Name

基于伦敦SMA交叉的ETH反转交易策略London-SMA-Cross-ETH-Reversal-Trading-Strategy

Author

ChaoZhang

Strategy Description

本策略名称为“伦敦时间段SMA交叉ETH反转交易策略”。该策略的主要思想是利用伦敦交易时段的高流动性,结合SMA均线的金叉死叉信号,对ETH/USDT这个主流数字货币交易对进行反转交易。

该策略的核心逻辑是首先确定伦敦时段的交易时间,然后计算一定周期的SMA均线,再在伦敦时段判断价格是否与SMA发生金叉或死叉。具体来说,该策略首先定义了伦敦时段的开始和结束时间,然后设置了SMA均线的长度参数为50周期。在此基础上,该策略使用ta.sma()函数计算出50周期的SMA均线。接下来,该策略判断当前价格是否在伦敦时段,以及是否在回测时间范围内。在满足这两个条件的情况下,使用ta.crossover()和ta.crossunder()函数判断价格与SMA均线是否发生了金叉和死叉。当发生金叉时,做多;当发生死叉时,做空。

该策略的关键优势在于利用了伦敦时段的高流动性进行交易,可以获得更好的入场机会。同时,SMA均线的金叉死叉信号是经典且有效的技术指标信号。所以,这种组合可以在一定程度上过滤假信号,提高策略的稳定性和盈利率。

- 利用伦敦时段的高流动性,可以获得更好的入场时机

- SMA均线金叉死叉是经典且有效的技术指标信号

- 组合使用可以提高信号质量,过滤假信号

- 采用反转交易方式,适合短线交易

- 资金利用率高,可以通过杠杆放大收益

该策略也存在一定的风险,主要包括:

- 趋势市场中金叉死叉信号可能频繁被打击

- SMA周期设置不当,可能产生过多假信号

- 反转交易容易受困于震荡行情

对于这些风险,可以通过以下方法加以控制和解决:

- 结合趋势指标,避免在趋势震荡中使用

- 优化SMA参数,寻找最佳交易周期

- 设置止损位,控制单笔损失

该策略还存在以下可优化的地方:

- 可以引入其他指标进行组合,例如RSI、KD等,形成多指标过滤规则,提高信号质量

- 可以优化SMA均线的周期参数,寻找最佳交易周期

- 可以在SMA均线基础上,再引入longer时间周期的均线,形成多均线交叉组合

- 可以对交易时段进行优化,测试哪些时段的交易效果最好

- 可以引入机器学习算法,对信号进行训练和过滤

整体来说,本策略通过高流动性时段交易和均线交叉的经典技术指标组合,实现了一个较为简单实用的短线反转交易策略。该策略具有资金利用率高,技术指标简单,容易实施等优势。但也存在一定的风险,需要对参数、止损以及交易时段等进行测试和优化,以便获得更好的稳定盈利能力。

||

The strategy is named "London Session SMA Cross ETH Reversal Trading Strategy". The main idea of this strategy is to utilize the high liquidity during the London session, combined with the golden cross and dead cross signals of the SMA lines, to conduct reversal trading on the mainstream digital currency trading pair ETH/USDT.

The core logic of this strategy is to first determine the trading hours of the London session, then calculate the SMA line of a certain cycle, and finally judge whether the price has golden cross or dead cross with the SMA during the London session. Specifically, the strategy first defines the start and end time of the London session, and then sets the length parameter of the SMA line to 50 periods. On this basis, the strategy uses the ta.sma() function to calculate the 50-period SMA line. Next, the strategy judges whether the current price is in the London session and within the backtesting time range. If these two conditions are met, use the ta.crossover() and ta.crossunder() functions to determine if the price and the SMA line have a golden cross or dead cross. When a golden cross occurs, go long; when a dead cross occurs, go short.

The key advantage of this strategy is that it utilizes the high liquidity of the London session for trading, which can obtain better entry opportunities. At the same time, the golden cross and dead cross signals of the SMA line are classic and effective technical indicator signals. Therefore, this combination can filter false signals to a certain extent and improve the stability and profitability of the strategy.

- Utilize the high liquidity of the London session to obtain better entry opportunities

- The golden cross and dead cross of SMA lines are classic and effective technical indicator signals

- The combination use can improve signal quality and filter false signals

- Adopt reversal trading method, suitable for short-term trading

- High capital utilization, profits can be amplified through leverage

The strategy also has some risks, mainly including:

- Golden cross and dead cross signals may be frequently hit in a trending market

- Improper SMA period setting may generate too many false signals

- Reversal trading is prone to get trapped in range-bound markets

The following methods can be used to control and resolve these risks:

- Incorporate trend indicators to avoid using during trend consolidation

- Optimize SMA parameters to find the best trading cycle

- Set stop loss to control single loss

The following aspects of the strategy can be optimized:

- Other indicators can be introduced for combination, such as RSI, KD, etc., to form multi-indicator filtering rules to improve signal quality

- The cycle parameter of the SMA line can be optimized to find the best trading cycle

- Longer time cycle moving averages can be introduced based on the SMA to form multi-moving average cross combinations

- Optimize trading sessions to test which sessions perform best

- Introduce machine learning algorithms to train and filter signals

In general, this strategy realizes a relatively simple and practical short-term reversal trading strategy through trading in high liquidity sessions and combining classic technical indicator of moving average crosses. The advantages of this strategy include high capital utilization, simple technical indicators and easy implementation. But there are also certain risks, the parameters, stop loss and trading sessions need to be tested and optimized in order to obtain better steady profitability.

[/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_int_1 | 50 | SMA Length |

| v_input_source_1_close | 0 | SMA Source: close |

Source (PineScript)

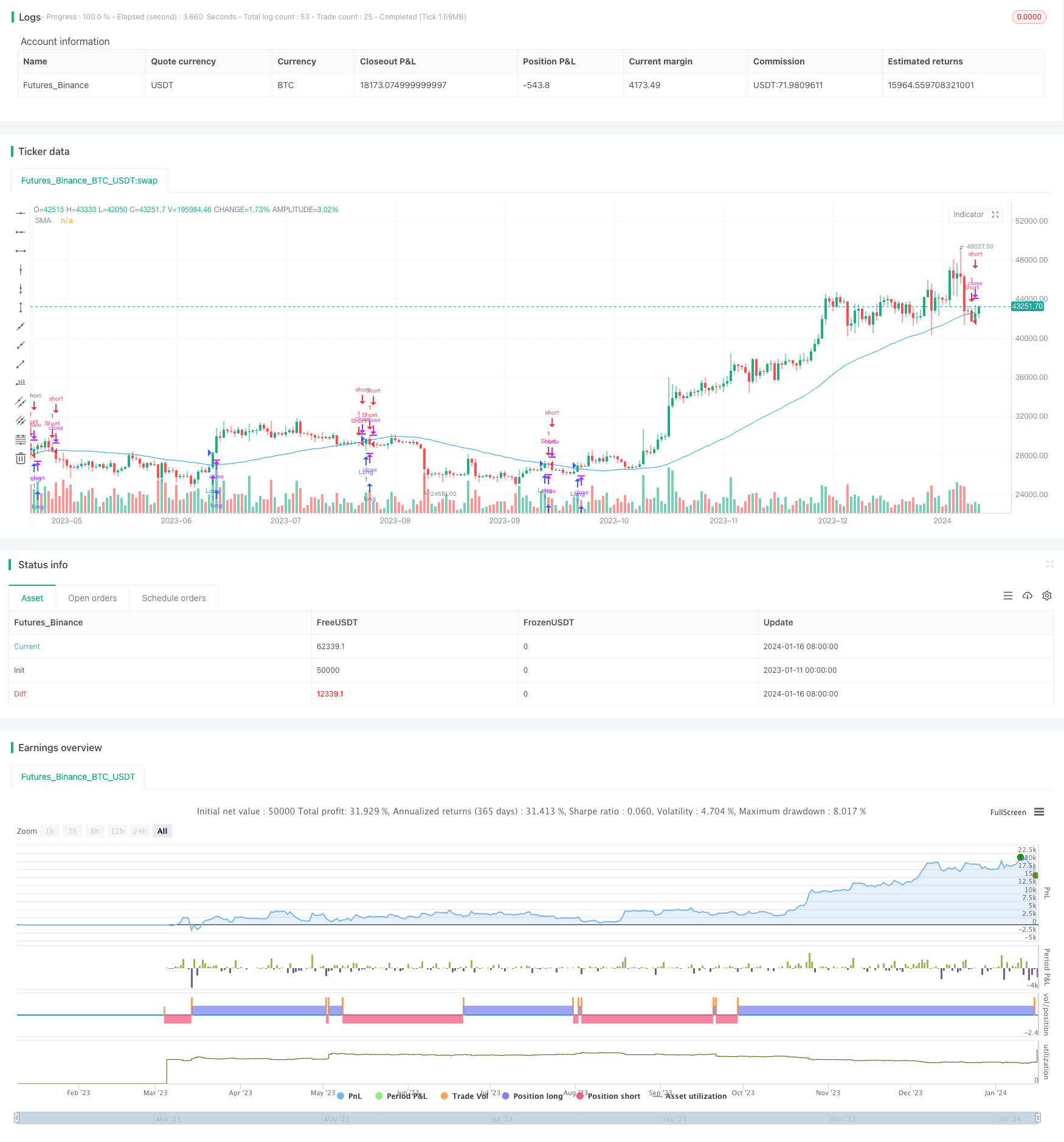

/*backtest

start: 2023-01-11 00:00:00

end: 2024-01-17 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("London SMA Strategy ", overlay=true)

// Define London session times

london_session_start_hour = 6

london_session_start_minute = 59

london_session_end_hour = 15

london_session_end_minute = 59

// Define SMA input parameters

sma_length = input.int(50, title="SMA Length")

sma_source = input.source(close, title="SMA Source")

// Calculate SMA

sma = ta.sma(sma_source, sma_length)

// Convert input values to timestamps

london_session_start_timestamp = timestamp(year, month, dayofmonth, london_session_start_hour, london_session_start_minute)

london_session_end_timestamp = timestamp(year, month, dayofmonth, london_session_end_hour, london_session_end_minute)

// Define backtesting time range

start_date = timestamp(2021, 1, 1, 0, 0)

end_date = timenow

// Filter for London session and backtesting time range

in_london_session = time >= london_session_start_timestamp and time <= london_session_end_timestamp

in_backtesting_range = time >= start_date and time <= end_date

// Long condition: Close price crosses above SMA during London session

long_condition = ta.crossover(close, sma)

// Short condition: Close price crosses below SMA during London session

short_condition = ta.crossunder(close, sma)

// Plot SMA for reference

plot(sma, title="SMA", color=color.blue)

// Strategy entries and exits

if (long_condition)

strategy.entry("Long", strategy.long)

if (short_condition)

strategy.entry("Short", strategy.short)

Detail

https://www.fmz.com/strategy/439262

Last Modified

2024-01-18 16:08:26