Name

多时间框架均线回调交易策略Multi-Timeframe-Moving-Average-Pullback-Trading-Strategy

Author

ChaoZhang

Strategy Description

该策略采用多时间框架均线的方法,利用长期均线判断大趋势方向,短期均线判断短期趋势方向,在长线和短线确认趋势一致时,进场做多/空;当短线回调到长线附近时,判断形成短期调整进入机会,此时做反向操作。该策略主要适用于中长线趋势性股票。

该策略使用200日简单移动均线判断长期趋势方向,使用10日简单移动均线判断短期趋势方向。当股价高于200日均线且低于10日均线时,说明目前处于长线上升和短线回调阶段,此时做多;当股价低于200日均线且高于10日均线时,说明目前处于长线下降和短线反弹阶段,此时做空。

具体来说,当满足如下条件时,做多入场:收盘价>200日均线 且 收盘价<10日均线;当满足如下条件时,做空入场:收盘价<200日均线 且 收盘价>10日均线。

入场后设置止损机制,如果从买入价回撤超过10%,则止损出场。同时,如果设置了i_lowerClose选项,则会等待较低的收盘价出现后再出场,这可以避免止损过于敏感。

该策略结合多时间框架均线,可以在较大概率上捕捉中长线趋势的方向。当短期均线回调到长期均线时,utsch策略提供较好的入场时机。与单一均线系统相比,可以减少因短期调整而被套的概率。

该策略风险可控。设置了10%的止损比例以控制亏损;同时设置了时间过滤条件,可以避免在特定时间段交易。

该策略依然存在被套的风险。当短线调整的时间过长或调整幅度过大时,可能触发止损而被套出场。这时就面临亏损的风险。

该策略对交易品种的适配性较差。对于波动性大,调整时间长的股票,该策略容易被止损出场,效果不佳。

在市场整体发生重大调整时,该策略也会面临较大亏损。例如金融危机期间,该策略可能难以获利。

可以引入更多均线系统,形成多重筛选机制。例如加入50日均线,只有当收盘价处于50日均线与200日均线之间时才考虑入场。这可以进一步筛选出趋势性较好的品种。

可以设置浮动止损。具体来说,入场后,可以根据股票的波动范围,设置可变化的止损幅度,而不是固定的10%止损。这可以减少不必要的止损被触发的概率。

可以结合其他指标判断市场状况。例如MACD,在MACD显示市场脱离时,可以暂停该策略,避免亏损。这可以根据大市场判断来控制策略的启动与关闭。

该策略整体来说是一种典型的多时间框架均线策略。它结合长短期均线,在大概率捕捉中长线趋势的同时,抓住短线回调机会入场。策略风险也在可控范围内。通过引入更多指标、优化止损方式等,可以进一步增强该策略的稳定性。

||

This strategy adopts the multi timeframe moving average approach, using the long term moving average to determine the major trend direction while the short term moving average to determine the short term trend direction. When the long term trend aligns with the short term trend, positions are taken accordingly. When the short term moving average pulls back to the vicinity of the long term moving average, it indicates a short term correction presenting trading opportunities for the reverse direction. This strategy works best for trending stocks over medium to long term timeframe.

The strategy uses the 200-day simple moving average (SMA) to determine the long term trend direction, and the 10-day SMA for the short term trend direction. When the price closes above the 200-day SMA and below the 10-day SMA, it signals an upward long term trend with a short term pullback, presenting buying opportunity. When the price closes below the 200-day SMA and above the 10-day SMA, it signals a downward long term trend with a short term bounce, presenting selling opportunity.

Specifically, when the following conditions are met, long entry is triggered: Close > 200-day SMA AND Close < 10-day SMA. When the following conditions are met, short entry is triggered: Close < 200-day SMA AND Close > 10-day SMA.

After entry, a 10% stop loss mechanism is implemented. The position will be stopped out if the retracement from the entry price exceeds 10%. Also, if the i_lowerClose option is enabled, it will wait for a lower close before exiting, avoiding excessive sensitivity of the stop loss.

This strategy combines multi timeframe moving averages, enabling high probability in capturing the mid to long term trend direction. It provides decent entry timing when the short term SMA pulls back to the long term SMA. Compared to single moving average systems, the probability of being caught in short term corrections is reduced.

The risk involved in this strategy is well defined and capped. A 10% stop loss ratio restricts the maximum loss size. Also the time range filter avoids trading in specified time periods.

There is still the risk of being caught in this strategy. If the short term correction lasts too long or the pullback amplitude is too big, the stop loss could be triggered resulting in forced exit at inopportune times. This introduces the risk of loss.

The adaptiveness of this strategy across trading instruments is limited. For stocks with high volatility and prolonged correction periods, this strategy tends to hit stop loss prematurely rendering poor performance.

During major market-wide corrections, e.g. financial crisis, this strategy could suffer big losses. Profitability is improbable during such times.

More moving average systems can be introduced to form a multiple filtering mechanism. For example, adding a 50-day SMA, entry positions are considered only when price is between the 50-day SMA and 200-day SMA. This extra filters out stocks with inferior trend characteristics.

A dynamic stop loss mechanism can be implemented. Specifically, after entry, the stop loss ratio is adjusted based on the observed volatility instead of a fixed 10%. This avoids premature trigger of the hard stop loss.

Other indicators gauging market conditions can also be incorporated. For example MACD, when MACD shows market divergence, this strategy could be temporarily deactivated to avoid losses. It adds a market timing mechanism to turn the strategy on and off.

In conclusion this is a typical multi timeframe moving average strategy. It capitalizes on the mid-long term trend direction indicated by the long term moving average, while taking advantage of short term pullback opportunities revealed by the short term moving average. The risk factors are defined and well capped. Further enhancements like additional filters, adaptive stop loss and market timing mechanism could improve its stability.

[/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_int_1 | 200 | (?Strategy Parameters)MA 1 Length |

| v_input_int_2 | 10 | MA 2 Length |

| v_input_float_1 | 0.1 | Stop Loss Percent |

| v_input_bool_1 | false | Exit On Lower Close |

| v_input_1 | timestamp(01 Jan 1995 13:30 +0000) | (?Time Filter)Start Filter |

| v_input_2 | timestamp(1 Jan 2099 19:30 +0000) | End Filter |

Source (PineScript)

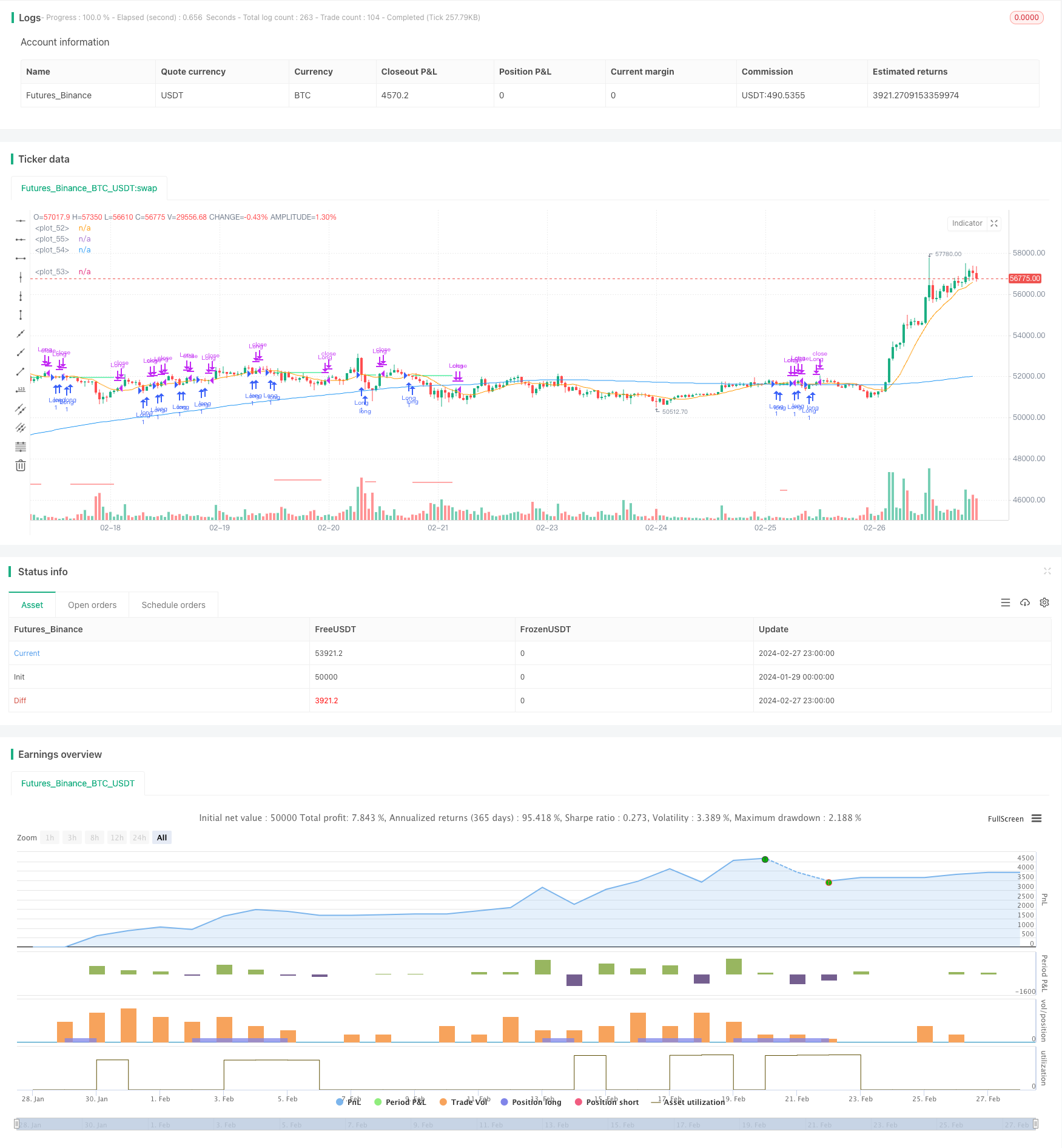

/*backtest

start: 2024-01-29 00:00:00

end: 2024-02-28 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © irfanp056

// @version=5

strategy("Simple Pullback Strategy",

overlay=true) // Interactive Brokers rate

// Get user input

i_ma1 = input.int(title="MA 1 Length", defval=200, step=10, group="Strategy Parameters", tooltip="Long-term MA")

i_ma2 = input.int(title="MA 2 Length", defval=10, step=10, group="Strategy Parameters", tooltip="Short-term MA")

i_stopPercent = input.float(title="Stop Loss Percent", defval=0.10, step=0.1, group="Strategy Parameters", tooltip="Failsafe Stop Loss Percent Decline")

i_lowerClose = input.bool(title="Exit On Lower Close", defval=false, group="Strategy Parameters", tooltip="Wait for a lower-close before exiting above MA2")

i_startTime = input(title="Start Filter", defval=timestamp("01 Jan 1995 13:30 +0000"), group="Time Filter", tooltip="Start date & time to begin searching for setups")

i_endTime = input(title="End Filter", defval=timestamp("1 Jan 2099 19:30 +0000"), group="Time Filter", tooltip="End date & time to stop searching for setups")

// Get indicator values

ma1 = ta.sma(close, i_ma1)

ma2 = ta.sma(close, i_ma2)

// Check filter(s)

f_dateFilter = true

// Check buy/sell conditions

var float buyPrice = 0

buyCondition = close > ma1 and close < ma2 and strategy.position_size == 0 and f_dateFilter

sellCondition = close > ma2 and strategy.position_size > 0 and (not i_lowerClose or close < low[1])

stopDistance = strategy.position_size > 0 ? ((buyPrice - close) / close) : na

stopPrice = strategy.position_size > 0 ? buyPrice - (buyPrice * i_stopPercent) : na

stopCondition = strategy.position_size > 0 and stopDistance > i_stopPercent

// Enter positions

if buyCondition

strategy.entry(id="Long", direction=strategy.long)

if buyCondition[1]

buyPrice := open

// Exit positions

if sellCondition or stopCondition

strategy.close(id="Long", comment="Exit" + (stopCondition ? "SL=true" : ""))

buyPrice := na

// Draw pretty colors

plot(buyPrice, color=color.lime, style=plot.style_linebr)

plot(stopPrice, color=color.red, style=plot.style_linebr, offset=-1)

plot(ma1, color=color.blue)

plot(ma2, color=color.orange)

Detail

https://www.fmz.com/strategy/443098

Last Modified

2024-02-29 11:20:28