Name

反转交叉捕捉策略Price-Reversal-with-Crossover-Capturing-Strategy

Author

ChaoZhang

Strategy Description

反转交叉捕捉策略是一种结合了反转交易和指标交叉的复合策略。它首先利用价格反转形态产生交易信号,然后结合随机指标的多空交叉进行过滤,从而捕捉短期市场的反转机会。

该策略由两个子策略组成:

- 123反转策略

- 当两天内收盘价从高点转为低点时,若9日随机指标低位(某一数值以下),产生买入信号

- 当两天内收盘价从低点转为高点时,若9日随机指标高位(某一数值以上),产生卖出信号

- 随机指标金叉死叉策略

- 当%K线从上向下跌破%D线,同时%K线和%D线都处于超买区域,产生卖出信号

- 当%K线从下向上突破%D线,同时%K线和%D线都处于超卖区域,产生买入信号

该复合策略对两个子策略的信号进行判断,当两个子策略的交易信号一致时,产生实际的交易信号。

这种策略结合了反转和指标交叉,综合判断价格和指标信息,可有效过滤假信号,挖掘潜在的反转机会,提高盈利回报率。

具体优势包括:

- 捕捉市场反转,回转较快,不需要长时间震荡等待信号

- 两种子策略交叉验证提高信号准确性

- 结合价格行情判断和指标分析,提高胜率

该策略也存在一定风险:

- 市场剧烈波动时,价格短期内难以明确反转方向,容易产生错误信号

- 指标参数设置不当也会影响信号质量

- 反转时间无法掌握,存在一定的时间风险

针对这些风险,可通过调整指标参数、设置止损机制等方式加以控制。

该策略可从以下几个维度进行优化:

- 调整指标参数,优化参数组合

- 增加其他指标过滤信号,如成交量指标等

- 根据不同品种特点和市场环境,定制指标参数

- 增加止损策略控制风险

- 结合机器学习技术进行信号判断

反转交叉捕捉策略综合运用多个策略优势,在控制风险的前提下,具有较强的获利能力。通过不断优化和改进,可以打造出适合自身风格的高效策略,从容应对多变的市场环境。

||

The price reversal with crossover capturing strategy is a compound strategy that combines price reversal trading techniques and indicator crossovers. It first generates trading signals using price reversal patterns, then filters the signals with overbought/oversold crossovers of a stochastic oscillator, in order to capture short-term reversals in the market.

The strategy consists of two sub-strategies:

- 123 Reversal Strategy

- When the close price turns from higher to lower in two days, and the 9-day stochastic indicator is at lower band (below a threshold), a buy signal is generated

- When the close price turns from lower to higher in two days, and the 9-day stochastic indicator is at upper band (above a threshold), a sell signal is generated

- Stochastic Crossover Strategy

- When the %K line crosses below the %D line, while both lines are in overbought levels, a sell signal is generated

- When the %K line crosses above the %D line, while both lines are in oversold levels, a buy signal is generated

The compound strategy checks the signals from both sub-strategies and only triggers actual trades when the signals align in the same direction.

The strategy combines price reversal patterns and indicator crossovers to evaluate both price action and indicator information, which helps filter out false signals and uncover reversal opportunities to improve profitability.

Specific advantages include:

- Capturing market reversals quickly without long consolidation waits

- Increased signal accuracy with dual validation from both sub-strategies

- Better win rate combining analysis of both price action and indicators

There are also some risks with this strategy:

- Price may reverse abruptly during high volatility, causing incorrect signals

- Poor indicator parameter tuning affects signal quality

- Unsure about reversal timing, some time risk exists

These risks can be managed by adjusting parameters, using stop losses etc.

Some ways the strategy can be enhanced:

- Optimize indicator parameters

- Add other filters like volume

- Customize parameters based on symbol and market conditions

- Incorporate stop loss for risk control

- Employ machine learning for signal identification

The price reversal with crossover capturing strategy combines multiple complementary strategies to profit while controlling risks. With continuous improvements, it can be tailored into an efficient strategy that thrives in changing markets.

[/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_1 | true | ---- 123 Reversal ---- |

| v_input_2 | 14 | Length |

| v_input_3 | true | KSmoothing |

| v_input_4 | 3 | DLength |

| v_input_5 | 50 | Level |

| v_input_6 | true | ---- Stochastic Crossover ---- |

| v_input_7 | 7 | LengthSC |

| v_input_8 | 3 | DLengthSC |

| v_input_9 | 20 | Oversold |

| v_input_10 | 70 | Overbought |

| v_input_11 | false | Trade reverse |

Source (PineScript)

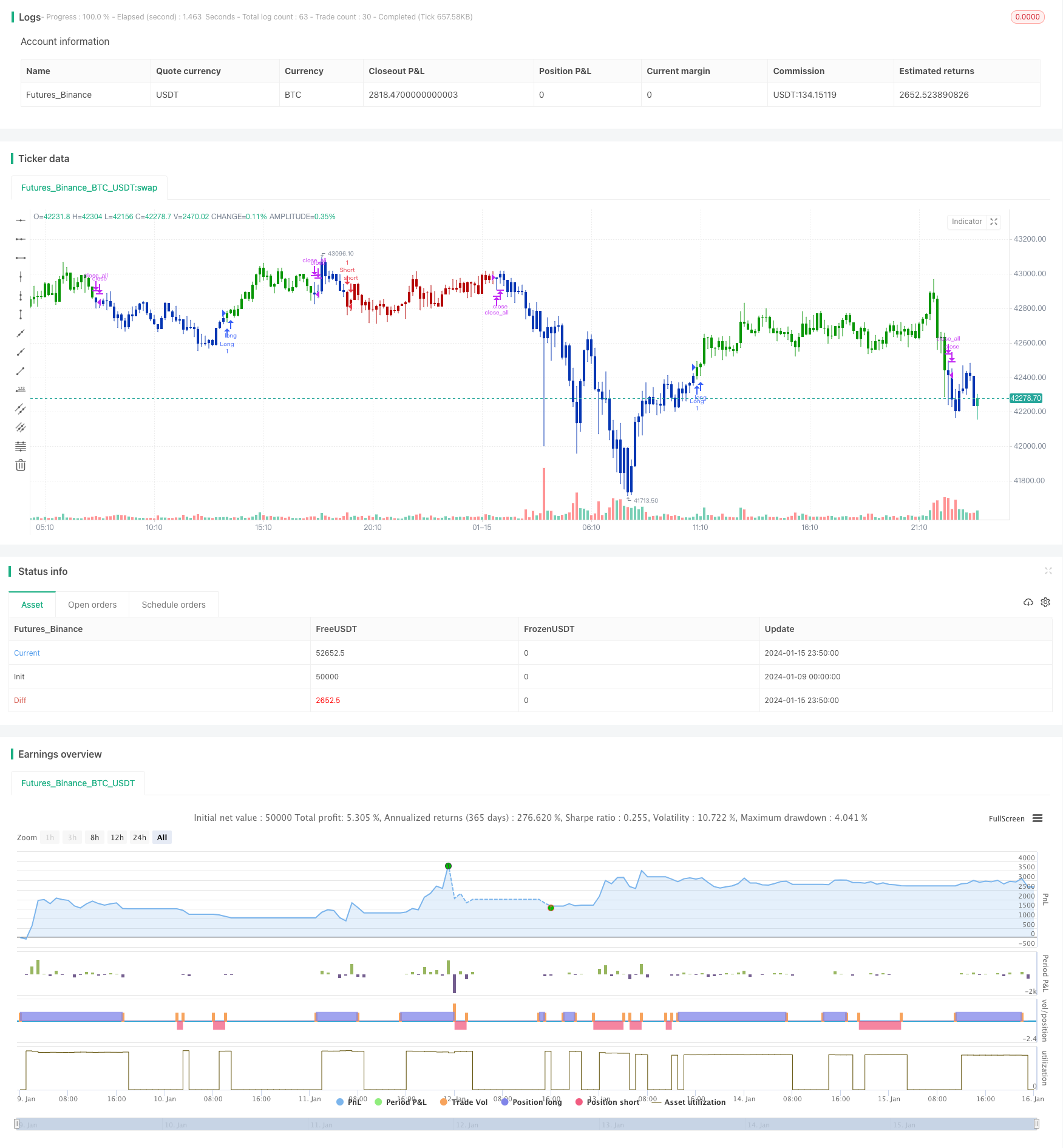

/*backtest

start: 2024-01-09 00:00:00

end: 2024-01-16 00:00:00

period: 10m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

////////////////////////////////////////////////////////////

// Copyright by HPotter v1.0 15/09/2021

// This is combo strategies for get a cumulative signal.

//

// First strategy

// This System was created from the Book "How I Tripled My Money In The

// Futures Market" by Ulf Jensen, Page 183. This is reverse type of strategies.

// The strategy buys at market, if close price is higher than the previous close

// during 2 days and the meaning of 9-days Stochastic Slow Oscillator is lower than 50.

// The strategy sells at market, if close price is lower than the previous close price

// during 2 days and the meaning of 9-days Stochastic Fast Oscillator is higher than 50.

//

// Second strategy

// This back testing strategy generates a long trade at the Open of the following

// bar when the %K line crosses below the %D line and both are above the Overbought level.

// It generates a short trade at the Open of the following bar when the %K line

// crosses above the %D line and both values are below the Oversold level.

//

// WARNING:

// - For purpose educate only

// - This script to change bars colors.

////////////////////////////////////////////////////////////

Reversal123(Length, KSmoothing, DLength, Level) =>

vFast = sma(stoch(close, high, low, Length), KSmoothing)

vSlow = sma(vFast, DLength)

pos = 0.0

pos := iff(close[2] < close[1] and close > close[1] and vFast < vSlow and vFast > Level, 1,

iff(close[2] > close[1] and close < close[1] and vFast > vSlow and vFast < Level, -1, nz(pos[1], 0)))

pos

StochCross(Length, DLength,Oversold,Overbought) =>

pos = 0.0

vFast = stoch(close, high, low, Length)

vSlow = sma(vFast, DLength)

pos := iff(vFast < vSlow and vFast > Overbought and vSlow > Overbought, 1,

iff(vFast >= vSlow and vFast < Oversold and vSlow < Oversold, -1, nz(pos[1], 0)))

pos

strategy(title="Combo Backtest 123 Reversal & Stochastic Crossover", shorttitle="Combo", overlay = true)

line1 = input(true, "---- 123 Reversal ----")

Length = input(14, minval=1)

KSmoothing = input(1, minval=1)

DLength = input(3, minval=1)

Level = input(50, minval=1)

//-------------------------

line2 = input(true, "---- Stochastic Crossover ----")

LengthSC = input(7, minval=1)

DLengthSC = input(3, minval=1)

Oversold = input(20, minval=1)

Overbought = input(70, minval=1)

reverse = input(false, title="Trade reverse")

posReversal123 = Reversal123(Length, KSmoothing, DLength, Level)

posmStochCross = StochCross(LengthSC, DLengthSC,Oversold,Overbought)

pos = iff(posReversal123 == 1 and posmStochCross == 1 , 1,

iff(posReversal123 == -1 and posmStochCross == -1, -1, 0))

possig = iff(reverse and pos == 1, -1,

iff(reverse and pos == -1 , 1, pos))

if (possig == 1 )

strategy.entry("Long", strategy.long)

if (possig == -1 )

strategy.entry("Short", strategy.short)

if (possig == 0)

strategy.close_all()

barcolor(possig == -1 ? #b50404: possig == 1 ? #079605 : #0536b3 )

Detail

https://www.fmz.com/strategy/439087

Last Modified

2024-01-17 16:29:13