Name

指标组合突破趋势追踪策略Strategy-of-Indicators-Combination-Breakthrough-Trend-Tracking

Author

ChaoZhang

Strategy Description

本策略名称为“指标组合突破趋势追踪策略”。该策略综合运用多种指标,识别市场趋势方向,进行趋势追踪操作。主要包括以下几个部分:

- 使用波浪趋势指标判断市场主要趋势

- 结合RSI指标和资金流指标过滤掉部分假信号

- EMA指标判断具体的操作方向

- 入场采用突破追踪方法,确保跟趋势运行

该策略主要判断大趋势的方向和力度,并设置多空双向交易。具体操作原理如下:

多头入场信号:

- 价格高于200日EMA,表明处于多头市场

- 价格回调到50日EMA附近形成支撑

- 波浪指标反转为上升趋势,并出现买入信号

- RSI和MFI均显示超买

- 连续3根K线依次突破50日EMA,表明突破上行

空头入场信号: 与多头入场信号相反

止盈止损方式: 提供两种可选方案:最低价/最高价止损、ATR止损

该策略具有以下优势:

- 综合多种指标判断大趋势,避免假突破

- 采用EMA判断操作方向,容易跟踪趋势

- 追踪止损方法实现持续盈利

- 可同时做多做空,跟随市场任意方向运行

该策略也存在一些风险:

- 指标发出错误信号的概率

- 止损点设置过小,增加止损风险

- 交易次数较多,交易费用是一种隐藏损失

为降低上述风险,可以从以下几个方面进行优化:

- 调整指标参数,过滤错误信号

- 适当放宽止损点

- 优化指标参数,减少交易次数

从代码层面看,该策略主要可优化的方向包括:

- 调整波浪指标、RSI和MFI的参数,筛选出最佳参数组合

- 测试不同EMA周期参数的表现效果

- 调整止盈止损的收益风险比例因子,得到最佳配置

通过参数调整和测试,可使策略在最大化收益的同时,降低回撤和风险。

本策略综合运用多种指标判断大趋势方向,采用EMA指标作为具体操作信号,并使用追踪止损方式锁定利润。通过参数优化,可以获得较好的稳定收益。但也应注意一定的系统风险,需要持续关注指标效果和市场环境的变化。

||

The strategy is named "Strategy of Indicators Combination Breakthrough Trend Tracking". It combines various indicators to identify market trend directions and carry out trend tracking operations. The main components include:

- Using Wave Trend indicator to judge the main trend of the market

- Filtering out some false signals with RSI and MFI indicators

- Determining specific operational directions with EMA indicator

- Entering the market with breakthrough tracking method to ensure following the trend

The strategy mainly judges the direction and strength of the major trend, and sets bidirectional trading of long and short. The specific operating principles are as follows:

Long signal:

- Price is above 200-day EMA, indicating a bull market

- Price pulls back to around 50-day EMA forming support

- Wave Trend reverses to upward trend and a buy signal appears

- Both RSI and MFI show overbought

- 3 consecutive K-lines break through 50-day EMA successively, indicating a breakthrough upwards

Short signal: Opposite of long signal

Profit taking and stop loss: Two options provided: lowest price/highest price stop loss, ATR stop loss

The strategy has the following advantages:

- Integrates multiple indicators to determine the major trend and avoid false breakouts

- Adopts EMA to determine operational direction, easy to follow trends

- Trailing stop loss method achieves sustained profits

- Capable of going both long and short, following the market in either direction

The strategy also has some risks:

- Probability of wrong signals from the indicators

- Stop loss point set too small, increasing stop loss risk

- High trading frequency leads to hidden loss from trading fees

To reduce the above risks, optimization can be done in the following aspects:

- Adjust indicator parameters to filter wrong signals

- Appropriately loosen the stop loss point

- Optimize indicator parameters to reduce trading frequency

From the code level, the main optimizable directions of this strategy include:

- Adjusting parameters of Wave Trend, RSI and MFI to find the best parameter combination

- Testing the performance of different EMA cycle parameters

- Adjusting risk-reward ratio factors of profit taking and stop loss to obtain optimal configuration

Through parameter adjustment and testing, the strategy can maximize returns while reducing drawdowns and risks.

The strategy integrates multiple indicators to determine the major trend direction, uses EMA indicator as specific operation signal, and uses trailing stop loss to lock in profits. Through parameter optimization, relatively good steady profits can be obtained. But the certain system risks should also be noted, the effectiveness of indicators and changes in market environment need to be continuously monitored.

[/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_1 | true | FromMonth |

| v_input_2 | true | FromDay |

| v_input_3 | 2020 | FromYear |

| v_input_4 | true | ToMonth |

| v_input_5 | true | ToDay |

| v_input_6 | 9999 | ToYear |

| v_input_7 | 12 | Channel Length |

| v_input_8 | 12 | Average Length |

| v_input_9 | 53 | WT Overbought Level 1 |

| v_input_10 | -53 | WT Oversold Level 1 |

| v_input_11 | 2 | MFI Area Y Pos |

| v_input_12 | 80 | MFI Period |

| v_input_13 | 200 | MFI Area multiplier |

| v_input_14 | 30 | EMA Timeframe |

| v_input_15 | 200 | EMA1 Length |

| v_input_16 | 50 | EMA2 Length |

| v_input_17 | true | Enable long? |

| v_input_18 | true | Enable short? |

| v_input_19 | false | SL Buffer |

| v_input_20 | false | Enable lowest low/ highest high exit? |

| v_input_21 | 2 | ProfitfactorLong |

| v_input_22 | 50 | Lowest Low Lookback |

| v_input_23 | 2 | ProfitfactorShort |

| v_input_24 | 50 | highest high lookback |

| v_input_25 | true | Enable ATR exit? |

| v_input_26 | 6 | ATR Profitfactor Long |

| v_input_27 | 5 | ATR Stopfactor Long |

| v_input_28 | 3 | ATR Profitfactor Short |

| v_input_29 | 5 | ATR Stopfactor Short |

| v_input_30 | 11 | ATR Length |

Source (PineScript)

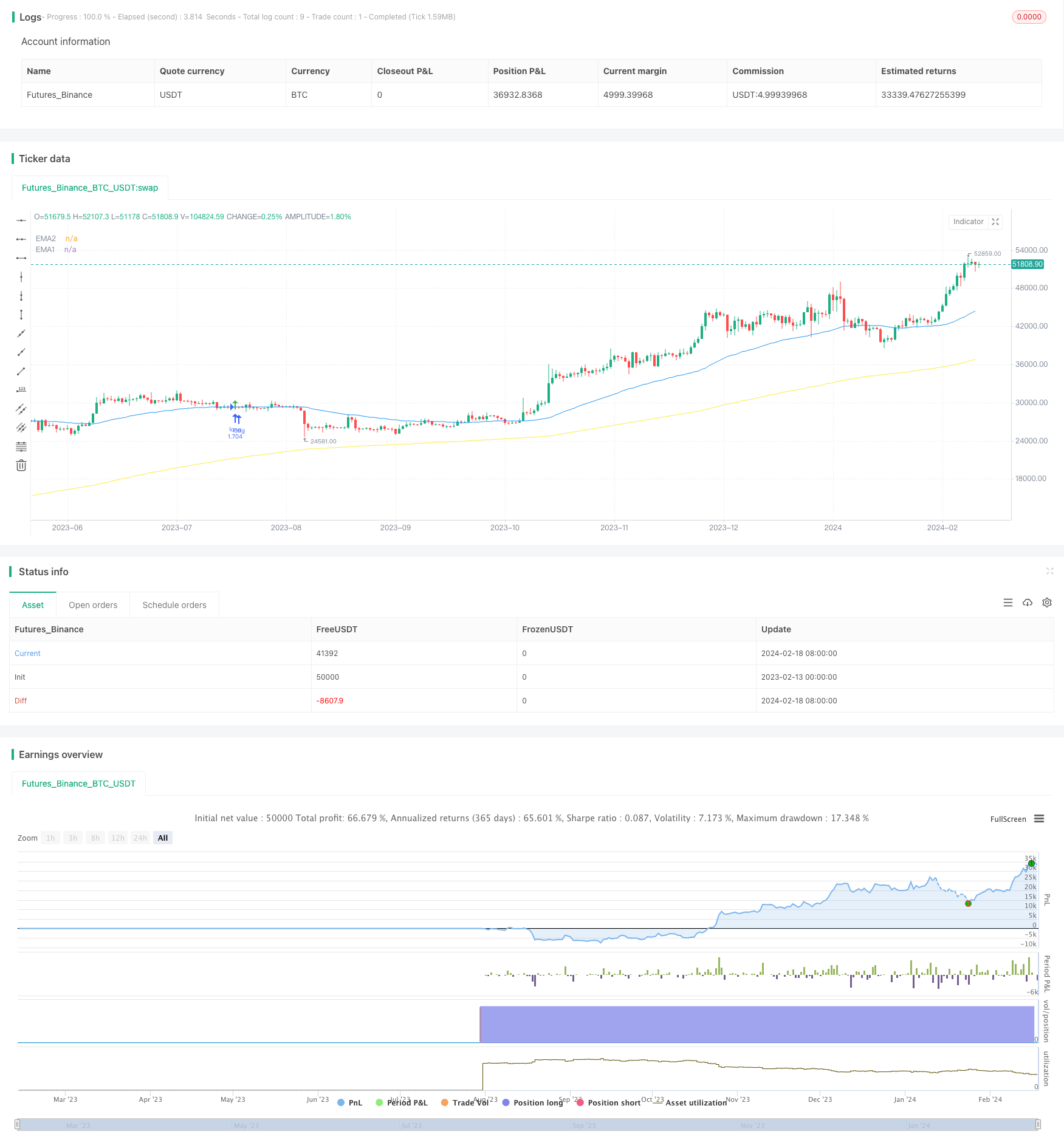

/*backtest

start: 2023-02-13 00:00:00

end: 2024-02-19 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

//Lowest Low/ Highest High & ATR Stop Loss/ Take Profit

//Optimized for the 30 minutes chart

strategy(title="TradePro's Trading Idea Cipher B+ Divergence EMA Pullback Strategy", shorttitle="WT MFI RSI EMA PB STRAT", overlay = true, pyramiding = 0, max_bars_back=5000, calc_on_order_fills = false, commission_type = strategy.commission.percent, commission_value = 0, default_qty_type = strategy.percent_of_equity, default_qty_value = 100, initial_capital=5000, currency=currency.USD)

// { Time Range

FromMonth=input(defval=1,title="FromMonth",minval=1,maxval=12)

FromDay=input(defval=1,title="FromDay",minval=1,maxval=31)

FromYear=input(defval=2020,title="FromYear",minval=2016)

ToMonth=input(defval=1,title="ToMonth",minval=1,maxval=12)

ToDay=input(defval=1,title="ToDay",minval=1,maxval=31)

ToYear=input(defval=9999,title="ToYear",minval=2017)

start=timestamp(FromYear,FromMonth,FromDay,00,00)

finish=timestamp(ToYear,ToMonth,ToDay,23,59)

window()=>true

// See if this bar's time happened on/after start date

afterStartDate = time >= start and time<=finish?true:false

zeroline = 0

// } Time Range

// { Wavetrend, RSI, MFI

// WaveTrend

cl = input(12, "Channel Length")

al = input(12, "Average Length")

overbought = input(53, title = 'WT Overbought Level 1', type = input.integer)

oversold = input(-53, title = 'WT Oversold Level 1', type = input.integer)

ap = hlc3

esa = ema(ap, cl)

d = ema(abs(ap - esa), cl)

ci = (ap - esa) / (0.015 * d)

tci = ema(ci, al)

wt1 = tci

wt2 = sma(wt1,4)

wtOs = wt2 <= oversold

wtOb = wt2 >= overbought

wtX = cross(wt1, wt2)

wtUp = wt2 - wt1 <= 0

wtDown = wt2 - wt1 >= 0

buySignal = wtX and wtOs and wtUp

sellSignal = wtX and wtOb and wtDown

// RSI & MFI

rsiMFIPosY = input(2, title = 'MFI Area Y Pos', type = input.float)

rsiMFIperiod = input(80,title = 'MFI Period', type = input.integer)

rsiMFIMultiplier = input(200, title = 'MFI Area multiplier', type = input.float)

f_rsimfi(_period, _multiplier, _tf) => security(syminfo.tickerid, _tf, sma(((close - open) / (high - low)) * _multiplier, _period) - rsiMFIPosY)

rsiMFI = f_rsimfi(rsiMFIperiod, rsiMFIMultiplier, timeframe.period)

// } Wavetrend, RSI, MFI

// { EMA

emasrc = close

res = input(title="EMA Timeframe", type=input.resolution, defval="30")

len1 = input(title="EMA1 Length", type=input.integer, defval=200)

col1 = color.yellow

len2 = input(title="EMA2 Length", type=input.integer, defval=50)

col2 = color.blue

// Calculate EMA

ema1 = ema(emasrc, len1)

emaSmooth1 = security(syminfo.tickerid, res, ema1, barmerge.gaps_off, barmerge.lookahead_off)

ema2 = ema(emasrc, len2)

emaSmooth2 = security(syminfo.tickerid, res, ema2, barmerge.gaps_off, barmerge.lookahead_off)

// Draw EMA

plot(emaSmooth1, title="EMA1", linewidth=1, color=col1)

plot(emaSmooth2, title="EMA2", linewidth=1, color=col2)

// } EMA

// { Long Entry

enablelong = input(true, title="Enable long?")

//Long Signal

upcondition = close > emaSmooth1

wavetrendlong = wt1 and wt2 < zeroline

mfilong = rsiMFI > 0

emapblong1 = (close > emaSmooth2) and (close[1] < emaSmooth2[1])

emapblong2 = ((close[2] > emaSmooth2[2]) and (close[3] > emaSmooth2[3]) and (close[4] > emaSmooth2[4])) or ((close[5] > emaSmooth2[5]) and (close[6] > emaSmooth2[6]) and (close[7] > emaSmooth2[7])) or ((close[8] > emaSmooth2[8]) and (close[9] > emaSmooth2[9]) and (close[10] > emaSmooth2[10]))

longcondition = upcondition and wavetrendlong and buySignal and mfilong and emapblong1 and emapblong2

//strategy buy long

if (longcondition) and (afterStartDate) and strategy.opentrades < 1 and (enablelong == true)

strategy.entry("long", strategy.long)

plotshape(longcondition, style=shape.arrowup,

location=location.abovebar, color=color.green)

// } Long Entry

// { Short Entry

enableshort = input(true, title="Enable short?")

//Short Signal

downcondition = close < emaSmooth1

wavetrendshort = wt1 and wt2 > zeroline

mfishort = rsiMFI < 0

emapbshort1 = (close < emaSmooth2) and (close[1] > emaSmooth2[1])

emapbshort2 = ((close[2] < emaSmooth2[2]) and (close[3] < emaSmooth2[3]) and (close[4] < emaSmooth2[4])) or ((close[5] < emaSmooth2[5]) and (close[6] < emaSmooth2[6]) and (close[7] < emaSmooth2[7])) or ((close[8] < emaSmooth2[8]) and (close[9] < emaSmooth2[9]) and (close[10] < emaSmooth2[10]))

shortcondition = downcondition and wavetrendshort and sellSignal and mfishort and emapbshort1 and emapbshort2

//strategy buy short

if (shortcondition) and (afterStartDate) and strategy.opentrades < 1 and (enableshort == true)

strategy.entry("short", strategy.short)

plotshape(shortcondition, style=shape.arrowdown,

location=location.belowbar, color=color.red)

// } Short Entry

// { Exit Conditions

bought = strategy.position_size[1] < strategy.position_size

sold = strategy.position_size[1] > strategy.position_size

barsbought = barssince(bought)

barssold = barssince(sold)

slbuffer = input(title="SL Buffer", type=input.float, step=0.1, defval=0)

// } Exit Conditions

// { Lowest Low/ Highes High Exit Condition

enablelowhigh = input(false, title="Enable lowest low/ highest high exit?")

//Lowest Low LONG

profitfactorlong = input(title="ProfitfactorLong", type=input.float, step=0.1, defval=2)

loLen = input(title="Lowest Low Lookback", type=input.integer,

defval=50, minval=2)

stop_level_long = lowest(low, loLen)[1]

if enablelowhigh == true and strategy.position_size>0

profit_level_long = strategy.position_avg_price + ((strategy.position_avg_price - stop_level_long[barsbought])*profitfactorlong) + slbuffer

strategy.exit(id="TP/ SL", stop=stop_level_long[barsbought] - slbuffer, limit=profit_level_long)

//Lowest Low SHORT

profitfactorshort = input(title="ProfitfactorShort", type=input.float, step=0.1, defval=2)

highLen = input(title="highest high lookback", type=input.integer,

defval=50, minval=2)

stop_level_short = highest(high, highLen)[1]

if enablelowhigh == true and strategy.position_size<0

profit_level_short = strategy.position_avg_price - ((stop_level_short[barssold] - strategy.position_avg_price)*profitfactorshort) - slbuffer

strategy.exit(id="TP/ SL", stop=stop_level_short[barssold] + slbuffer, limit=profit_level_short)

// } Lowest Low/ Highes High Exit Condition

// { ATR Take Profit/ Stop Loss

enableatr = input(true, title="Enable ATR exit?")

atrprofitfactorlong = input(title="ATR Profitfactor Long", type=input.float, step=0.1, defval=6)

atrstopfactorlong = input(title="ATR Stopfactor Long", type=input.float, step=0.1, defval=5)

atrprofitfactorshort = input(title="ATR Profitfactor Short", type=input.float, step=0.1, defval=3)

atrstopfactorshort = input(title="ATR Stopfactor Short", type=input.float, step=0.1, defval=5)

//ATR

lengthATR = input(title="ATR Length", defval=11, minval=1)

atr = atr(lengthATR)

//LONG EXIT

if (afterStartDate) and ((enableatr == true) and (strategy.opentrades > 0))

barsbought1 = barssince(bought)

profit_level = strategy.position_avg_price + (atr*atrprofitfactorlong)

stop_level = strategy.position_avg_price - (atr*atrstopfactorlong)

strategy.exit("Take Profit/ Stop Loss", "long", stop=stop_level[barsbought1], limit=profit_level[barsbought1])

//SHORT EXIT

if (afterStartDate) and ((enableatr == true) and (strategy.opentrades > 0))

barssold1 = barssince(sold)

profit_level = strategy.position_avg_price - (atr*atrprofitfactorshort)

stop_level = strategy.position_avg_price + (atr*atrstopfactorshort)

strategy.exit("Take Profit/ Stop Loss", "short", stop=stop_level[barssold1], limit=profit_level[barssold1])

// } ATR Take Profit/ Stop Loss

Detail

https://www.fmz.com/strategy/442214

Last Modified

2024-02-20 11:38:22