Name

基于两条不同参数渐变均线交易策略Meticulous-EMA-Crossover-Strategy

Author

ChaoZhang

Strategy Description

渐变均线交易策略是一种基于两条不同参数设置的指数移动平均线(Exponential Moving Average,EMA)的交叉信号来进行交易的策略。它使用一条较短周期的EMA线和一条较长周期的EMA线,当它们交叉时来产生交易信号,由快线向上穿越慢线时做多,向下穿越时平仓。该策略还结合止损、追踪止损等风险管理手段来锁定利润、控制风险。

该策略的核心指标是两条EMA线:快线和慢线。快线参数默认设置为13日线,反应价格变化更为灵敏;慢线参数默认设置为48日线,对价格变化响应更为缓慢。当短线快速上涨,快线会先于慢线上涨;当短线下跌,快线也会比慢线更快下跌。因此,快线向上突破慢线是一个长线上涨信号;快线向下跌破慢线则是一个长线下跌信号。

根据这个原理,该策略在快线从下向上突破慢线时做多,表示价格开始上涨,可以买入;当快线从上向下跌破慢线时平仓,表示上涨趋势结束,应适时止盈了结。为控制风险,策略还设置了初始止损和追踪止损:初始止损距离为入场价的8%,追踪止损距离则默认为120点。这可以在价格反转时尽早止损,减小亏损。

代码实现上,该策略通过crossover和crossunder这两个函数来判定EMA交叉信号,在交叉发生时触发对应的entry和close来进行买入和平仓。

渐变均线交易策略具有以下优势:

-

策略信号简单明确,容易理解实现,适合新手学习;

-

均线指标对市场噪音的滤波效果好,可以发现趋势的变化;

-

可配置性强,快慢线参数、止损点位都可以自定义设置;

-

结合止损手段,可以有效控制风险。

-

具有一定的稳定性。

该策略也存在一定的风险:

-

在市场剧烈波动时,EMA交叉信号可能滞后,无法及时反映价格变化;

-

速度过快的均线指标参数调整,可能会产生更多错误信号;

-

行情趋势较弱时,EMA交叉也较少,无法有效捕捉价格行情。

-

策略本身没有考虑大级别的趋势分析,在市场整体趋势不明朗时,容易产生与大趋势背离的交易。

以上风险可以通过以下手段加以缓解:

-

结合其他指标来确认均线交叉信号,如MACD、KD等;

-

根据不同市场调整EMA参数,降低错误信号率;

-

增加趋势判断模块,参考长期均线判断整体行情方向。

该策略可以从以下几个方向进行优化:

-

增加开仓条件过滤,避免在震荡行情中产生过多不必要交易。可以结合波动率、交易量等指标来设定开仓阈值;

-

结合市场的高低点、支撑位等来设定止损止盈位置,提高止损止盈的准确性;

-

增加趋势判断模块,用更高时间框架下的长期趋势来过滤短期信号,避免与大趋势形成背离;

-

可以通过机器学习来训练和优化EMA参数,使其更加适合实际市场情况,降低错误信号率。

以上几点是该策略未来可以改进和优化的主要方向。适当结合更多指标和风险管理手段,会使该EMA交叉策略的效果更好。

渐变均线交易策略是一个基础的趋势跟随策略。它使用EMA快线和慢线交叉来判断价格趋势,并结合止损手段控制风险。该策略信号简单清晰,容易理解使用,特别适合新手学习,是量化入门的典型策略之一。但它也存在一定的滞后性和误报风险。未来可以通过引入更多指标和手段来优化和改进该策略,使其在更复杂的市场环境中稳定运行。

||

The Meticulous EMA Crossover Strategy is a trend trading system based on the crossover signals between two exponential moving average lines (EMAs) with different parameter settings. It uses a shorter-period fast EMA line and a longer-period slow EMA line and generates trade signals when they cross over. A long signal is triggered when the fast line crosses above the slow line, and a close position signal is triggered when the fast line crosses below the slow line. This system also incorporates risk management means like stop loss, trailing stop to lock profits and control risks.

The core indicators of this strategy are two EMA lines: fast line and slow line. The fast line's parameter is defaulted to a 13-period line for faster reaction to price changes. The slow line's parameter is defaulted to a 48-period line for slower responses. When the short-term trend rises rapidly, the fast line will rally ahead of the slow line. And when the prices fall, the fast line will drop faster than the slow line. Therefore, the fast line's crossing above the slow line signals an upward trend, and the fast line's crossing below the slow line signals a downward reversal.

Based on this principle, the strategy goes long when the fast EMA line crosses above the slow EMA line, indicating an upward trend so you can buy. When the fast line crosses below the slow line, it closes positions, showing the end of uptrend and the time to take profit. To control risks, the strategy also sets an initial stop loss at 8% below entry price and a trailing stop defaulted to be 120 points from market price. This allows the system to exit early and minimize losses when there is a trend reversal.

In coding implementation, the "crossover" and "crossunder" functions are used to determine the EMA crossover signals. The corresponding "entry" and "close" commands will then be triggered to buy or close positions.

The Meticulous EMA Crossover Strategy has the following key advantages:

-

The signals are simple and clear, easy to understand and implement. Suitable for beginners.

-

The MA filter can discover trend changes with less market noise.

-

Highly configurable parameters on fast/slow EMA lines, stop loss levels, etc.

-

Stop loss means effectively control risks.

-

Relatively stable system across various market conditions.

There are also some inherent risks of this strategy:

-

EMA signals may lag during violent market swings, unable to reflect price changes timely.

-

Overly fast parameter tuning of the MA indicators can produce more false signals.

-

Weak price trends may generate fewer EMA crossovers thus unable to capture moves.

-

No analysis of overall market trends means going against the main trend.

The risks can be mitigated through:

-

Adding filters like MACD and KD to confirm crossover signals.

-

Adjust EMA parameters based on different markets to decrease false signals.

-

Incorporate analysis of overall trend based on long-term moving averages.

The strategy can be upgraded from the aspects below:

-

Adding open position filters to avoid overtrading in range-bound markets. Can combine volatility and volume indicators to set position opening threshold.

-

Set stop loss and take profit levels based on swing high/low levels and support/resistance zones for better accuracy.

-

Add a trend module to analyze longer-timeframe trends as filters for short-term signals, avoiding trading against major trends.

-

Use machine learning to train and optimize ideal EMA parameters fitting the practical markets to decrease false signals.

The above are the major directions for improving this basic EMA crossover strategy going forward. Properly combining more technical indicators and risk management means can surely enhance the strategy's efficacy.

The Meticulous EMA Crossover Strategy is a foundational trend following system based on EMA fast and slow line crossovers to determine price trends and incorporates stop loss to control risks. Its signals are simple and clean, easy to understand for beginners, making it one of the typical starter quant strategies. But inherent lags and false signals risks exist. Going forward, introducing more filters and means can better optimize this strategy for more sophisticate market environments and achieve more stable returns.

[/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_1_close | 0 | Fast MA Source: close |

| v_input_2 | 13 | Fast MA Period |

| v_input_3_close | 0 | Slow MA Source: close |

| v_input_4 | 48 | Slow MA Period |

| v_input_5 | false | Invert Trade Direction? |

| v_input_6 | true | Use Initial Stop Loss? |

| v_input_7 | 25 | Initial Stop Loss Points |

| v_input_8 | true | Use Trailing Stop? |

| v_input_9 | 120 | Trail Points |

| v_input_10 | false | Use Offset For Trailing Stop? |

| v_input_11 | 20 | Trail Offset Points |

Source (PineScript)

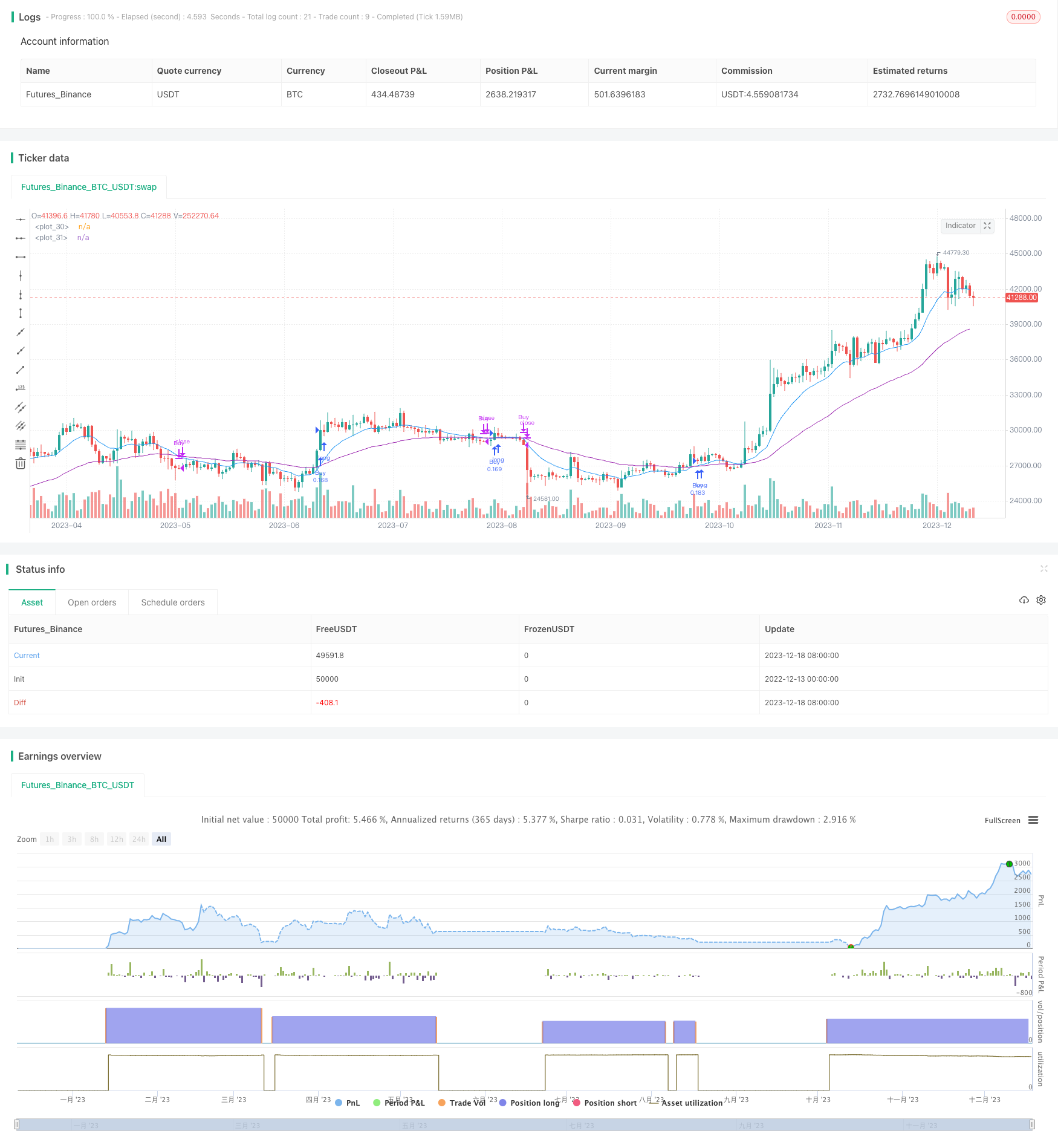

/*backtest

start: 2022-12-13 00:00:00

end: 2023-12-19 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=3

// *** USE AT YOUR OWN RISK ***

//

strategy("EMA Strategy", shorttitle = "EMA Strategy", overlay=true, pyramiding = 3,default_qty_type = strategy.percent_of_equity, default_qty_value = 10)

// === Inputs ===

// short ma

maFastSource = input(defval = close, title = "Fast MA Source")

maFastLength = input(defval = 13, title = "Fast MA Period", minval = 1)

// long ma

maSlowSource = input(defval = close, title = "Slow MA Source")

maSlowLength = input(defval = 48, title = "Slow MA Period", minval = 1)

// invert trade direction

tradeInvert = input(defval = false, title = "Invert Trade Direction?")

// risk management

useStop = input(defval = true, title = "Use Initial Stop Loss?")

slPoints = input(defval = 25, title = "Initial Stop Loss Points", minval = 1)

useTS = input(defval = true, title = "Use Trailing Stop?")

tslPoints = input(defval = 120, title = "Trail Points", minval = 1)

useTSO = input(defval = false, title = "Use Offset For Trailing Stop?")

tslOffset = input(defval = 20, title = "Trail Offset Points", minval = 1)

// === Vars and Series ===

fastMA = ema(maFastSource, maFastLength)

slowMA = ema(maSlowSource, maSlowLength)

plot(fastMA, color=blue)

plot(slowMA, color=purple)

goLong() => crossover(fastMA, slowMA)

killLong() => crossunder(fastMA, slowMA)

strategy.entry("Buy", strategy.long, when = goLong())

strategy.close("Buy", when = killLong())

// Shorting if using

goShort() => crossunder (fastMA, slowMA)

killShort() => crossover(fastMA, slowMA)

//strategy.entry("Sell", strategy.short, when = goShort())

//strategy.close("Sell", when = killShort())

if (useStop)

strategy.exit("XLS", from_entry ="Buy", stop = strategy.position_avg_price / 1.08 )

strategy.exit("XSS", from_entry ="Sell", stop = strategy.position_avg_price * 1.08)

Detail

https://www.fmz.com/strategy/435963

Last Modified

2023-12-20 14:28:36