Name

基于RSI指标的反转交易策略An-RSI-Reversal-Trading-Strategy

Author

ChaoZhang

Strategy Description

本策略利用RSI指标识别股票超买超卖的市场状态,在超买区形成死叉做空,在超卖区形成金叉做多,属于基于指标的反转交易策略。该策略结合趋势跟踪止损、固定止盈止损,可以有效控制交易风险。

该策略的交易信号是基于RSI指标的金叉死叉产生的。RSI指标一般以30作为超卖线,70作为超买线。当RSI指标上穿超卖线时,产生买入信号;当RSI指标下穿超买线时,产生卖出信号。根据这个原理,策略判断超买超卖区域的形成,并相应的产生做多做空信号。

在进场后,策略采用百分比追踪止损方式,通过持续刷新最高价或最低价,并离开一定百分比作为止损位。同时也采用了固定的止盈止损距离,当达到目标利润或最大亏损时止损。这种组合可以很好地控制交易风险。

该策略具有以下优势:

-

利用RSI指标判断超买超卖区域,这是比较成熟的交易技巧,可以较准确地捕捉到市场反转点。

-

采用金叉死叉方式,可以过滤掉部分噪音交易信号,使交易更加可靠。

-

结合趋势跟踪止损,可以最大限度锁定盈利,同时也可以快速止损,降低单笔损失。

-

固定止盈止损距离,也可以有效控制单笔交易风险。

-

整体来说,该策略规则清晰,易于理解和实现,适合量化交易初学者学习。

该策略也存在以下风险:

-

RSI指标容易产生错误信号,技术形态破裂的概率较大,可能导致止损被触发。

-

固定止盈止损距离,不能根据市场波动程度做调整,可能会过早止盈或扩大止损。

-

百分比跟踪止损只跟踪价格最高点或最低点,可能会过于激进,使盈利不足。

-

回测数据拟合风险。该策略的参数可能是针对历史数据进行优化的,在实际应用中表现可能会逊色。

-

交易频率可能过高,增加交易费用和滑点风险。

该策略可以从以下几个方向进行优化:

-

优化RSI参数,寻找最佳指标参数组合,提高信号质量。

-

增加其他指标过滤,形成多指标共振,提高信号准确率。

-

采用自适应止盈止损机制,根据市场波动自动调整止损止盈位。

-

增加交易频率控制模块,降低交易次数,减少交易费用。

-

增加资金管理模块,控制单笔交易规模,降低单笔损失。

-

在更长时间周期内进行回测,检验参数稳定性。

本策略整体是一个典型的反转交易策略,利用RSI指标判定超买超卖区域,采取金叉死叉方式产生交易信号。并使用趋势跟踪止损和固定止盈止损来控制风险。该策略逻辑清晰,容易实现,适合量化交易初学者学习和实践。但也存在一定的假信号风险和参数优化风险,需要继续对策略进行验证和优化,才能实际投入使用。

||

This strategy identifies overbought and oversold market conditions using the RSI indicator to go short on bearish crossovers in overbought zones and go long on bullish crossovers in oversold zones. It is a reversal trading strategy based on indicators. The strategy incorporates trend trailing stops and fixed take profit/stop loss to effectively control trading risk.

The trading signals of this strategy are generated based on bullish/bearish crossovers of the RSI indicator. The RSI indicator typically uses 30 as the oversold line and 70 as the overbought line. When the RSI line crosses above the oversold line, a buy signal is generated. When the RSI line crosses below the overbought line, a sell signal is generated. Based on this logic, the strategy identifies overbought and oversold zones and generates corresponding long/short signals.

After entering a position, the strategy uses percentage trailing stops by continuously updating the highest/lowest price reached and trailing a fixed percentage away from that as the stop loss. There are also fixed take profit and stop loss levels, closing the position when the target profit is reached or max loss is exceeded. This combination can effectively control trade risk.

The advantages of this strategy include:

-

Using RSI to identify overbought/oversold levels is a mature trading technique for reliably capturing market turning points.

-

Using bullish/bearish crossovers filters out some false signals and makes trading more reliable.

-

Trend trailing stops lock in profits as much as possible, while also having quick stop outs to contain loss per trade.

-

Fixed TP/SL levels also control per trade risk effectively.

-

Overall simple and clear logic, easy to understand and implement, suitable for beginners.

The risks of this strategy include:

-

RSI signals can be false, with high chance of pattern failure, leading to stop loss trigger.

-

Fixed TP/SL cannot adapt to market volatility, may cut profits short or let losses run.

-

Percentage trailing only follows highest/lowest price, may be too aggressive leaving profits behind.

-

Overfitting risk as parameters could be optimized just for historical data.

-

High trade frequency increasing transaction costs and slippage.

Possible ways to improve the strategy:

-

Optimize RSI parameters for best results.

-

Add filter indicators for higher signal accuracy.

-

Adaptive stops/profits based on market volatility.

-

Limit trade frequency to reduce transaction costs.

-

Add position sizing to limit loss per trade.

-

Backtest over longer timeframe to test stability.

In summary this is a typical reversal strategy using RSI to identify overbought/oversold, with bull/bear crossovers as signals. Trend trailing stops and fixed TP/SL manage risk. The logic is simple and easy to implement, suitable for beginners. But risks like false signals and curve fitting need to be addressed through further verification and optimization before live trading.

[/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_1 | 2011 | Backtest Start Year |

| v_input_2 | 8 | Backtest Start Month |

| v_input_3 | true | Backtest Start Day |

| v_input_4 | 2100 | Backtest Stop Year |

| v_input_5 | 9 | Backtest Stop Month |

| v_input_6 | 29 | Backtest Stop Day |

| v_input_7 | true | Color Background? |

| v_input_8 | 14 | length |

| v_input_9 | 30 | overSold |

| v_input_10 | 70 | overBought |

| v_input_11 | 99999 | Trailing Stop |

| v_input_12 | 99999 | Take Profit |

| v_input_13 | 99999 | Stop Loss |

| v_input_14 | 200 | Leverage |

Source (PineScript)

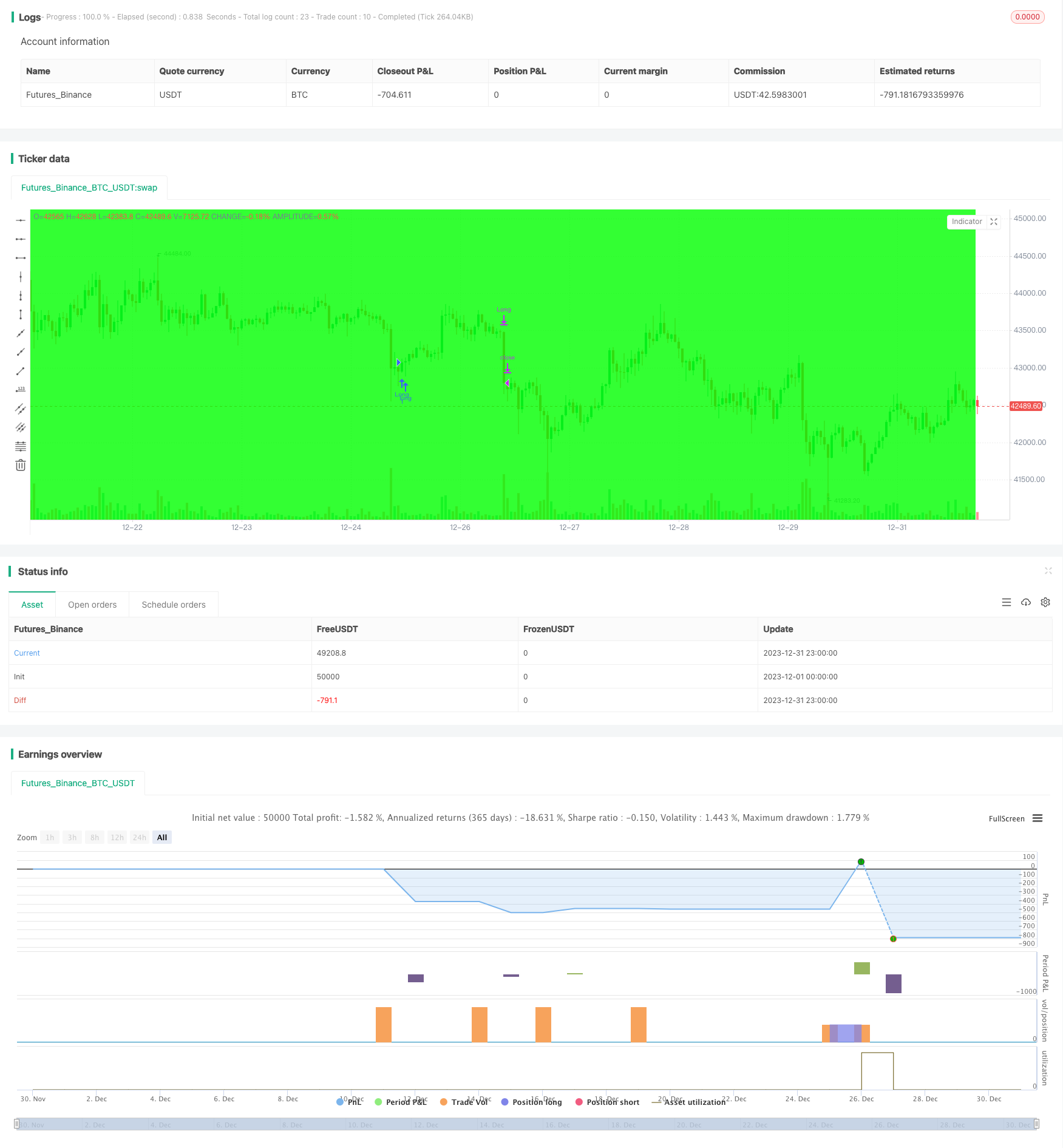

/*backtest

start: 2023-12-01 00:00:00

end: 2023-12-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// LOVE JOY PEACE PATIENCE KINDNESS GOODNESS FAITHFULNESS GENTLENESS SELF-CONTROL

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// Author: © JoshuaMcGowan

// Taken from https://www.tradingview.com/script/GbZGYi6l-Adding-some-essential-components-to-a-prebuilt-RSI-strategy/

// Just updated to compile in version 4.

//@version=4

strategy("Adding some essential components to a prebuilt RSI strategy", overlay=true)

/////////////// Component Code Start ///////////////

testStartYear = input(2011, "Backtest Start Year")

testStartMonth = input(8, "Backtest Start Month")

testStartDay = input(1, "Backtest Start Day")

testPeriodStart = timestamp(testStartYear,testStartMonth,testStartDay,0,0)

testStopYear = input(2100, "Backtest Stop Year")

testStopMonth = input(9, "Backtest Stop Month")

testStopDay = input(29, "Backtest Stop Day")

// testStopDay = testStartDay + 1

testPeriodStop = timestamp(testStopYear,testStopMonth,testStopDay,0,0)

// A switch to control background coloring of the test period

testPeriodBackground = input(title="Color Background?", type=input.bool, defval=true)

testPeriodBackgroundColor = testPeriodBackground and (time >= testPeriodStart) and (time <= testPeriodStop) ? #00FF00 : na

bgcolor(testPeriodBackgroundColor, transp=97)

testPeriod() => true

/////////////// Component Code Stop ///////////////

// Replace RSI Component, Long/Short, and Long Signal/Short Signal conditions with your trade setup components.

///////////// RSI component /////////////

length = input( 14 )

overSold = input( 30 )

overBought = input( 70 )

price = close

vrsi = rsi(price, length)

notna = not na(vrsi)

/////////////// STRATEGY ///////////////

ts = input(99999, "Trailing Stop") / 100

tp = input(99999, "Take Profit") / 100

sl = input(99999, "Stop Loss") / 100

// Update this with your setup.

long = notna and crossover(vrsi, overSold)

short = notna and crossunder(vrsi, overBought)

last_long = 0

last_short = 0

last_long := long ? time : nz(last_long[1])

last_short := short ? time : nz(last_short[1])

// Update this to reflect your setup.

long_signal = crossover(last_long, last_short)

short_signal = crossover(last_short, last_long)

float last_open_long_signal = 0

float last_open_short_signal = 0

last_open_long_signal := long_signal ? open : nz(last_open_long_signal[1])

last_open_short_signal := short_signal ? open : nz(last_open_short_signal[1])

last_long_signal = 0

last_short_signal = 0

last_long_signal := long_signal ? time : nz(last_long_signal[1])

last_short_signal := short_signal ? time : nz(last_short_signal[1])

in_long_signal = last_long_signal > last_short_signal

in_short_signal = last_short_signal > last_long_signal

float last_high = 0

float last_low = 0

last_high := not in_long_signal ? na : in_long_signal and (na(last_high[1]) or high > nz(last_high[1])) ? high : nz(last_high[1])

last_low := not in_short_signal ? na : in_short_signal and (na(last_low[1]) or low < nz(last_low[1])) ? low : nz(last_low[1])

long_ts = not na(last_high) and high <= (last_high - ts) //and high >= last_open_long_signal

short_ts = not na(last_low) and low >= (last_low + ts) //and low <= last_open_short_signal

long_tp = high >= (last_open_long_signal + tp)

short_tp = low <= (last_open_short_signal - tp)

long_sl = low <= (last_open_long_signal - sl)

short_sl = high >= (last_open_short_signal + sl)

leverage = input(200, "Leverage")

long_call = last_open_long_signal - (0.8 + 0.2 * (1/leverage)) / leverage * last_open_long_signal

short_call = last_open_short_signal + (0.78 + 0.2 * (1/leverage)) / leverage * last_open_short_signal

long_call_signal = low <= long_call

short_call_signal = high >= short_call

if testPeriod()

strategy.entry("Long", strategy.long, when=long_signal)

strategy.entry("Short", strategy.short, when=short_signal)

// plot(long_call, color=color.red)

// plot(short_call, color=color.green)

strategy.close("Long", when=long_call_signal)

strategy.close("Short", when=short_call_signal)

strategy.close("Long", when=long_tp)

strategy.close("Short", when=short_tp)

strategy.close("Long", when=long_sl)

strategy.close("Short", when=short_sl)

strategy.close("Long", when=long_ts)

strategy.close("Short", when=short_ts)

Detail

https://www.fmz.com/strategy/440456

Last Modified

2024-01-30 17:06:45