Name

基于年内调整的RSI震荡交易策略Bitlinc-MARSI-Trading-Strategy

Author

ChaoZhang

Strategy Description

本策略是一个基于年内调整的RSI震荡交易策略,通过追踪RSI指标在设定的上下轨之间的震荡特征,在RSI指标触碰上下轨时发出交易信号。

- 设置MA均线长度、RSI参数、上下轨、止盈止损参数、交易周期范围

- 计算RSI指标值,RSI=(上涨平均值)/(上涨平均值+下跌平均值)*100

- 绘制RSI指标和上下轨

- RSI指标上穿下轨为做多信号,下穿上轨为做空信号

- 开仓建立OCO挂单

- 按照设置的止盈止损逻辑进行止损和止盈

- 通过设置年度内的交易周期,可以避免一些不合适的外部环境。

- RSI指标可以有效反映超买超卖情况,通过设定合理区间进行震荡交易,可以过滤掉部分噪音。

- OCO挂单结合止盈止损设定,可以实现高效的风险控制。

- RSI临界判断准确性无法保证,可能存在一定的误判风险。

- 年内交易周期设置不当可能错过更好的交易机会或进入不适当交易环境。

- 止损点设定过大可能造成较大亏损,止盈点设定过小可能造成利润太小。

可以通过调整RSI参数、交易周期时间范围、止盈止损比例等方法进行优化。

- 测试不同市场不同周期下RSI参数的最优值

- 分析整体行情周期规律,设定最佳的年内交易时间段

- 通过回测确定合理的止盈止损比例

- 优化交易品种选择和加大持仓规模

- 结合其他更优交易技巧或指标进行优化

本策略通过RSI指标在年内指定周期的震荡特征进行趋势跟踪交易,有效控制了交易风险。通过参数优化和规则优化,可以获得更高的策略效果。

||

This strategy is an RSI oscillation tracking strategy based on annual adjustments. By tracking the oscillation characteristics of the RSI indicator between the set upper and lower bands, trading signals are issued when the RSI indicator touches the upper and lower bands.

- Set parameters for MA length, RSI, upper/lower band, take profit/stop loss, trading cycle range.

- Calculate RSI value, RSI = (Avg. Upward Change)/(Avg. Upward Change + Avg. Downward Change)*100

- Plot RSI line and bands

- RSI crossing below lower band is long signal, crossing above upper band is short signal

- Open position with OCO orders

- Execute stop loss and take profit based on settings

- Setting annual trading cycle avoids unsuitable external environments.

- RSI reflects overbought/oversold efficiently. Reasonable range oscillation filters noise.

- OCO orders + stop loss/profit settings enable efficient risk control.

- Accuracy of RSI threshold judgement cannot be guaranteed, wrong judgements may happen.

- Improper annual cycle settings may miss better opportunities or enter unsuitable environments.

- Overlarge stop loss setting may lead to big losses, while too-small profit setting gives small profit.

Methods like adjusting RSI parameters, trading cycle range, stop loss/profit ratios can be used to optimize.

- Test optimal RSI parameters for different markets and cycles

- Analyze overall market cycle pattern, set best annual trading phase

- Determine reasonable stop loss/profit ratios through backtest

- Optimize trading products selection and position sizing

- Combine with other better techniques for further optimization

This strategy tracks trend by RSI's annual cycle oscillation features, effectively controlling trading risks. Further performance improvement can be achieved by parameter tuning and logic optimization.

[/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_1 | 62 | Length of MA |

| v_input_2 | 31 | Length |

| v_input_3 | 89 | Upper Band for RSI |

| v_input_4 | 10 | Lower Band for RSI |

| v_input_5 | 1.25 | Take Profit Percent |

| v_input_6 | 0.04 | Stop Loss Percent |

| v_input_7 | 8 | Month Start |

| v_input_8 | 12 | Month End |

| v_input_9 | true | Day Start |

| v_input_10 | 31 | Day End |

Source (PineScript)

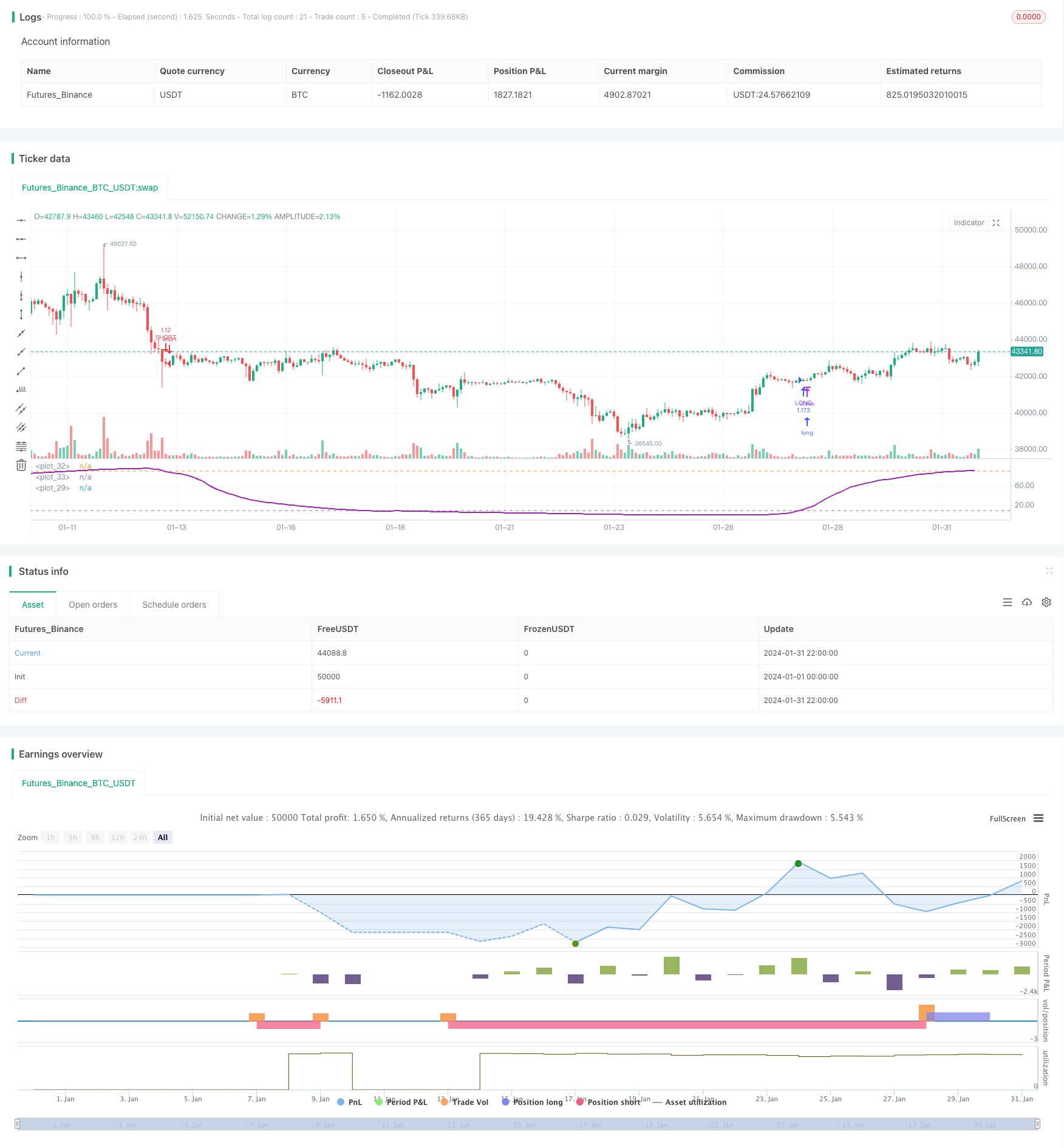

/*backtest

start: 2024-01-01 00:00:00

end: 2024-01-31 23:59:59

period: 2h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=3

strategy(title = "Bitlinc MARSI Study AST",shorttitle="Bitlinc MARSI Study AST",default_qty_type = strategy.percent_of_equity, default_qty_value = 100,commission_type=strategy.commission.percent,commission_value=0.1,initial_capital=1000,currency="USD",pyramiding=0, calc_on_order_fills=false)

// === General Inputs ===

lengthofma = input(62, minval=1, title="Length of MA")

len = input(31, minval=1, title="Length")

upperband = input(89, minval=1, title='Upper Band for RSI')

lowerband = input(10, minval=1, title="Lower Band for RSI")

takeprofit =input(1.25, title="Take Profit Percent")

stoploss =input(.04, title ="Stop Loss Percent")

monthfrom =input(8, title = "Month Start")

monthuntil =input(12, title = "Month End")

dayfrom=input(1, title= "Day Start")

dayuntil=input(31, title= "Day End")

// === Innput Backtest Range ===

//FromMonth = input(defval = 9, title = "From Month", minval = 1, maxval = 12)

//FromDay = input(defval = 1, title = "From Day", minval = 1, maxval = 31)

//FromYear = input(defval = 2018, title = "From Year", minval = 2017)

//ToMonth = input(defval = 1, title = "To Month", minval = 1, maxval = 12)

//ToDay = input(defval = 1, title = "To Day", minval = 1, maxval = 31)

//ToYear = input(defval = 9999, title = "To Year", minval = 2017)

// === Create RSI ===

src=sma(close,lengthofma)

up = rma(max(change(src), 0), len)

down = rma(-min(change(src), 0), len)

rsi = down == 0 ? 100 : up == 0 ? 0 : 100 - (100 / (1 + up / down))

plot(rsi,linewidth = 2, color=purple)

// === Plot Bands ===

band1 = hline(upperband)

band0 = hline(lowerband)

fill(band1, band0, color=blue, transp=95)

// === Entry and Exit Methods ===

longCond = crossover(rsi,lowerband)

shortCond = crossunder(rsi,upperband)

// === Long Entry Logic ===

if ( longCond )

strategy.entry("LONG", strategy.long, stop=close, oca_name="TREND", comment="LONG")

else

strategy.cancel(id="LONG")

// === Short Entry Logic ===

if ( shortCond )

strategy.entry("SHORT", strategy.short,stop=close, oca_name="TREND", comment="SHORT")

else

strategy.cancel(id="SHORT")

// === Take Profit and Stop Loss Logic ===

//strategy.exit("Take Profit LONG", "LONG", profit = close * takeprofit / syminfo.mintick, loss = close * stoploss / syminfo.mintick)

//strategy.exit("Take Profit SHORT", "SHORT", profit = close * takeprofit / syminfo.mintick, loss = close * stoploss / syminfo.mintick)

strategy.exit("LONG TAKE PROFIT", "LONG", profit = close * takeprofit / syminfo.mintick)

strategy.exit("SHORT STOP LOSS", "SHORT", profit = close * takeprofit / syminfo.mintick)

strategy.exit("LONG STOP LOSS", "LONG", loss = close * stoploss / syminfo.mintick)

strategy.exit("SHORT STOP LOSS", "SHORT", loss = close * stoploss / syminfo.mintick)

Detail

https://www.fmz.com/strategy/443090

Last Modified

2024-02-29 10:54:45