Name

基于导数的交易策略Derivative-Based-Trading-Strategy

Author

ChaoZhang

Strategy Description

[trans]

这个策略是基于使用Hull移动平均线(HMA)的1、2、3和4阶时间导数进行投资的。它会等份投入一定的资金。 entry点是通过2、3和4阶导数的趋势识别的,而exit点是在一个新的entry点或追踪止损百分比处创建的。

该策略首先计算HMA。Hull移动平均线是一个加权移动平均线,它使用以下公式计算:

hullma = wma(2*wma(src,sm/2)-wma(src,sm),round(sqrt(sm)))

其中src是价格,sm是一个输入参数,控制平均线的长度。

之后,该策略计算速度(1阶导数)、加速度(2阶导数)、震荡(3阶导数)和激荡(4阶导数)。这些是通过计算HMA和其滞后值之间的差值然后除以长度len来计算的。例如,速度计算公式是:

speed = (hullma-hullma[len])/len

其余导数的计算方式类似。

策略通过查看加速度、震荡和激荡的正负来决定入场和出场。如果三个指标都是正的,它会开多单。如果三个指标都是负的,它会开空单。

此外,该策略还会trailing stop loss来锁定利润。 多头头寸会根据一个可调整的输入百分比来设置止损,空头头寸同理。

这个策略的一个主要优势是它使用多个导数作为入场和出场信号,这可以过滤掉一些假信号。仅仅依靠速度(1阶导数)来决定入场通常太脆弱,但结合2、3、4阶导数,可以建立一个比较强劲的系统。

另一个优势是这个策略非常灵活。它有多个可调整的参数,包括HMA长度、各种导数的长度、止损百分比等,可以针对不同市场进行优化。

使用可调整的追踪止损也是一个优势。这可以帮助策略在趋势行情中获得更多利润,而在震荡行情中及时退出,限制了最大回撤。

该策略主要的风险在于突发事件造成的命中率下降。如果没有相关过滤规则,在重大新闻事件突发后,多个导数可能同时出现错误信号,导致较大亏损。可以设置一些新闻过滤,或者在突发事件后暂停策略一段时间以降低这种风险。

另一个风险是参数容易过拟合。HMA长度、各导数长度等参数都可能影响结果。这需要采用严格的回测方法,在不同市场中评估这些参数的稳健性。同时也要注意追踪止损百分比不宜设置太大,否则可能导致亏损扩大。

这个策略可以从以下几个方面进行优化:

-

增加基于突发事件的过滤机制,在重大新闻事件后暂停交易一段时间,避免错失入场点产生过大亏损

-

对参数进行多市场回测,确保其稳健性。可以回测不同品种、不同时间段的数据,评估参数设置的稳定性

-

尝试改进入场逻辑。可以引入机器学习算法自动识别趋势,而不是简单的正负判断

-

改进止损方式。可以使用波动率止损或机器学习止损代替简单的百分比追踪止损

-

增加止盈 exit。现有逻辑主要依靠止损,可以额外增加向上追踪止盈或目标利润退出

这个策略是一个多时间尺度的趋势跟踪策略。它使用Hull移动平均线的多个导数作为建仓和平仓信号,采用追踪止损来锁定利润。主要优势有利用多个导数过滤掉假信号,策略参数灵活等。需要注意的风险包括突发事件的影响和参数容易过拟合。该策略可以从增加过滤机制、改进参数稳健性、改进入场退出逻辑等方面进行优化,使其成为一个更加可靠和稳定的自动化交易系统。

||

This strategy invests equal percentages of capital based on utilizing the 1st, 2nd, 3rd and 4th time derivatives of the Hull Moving Average (HMA). Entry points are identified by trends in the 2nd, 3rd and 4th derivatives while exit points are created at either a new entry point or a trailing stop loss percentage.

The strategy first calculates the HMA. The Hull Moving Average is a weighted moving average calculated with the following formula:

hullma = wma(2*wma(src,sm/2)-wma(src,sm),round(sqrt(sm)))

where src is the price and sm is an input parameter controlling the length of the average.

The strategy then calculates the speed (1st derivative), acceleration (2nd derivative), jerk (3rd derivative) and jounce (4th derivative). These are calculated by taking the difference between the HMA and its lagged values divided by the length len. For example, the speed calculation is:

speed = (hullma-hullma[len])/len

The other derivatives are calculated similarly.

The strategy determines entries and exits by looking at the signs of the acceleration, jerk and jounce. If all three indicators are positive, it will go long. If all three are negative, it will go short.

In addition, the strategy will also trail stop losses to lock in profits. Long positions will have stop losses set based on an adjustable input percentage, and short positions likewise.

A key advantage of this strategy is it uses multiple derivatives as entry and exit signals, which can filter out some false signals. Relying solely on speed (1st derivative) to determine entries is often too fragile, but combining the 2nd, 3rd and 4th derivatives can build a more robust system.

Another advantage is that this strategy is very flexible. It has multiple adjustable parameters including HMA length, lengths of the various derivatives, stop loss percentages etc. which can be optimized for different markets.

The use of adjustable trailing stops is also an advantage. This can help the strategy capture more profits in trending markets, while exiting in a timely manner during choppy markets, limiting maximum drawdown.

The main risk of this strategy is decreased hit rate due to sudden events. If there are no relevant filters in place, major news events could cause multiple derivatives to give wrong signals at the same time, leading to larger losses. Some news filters could be implemented or the strategy could be paused for some time after burst events to mitigate this risk.

Another risk is parameters could be easily overfit. The HMA length, derivative lengths etc. could all impact results. This requires rigorous backtesting to evaluate the robustness of these parameters across different markets. Also the trailing stop loss percentages should not be too wide, otherwise losses could snowball.

This strategy could be optimized in several ways:

-

Add filters based on burst events to pause trading for some time after major news events, avoiding missing entry points leading to large losses

-

Conduct robustness test of parameters across markets. Backtest on different products, time periods to evaluate stability of parameters

-

Attempt to improve entry logic. Introduce machine learning models to identify trends instead of simple positive/negative judgments

-

Improve stop loss methodology. Use volatility or machine learning stops instead of simple percentage trailing stops

-

Add profit taking exits. The current logic relies mainly on stops, could add additional upside trailing or target profit exits

This is a multi-timeframe trend following strategy utilizing multiple derivatives of the Hull Moving Average as entry and exit signals with trailing stops to lock in profits. Key advantages include filtering out false signals using multiple derivatives, flexible tunable parameters etc. Risks to note include impacts from burst events and potential parameter overfitting. The strategy could be optimized by adding filters, improving parameter robustness, enhancing entry/exit logic and so on to make it a more reliable automated trading system.

[/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_1 | true | Derivatives Length |

| v_input_2 | 4 | HMA Length |

| v_input_3 | 25 | Trail Long Loss % |

| v_input_4 | 25 | Trail Short Loss % |

| v_input_5_ohlc4 | 0 | Source: ohlc4 |

Source (PineScript)

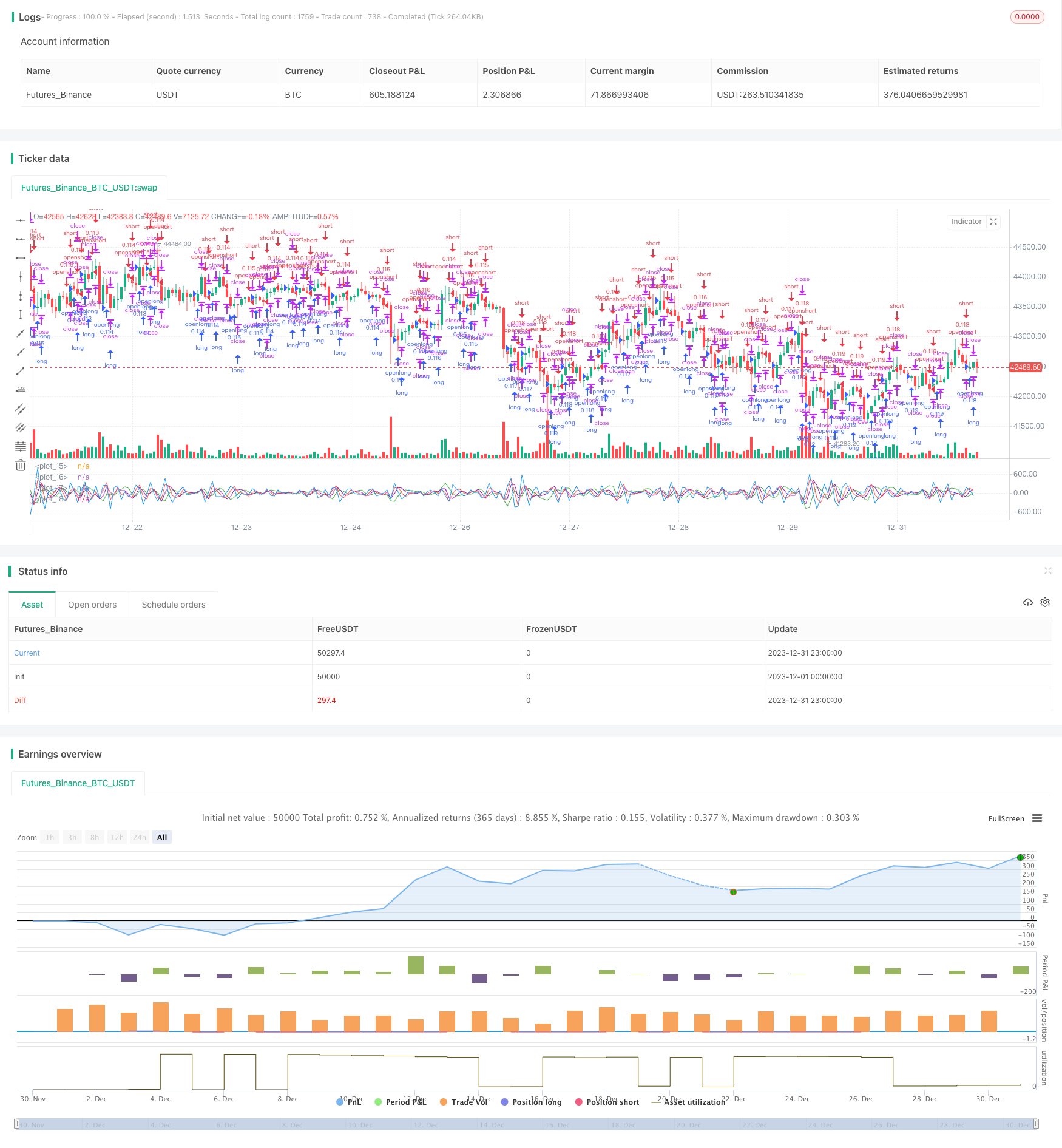

/*backtest

start: 2023-12-01 00:00:00

end: 2023-12-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=3

strategy(title="Derivative Based Strategy", shorttitle="DER", currency="USD", calc_on_order_fills=true, default_qty_type=strategy.percent_of_equity, default_qty_value=10, initial_capital=1000)

len = input(1, minval=1, title="Derivatives Length")

sm = input(4, minval=1, title="HMA Length")

longTrailPerc=input(title="Trail Long Loss %", type=float,minval=0.0,step=0.1,defval=25)*0.01

shortTrailPerc=input(title="Trail Short Loss %",type=float,minval=0.0,step=0.1,defval=25)*0.01

longStopPrice=0.0

shortStopPrice=0.0

src = input(ohlc4, title="Source")

hullma = wma(2*wma(src,sm/2)-wma(src,sm),round(sqrt(sm)))

speed = (hullma-hullma[len])/len

accel = (speed-speed[len])/len

jerk = (accel-accel[len])/len

jounce = (jerk-jerk[len])/len

plot(speed, color=green)

plot(accel, color=purple)

plot(jerk, color=red)

plot(jounce, color=blue)

// hline(0, linestyle=solid, color=black)

if accel>0 and jerk>0 and jounce>0// and strategy.opentrades==0

strategy.entry("openlong", strategy.long)

if accel<0 and jerk<0 and jounce<0// and strategy.opentrades==0

strategy.entry("openshort",strategy.short)

speed_profit = (strategy.openprofit-strategy.openprofit[1])/len

accel_profit = (speed_profit-speed_profit[1])/len

jerk_profit = (accel_profit-accel_profit[1])/len

longStopPrice:=if(strategy.position_size>0)

stopValue=ohlc4*(1-longTrailPerc)

max(stopValue,longStopPrice[1])

else

0

shortStopPrice:=if(strategy.position_size<0)

stopValue=ohlc4*(1+shortTrailPerc)

min(stopValue,shortStopPrice[1])

else

999999

if(strategy.position_size>0)

strategy.exit(id="closelong",stop=longStopPrice)

if(strategy.position_size<0)

strategy.exit(id="closeshort",stop=shortStopPrice)

Detail

https://www.fmz.com/strategy/438454

Last Modified

2024-01-12 11:06:28