加重新进入信号,即在止损退出后再次进入

- 结合其它指标作为辅助,例如RSI,KD等

双跳空策略同时利用趋势跟踪和突破过滤,可有效识别短线机会。结合动态止损管理风险,非常适合波动率较大的数字货币和贵金属品种的短线交易。通过参数优化和规则优化,可以进一步提高策略的稳定性和盈利能力。

||

The Double Gap strategy is a quantitative strategy used for short-term trading of Bitcoin and gold. It combines moving averages, Bollinger Bands and ATR stops to identify breakout signals and manage risk.

The Double Gap strategy uses fast EMA and slow EMA crossovers to determine trend direction. A buy signal is generated when the fast EMA crosses above the slow EMA, and a sell signal is generated when the fast EMA crosses below the slow EMA. To avoid false breakouts, the strategy requires the crossover to happen near the upper or middle Bollinger Bands. This is where the name "Double Gap" comes from.

Specifically, to determine a buy signal, both of the following conditions need to be met: 1) The fast EMA crosses above the slow EMA; 2) The close price is near or below the upper or middle Bollinger Bands. Judging the sell signal is similar. It requires the fast EMA to cross below the slow EMA and be near the lower or middle Bollinger Bands.

In addition, the Double Gap strategy uses the ATR indicator to calculate a dynamic stop loss to control the risk of each trade. The specific stop level is the lowest low of the most recent two bars minus N times the ATR.

- Identifies high probability breakouts using dual filters

- Fast EMA crossover judges main trend, Bollinger Bands filter false breakouts

- Dynamic ATR stop effectively controls single trade risks

- Suitable for short-term trading of high volatility products like BTC

- Improper fast and slow EMA parameters may produce excessive false signals

- Inappropriate Bollinger Bands parameters will also greatly reduce filtering effectiveness

- Stop loss set too tight increases probability of it being triggered

- High trading frequency required, not suitable for small accounts

The Double Gap strategy can be optimized from the following aspects:

- Optimize moving average parameters to find best fast and slow EMA combinations

- Optimize Bollinger Bands parameters to reduce false breakout rates

- Adjust ATR stop multiplier according to different products and market regimes

- Add re-entry signal after stop out

- Combine with other indicators like RSI, KD etc as confirmation

The Double Gap strategy effectively identifies short-term opportunities using both trend following and breakout filtering. With dynamic stop loss management, it is well suited for short-term trading of high volatility digital currencies and precious metals. Further improvements in stability and profitability can be achieved through parameter and logic optimization.

[/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_1 | 5 | Fast EMA Length |

| v_input_2 | 13 | Slow EMA Length |

| v_input_3 | 20 | Bollinger Band Length |

| v_input_4 | 2 | Bollinger Band Multiplier |

| v_input_5 | true | Stop Loss Multiplier |

Source (PineScript)

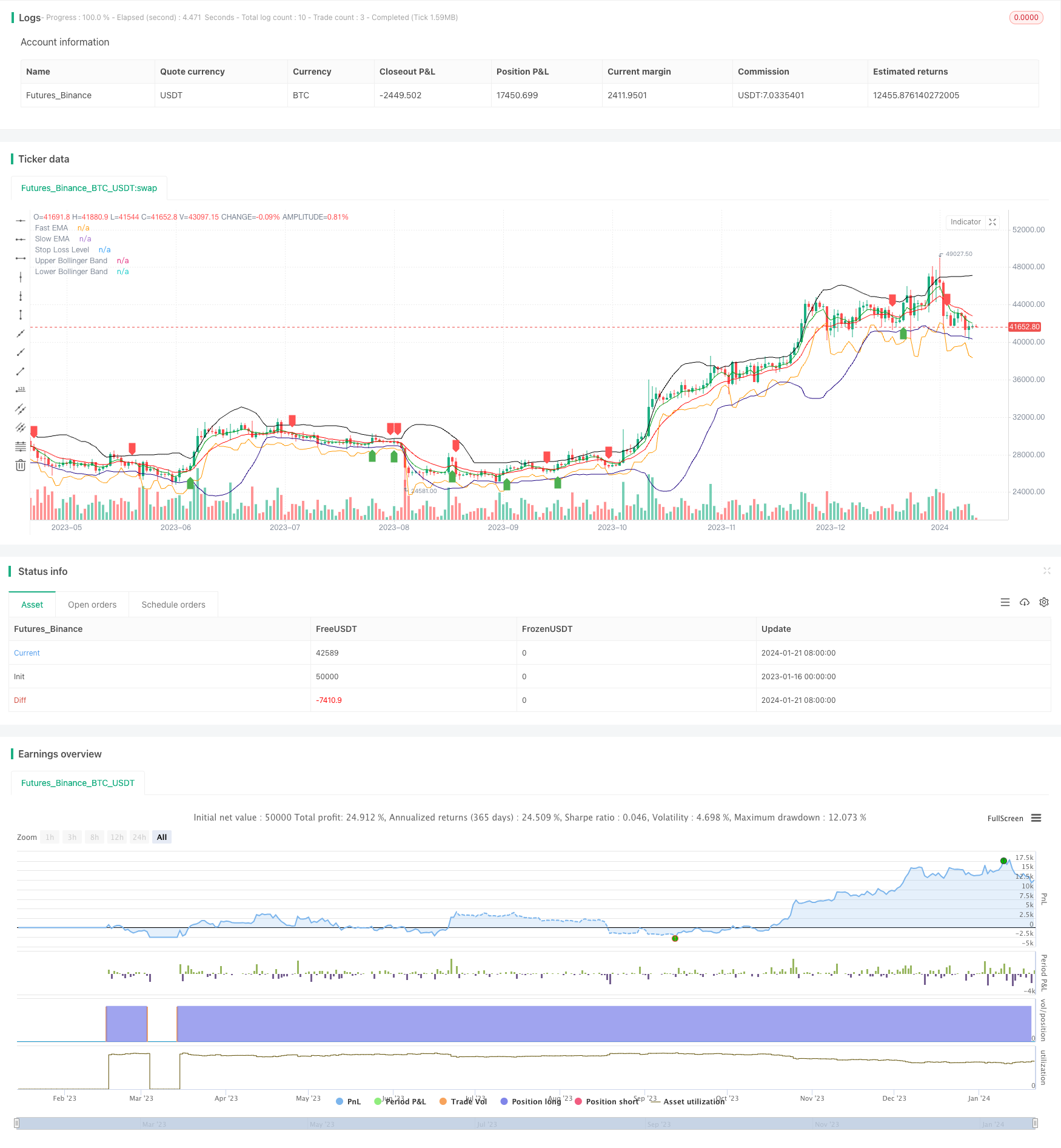

/*backtest

start: 2023-01-16 00:00:00

end: 2024-01-22 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © singhak8757

//@version=5

strategy("Bitcoin and Gold 5min Scalping Strategy2.0", overlay=true)

// Input parameters

fastLength = input(5, title="Fast EMA Length")

slowLength = input(13, title="Slow EMA Length")

bollingerLength = input(20, title="Bollinger Band Length")

bollingerMultiplier = input(2, title="Bollinger Band Multiplier")

stopLossMultiplier = input(1, title="Stop Loss Multiplier")

// Calculate EMAs

fastEMA = ta.ema(close, fastLength)

slowEMA = ta.ema(close, slowLength)

// Calculate Bollinger Bands

basis = ta.sma(close, bollingerLength)

upperBand = basis + bollingerMultiplier * ta.stdev(close, bollingerLength)

lowerBand = basis - bollingerMultiplier * ta.stdev(close, bollingerLength)

// Buy condition

buyCondition = ta.crossover(fastEMA, slowEMA) and (close <= upperBand or close <= basis)

// Sell condition

sellCondition = ta.crossunder(fastEMA, slowEMA) and (close >= lowerBand or close >= basis)

// Calculate stop loss level

stopLossLevel = ta.lowest(low, 2)[1] - stopLossMultiplier * ta.atr(14)

// Plot EMAs

plot(fastEMA, color=color.rgb(0, 156, 21), title="Fast EMA")

plot(slowEMA, color=color.rgb(255, 0, 0), title="Slow EMA")

// Plot Bollinger Bands

plot(upperBand, color=color.new(#000000, 0), title="Upper Bollinger Band")

plot(lowerBand, color=color.new(#1b007e, 0), title="Lower Bollinger Band")

// Plot Buy and Sell signals

plotshape(series=buyCondition, title="Buy Signal", color=color.green, style=shape.labelup, location=location.belowbar)

plotshape(series=sellCondition, title="Sell Signal", color=color.red, style=shape.labeldown, location=location.abovebar)

// Plot Stop Loss level

plot(stopLossLevel, color=color.orange, title="Stop Loss Level")

// Strategy logic

strategy.entry("Buy", strategy.long, when = buyCondition)

strategy.exit("Stop Loss/Close", from_entry="Buy", loss=stopLossLevel)

strategy.close("Sell", when = sellCondition)

Detail

https://www.fmz.com/strategy/439759

Last Modified

2024-01-23 15:28:56