Name

基于EMA和SMA交叉的趋势跟踪策略Trend-Following-Strategy-Based-on-EMA-and-SMA-Crossover

Author

ChaoZhang

Strategy Description

"基于EMA和SMA交叉的趋势跟踪策略"是一个基于指数移动平均线(EMA)和简单移动平均线(SMA)交叉的趋势跟踪交易策略。该策略旨在通过捕捉短期EMA跨过长期SMA的时机,识别潜在的买入和卖出信号。

该策略基于两个条件判断产生交易信号:

- 最新5期EMA上穿最新20期SMA

- 4小时级别上,最新5期EMA上穿最新20期SMA

当这两个条件同时满足时,产生买入信号;当这两个条件同时不满足时,产生卖出信号。

该策略通过比较不同时间周期上的EMA和SMA的交叉情况,综合判断趋势方向,产生交易信号。短期EMA反映价格的趋势变化更为敏感,而长期SMA具有更好的趋势过滤能力。当短期EMA上穿长期SMA时,表示价格略微反转,进入趋势状况,因此产生买入信号;反之,短期EMA下穿长期SMA时,表示趋势结束,因此产生卖出信号。

同时,策略加入4小时级别EMA和SMA的判断,可过滤掉短期噪音,使交易信号更加可靠。

该策略具有以下优势:

- 简单实用,容易理解实现

- 响应迅速,可及时捕捉趋势转折

- 结合多时间周期判断,可有效过滤噪音

该策略也存在一些风险:

- 容易产生假信号,须慎重验证信号

- 无法很好应对趋势震荡市

- 需谨慎选择EMA和SMA的参数

可通过加入止损止盈、优化参数等方法来控制风险。

该策略可从以下几个方面进行优化:

- 测试更多的EMA和SMA周期参数组合

- 加入其它指标进行信号验证,如MACD、布林带等

- 建立动态止损机制

- 结合交易量进行信号过滤

该策略整体较为简单实用,通过EMA和SMA交叉判断趋势转折,是一个基础的趋势跟踪策略。可通过参数优化、信号过滤等方法进行改进,从而适应更多市场情况,提高策略效果。

||

The "Trend Following Strategy Based on EMA and SMA Crossover" is a trend-following trading strategy based on the crossover of Exponential Moving Averages (EMAs) and Simple Moving Averages (SMAs). This strategy aims to identify potential buy and sell signals by capturing moments when the short-term EMA crosses above the long-term SMA.

This strategy generates trading signals based on two conditions:

- The latest 5-period EMA crossed above the latest 20-period SMA

- On the 4-hour timeframe, the latest 5-period EMA crossed above the latest 20-period SMA

When both conditions are true, a buy signal is generated. When both conditions are false, a sell signal is generated.

By comparing EMA and SMA crossovers across different timeframes, this strategy comprehensively judges the trend direction and generates trading signals. The short-term EMA reflects price changes more sensitively while the long-term SMA has better trend filtering capability. When the short-term EMA crosses above the long-term SMA, it indicates a slight trend reversal and generates a buy signal. Conversely, when the short-term EMA crosses below the long-term SMA, it indicates a trend reversal and generates a sell signal.

Adding the 4-hour EMA and SMA crossover filters out short-term noise and makes trading signals more reliable.

This strategy has the following advantages:

- Simple and easy to understand

- Quick response, timely captures trend reversal

- Noise filtering by incorporating multiple timeframes

There are also some risks with this strategy:

- Prone to false signals, signals should be carefully validated

- Does not cope well with trendless markets

- EMA and SMA parameters need to be chosen carefully

Risks can be managed through incorporating stop loss/take profit, parameter optimization etc.

Some ways to enhance this strategy:

- Test more EMA and SMA parameter combinations

- Add other indicators for signal validation e.g. MACD, Bollinger Bands

- Build a dynamic stop loss mechanism

- Filter by trading volume

In summary, this is a basic trend following strategy using simple EMA and SMA crossover rules. It can be improved via parameter optimization, signal filtering etc. to adapt better and improve strategy performance.

[/trans]

Source (PineScript)

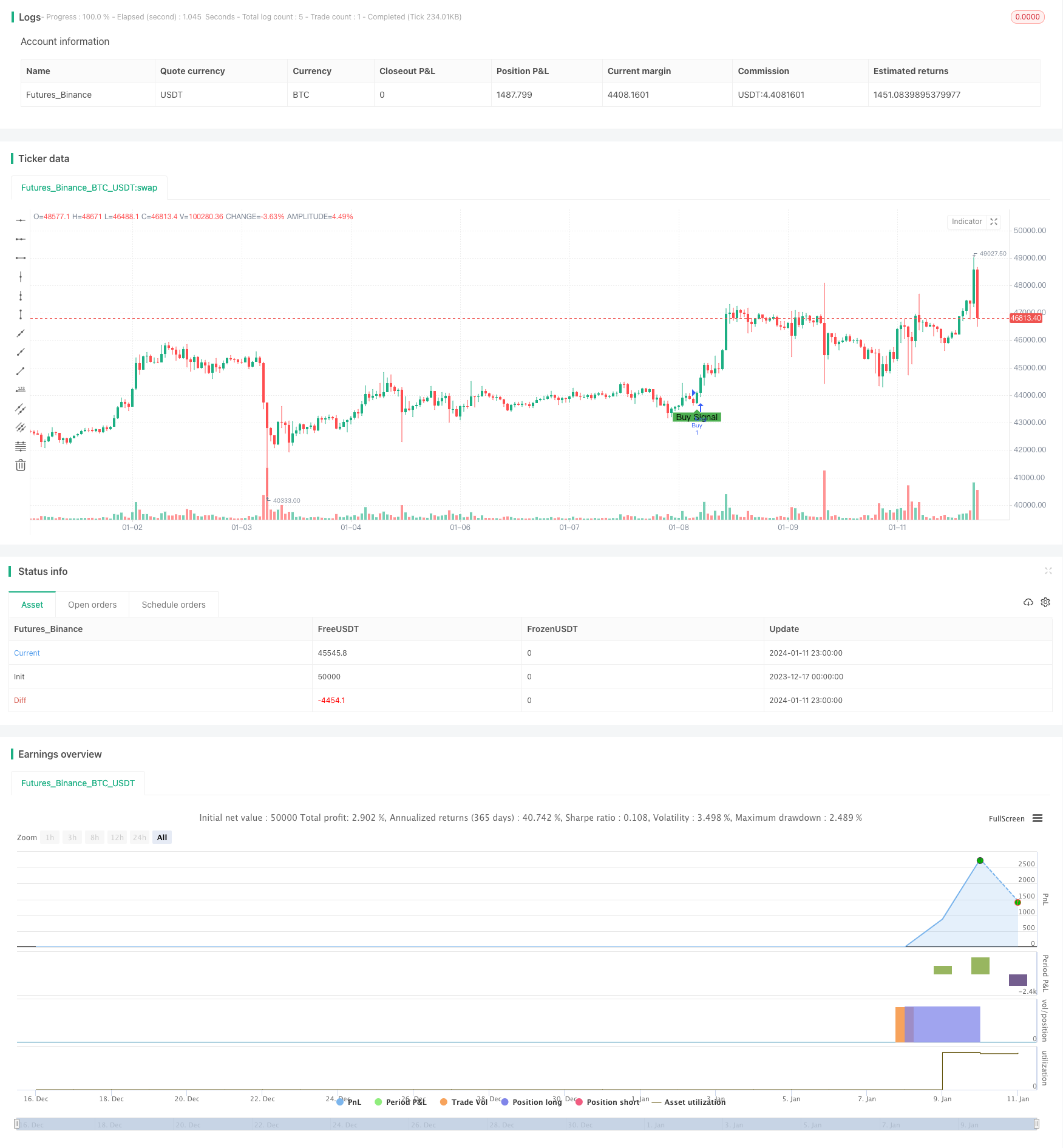

/*backtest

start: 2023-12-17 00:00:00

end: 2024-01-12 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("EMA and SMA Crossover Strategy", shorttitle="Shashank Cross", overlay=true)

// Condition 1: Latest EMA (Close, 5) crossed above Latest SMA (Close, 20)

ema5 = ta.ema(close, 5)

sma20 = ta.sma(close, 20)

condition1 = ta.crossover(ema5, sma20)

// Condition 2: [0] 4-hour EMA ([0] 4-hour Close, 5) crossed above [0] 4-hour SMA ([0] 4-hour Close, 20)

ema5_4h = request.security(syminfo.tickerid, "240", ta.ema(close, 5))

sma20_4h = request.security(syminfo.tickerid, "240", ta.sma(close, 20))

condition2 = ta.crossover(ema5_4h, sma20_4h)

// Combine both conditions for a buy signal

buy_signal = condition1 and condition2

// Plotting signals on the chart

plotshape(buy_signal, color=color.green, style=shape.labelup, location=location.belowbar, size=size.small, text="Buy Signal")

// Strategy logic

if (buy_signal)

strategy.entry("Buy", strategy.long)

// Exit long position on the next bar at market price

if (ta.barssince(buy_signal) == 1)

strategy.close("Exit")

// You can add more code for stop-loss, take-profit, etc., as per your strategy.

Detail

https://www.fmz.com/strategy/439079

Last Modified

2024-01-17 15:42:22