Name

季节反转跨期交易策略Seasonal-Reversal-Intertemporal-Trading-Strategy

Author

ChaoZhang

Strategy Description

该策略是一种基于季节效应的反转交易策略。它在特定的进入月份建立头寸,并在离开月份平仓,以捕获季节效应造成的价格反转。

该策略的核心逻辑是根据用户选择的进入月份和离开月份建立季节头寸。具体来说,如果当前月份等于进入月份,且没有建立头寸,则按照多头或空头方向入市。如果头寸已建立,且当前月份等于离开月份,则平仓头寸。

例如,如果选择10月入市,1月离场。那么每年的10月,如果没有持仓,则按照多头或空头方向建立新头寸;如果已有持仓,则每年1月份会平掉该头寸。依靠这样的逻辑,可以捕捉到由于季节效应造成的价格反转。

需要注意的是,该策略默认每次交易风险资金的25%,并按照0.5%的手续费计算。这会对最终收益产生一定影响。

该策略最大的优势在于利用季节效应产生的市场反转来获利。许多商品和金融市场都存在较为明显的季节性价格波动。如果选择合适的入市和离场时间,可以有效捕捉这样的季节效应造成的反转机会。

此外,该策略非常简单明了,容易理解和实施,适合量化交易的初学者。它只依赖两个参数,极大降低了策略优化难度。

尽管该策略效果显著,但依然存在一定的风险。首先,选择不当的入市和离场时间可能导致无法捕捉到价格反转,从而亏损;其次,市场环境变化也可能导致季节效应的减弱;最后,默认的止损逻辑较弱,无法有效控制单笔损失。

为了降低风险,可以考虑优化入市和离场时间的选择,结合更多分析判断市场环境,并设置止损来控制风险。当然,任何交易策略都无法完全规避市场风险,需要交易者谨慎对待。

该策略还有许多优化的空间。首先,可以引入止损逻辑,设置合理的止损幅度。其次,可以测试更多不同的入市离场组合,寻找最优参数。再者,可以结合更多的因素判断行情,避免在不利环境中交易。最后,引入指数加权算法,调整头寸规模,在盈利时加大头寸,亏损时减小头寸。

通过以上几点优化,可以进一步提高策略的稳定性、增强策略的跟踪性能。当然,任何优化都需要严格的回测验证,避免过度优化。

该季节反转跨期交易策略整体而言非常实用。它通过选择合适的入市和离场月份,有效捕捉了季节效应造成的价格反转,从而获利。同时,该策略也非常简单,容易理解和实施,适合量化交易的初学者。当然,交易者还需要注意一定的市场风险,并有针对性地持续优化策略,使其能适应市场环境的变化。

||

This strategy is a reversal trading strategy based on seasonal effects. It establishes positions in specific entry months and closes positions in exit months to capture price reversals caused by seasonal effects.

The core logic of this strategy is to establish seasonal positions based on the entry and exit months selected by the user. Specifically, if the current month equals the entry month and no position has been established, a long or short position will be entered according to the direction. If the position has been established and the current month equals the exit month, the position will be closed.

For example, if October is selected as the entry month and January is selected as the exit month, new positions will be established every October in the long or short direction if there is no existing position. And existing positions will be closed every January. Relying on such logic, price reversals caused by seasonal effects can be captured.

It should be noted that the strategy defaults to risk 25% of the account on each trade and charges 0.5% commission per trade. This will have some impact on the final profit.

The biggest advantage of this strategy is to profit from market reversals caused by seasonal effects. Many commodity and financial markets have significant seasonal price fluctuations. If appropriate entry and exit times are selected, such seasonal effect-induced reversal opportunities can be effectively captured.

In addition, this strategy is very simple and easy to understand and implement, suitable for beginners of quantitative trading. It relies only on two parameters, greatly reducing the difficulty of strategy optimization.

Although this strategy is effective, there are still some risks. Firstly, choosing inappropriate entry and exit times may fail to capture price reversals, resulting in losses. Secondly, changes in market conditions may also lead to weaker seasonal effects. Finally, the default stop loss logic is weak and cannot effectively control single trade losses.

To reduce risks, considerations can be given to optimizing the selection of entry and exit times, combining more analysis to judge market conditions, and setting stops to control risks. Of course, no trading strategy can completely avoid market risk, so traders need to treat it with caution.

There is still much room for optimization of this strategy. Firstly, stop loss logic can be introduced to set reasonable stop loss ranges. Secondly, more different combinations of entry and exit can be tested to find the optimal parameters. Also, more factors can be considered to judge market conditions and avoid trading in unfavorable environments. Finally, introduce the exponential weighted algorithm to adjust the position size, increase the position size when profiting, and decrease the position size when losing.

Through the above optimizations, the stability of the strategy can be further improved and the tracking ability of the strategy can be enhanced. Of course, any optimization needs to be strictly backtested to avoid over optimization.

Overall, this seasonal reversal intertemporal trading strategy is very practical. By selecting appropriate entry and exit months, it effectively captures price reversals caused by seasonal effects to make profits. At the same time, this strategy is also very simple and easy to understand and implement, suitable for beginners in quantitative trading. Of course, traders also need to be aware of certain market risks and continuously optimize strategies in a targeted manner to adapt them to changes in market conditions.

[/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_1 | 0 | Position Type: Long |

| v_input_2 | 0 | Entry Month: Oct |

| v_input_3 | 0 | Entry Month: Jan |

Source (PineScript)

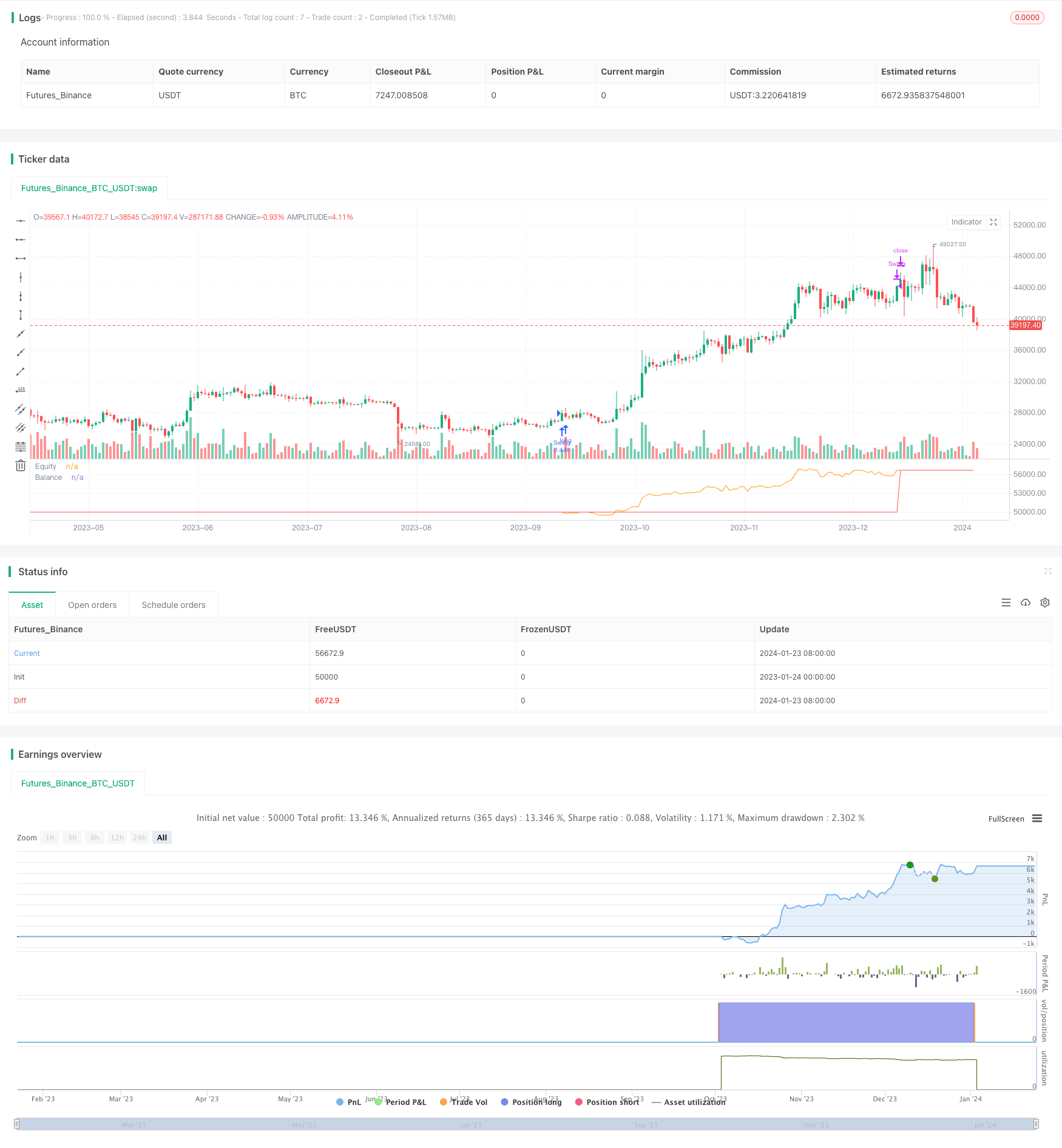

/*backtest

start: 2023-01-24 00:00:00

end: 2024-01-24 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © EmpiricalFX

//@version=4

strategy("Seasonality Benchmark ","Season",overlay=false,default_qty_type=strategy.percent_of_equity,

default_qty_value=25,initial_capital=100000,currency="USD",

commission_type=strategy.commission.percent,commission_value=0.5)

input_entry_direction = input("Long","Position Type",options=["Long","Short"])

input_entry_month = input("Oct","Entry Month",options=["Jan","Feb","Mar","Apr","May","Jun","Jul","Aug","Sep","Oct","Nov","Dec"])

input_exit_month = input("Jan","Entry Month",options=["Jan","Feb","Mar","Apr","May","Jun","Jul","Aug","Sep","Oct","Nov","Dec"])

//Convert three character month string to integer

month_str_to_int(m)=>

ret = m == "Jan" ? 1 :

m == "Feb" ? 2 :

m == "Mar" ? 3 :

m == "Apr" ? 4 :

m == "May" ? 5 :

m == "Jun" ? 6 :

m == "Jul" ? 7 :

m == "Aug" ? 8 :

m == "Sep" ? 9 :

m == "Oct" ? 10 :

m == "Nov" ? 11 :

m == "Dec" ? 12 : -1

is_long = input_entry_direction == "Long" ? true : false

entry = month_str_to_int(input_entry_month)

exit = month_str_to_int(input_exit_month)

var balance = strategy.equity

//Entering a position is conditional on:

//1. No currently active trades

//2. Input entry month matches current month

if(strategy.opentrades == 0 and entry == month)

strategy.entry("Swing",is_long)

//Exiting a position is conditional on:

//1. Must have open trade

//2. Input exit month matches current month

if(strategy.opentrades > 0 and exit == month)

strategy.close("Swing")

//Update the balance every time a trade is exited

if(change(strategy.closedtrades)>0)

balance := strategy.equity

plot(strategy.equity,"Equity",color.orange)

plot(balance,"Balance",color.red)

Detail

https://www.fmz.com/strategy/439970

Last Modified

2024-01-25 14:07:35