Name

双MA顺势突破策略Dual-MA-Trend-Breakout-Strategy

Author

ChaoZhang

Strategy Description

[trans]

双MA顺势突破策略是一个利用两个不同周期的移动平均线进行趋势判断和入场的量化交易策略。策略主要通过慢速MA判断整体趋势方向,并利用快速MA进行入场过滤,在大级别趋势方向一致时,选择反转K线进行入场,以追求更高的胜率和盈利率。

该策略主要由以下几部分构成:

趋势判断: 通过计算21周期的MA,定义为慢速MA,其位置较为平稳,可用于判断整体趋势方向。当价格上涨时接近该MA值即为上升趋势,当价格下跌时接近该MA值即为下降趋势。

入场过滤: 计算5周期的MA,定义为快速MA。只有当价格突破慢速MA时,同时也突破快速MA,才产生交易信号。这个设计主要是进一步过滤假突破的可能性。

K线过滤: 策略只在该周期K线为阴线时做多,或该周期K线为阳线时做空。这是考虑到使用反转K线入场可获得更高的成功率。同时结合快速RSI指标避免在过度超买或超卖区域入场。

加仓过滤: 对于加密货币市场,策略额外增加了三倍波动突破的加仓条件,在大级别下跌过程中筛选出超跌机会。

止损设计: 策略支持移动止损。当开仓后,会根据设置的止损百分比实时更新止损位。

该策略具有以下优势:

- 双MA设计简单实用,容易理解掌握; 2.利用快慢MA组合过滤,可靠判断趋势;

- 反转K线入场,提高交易胜率;

- 整体方法论保守稳健,适合各级别交易;

- 支持移动止损,可控风险;

- 特别考虑加密货币市场特征,加入超跌加仓机会,可获超额收益。

该策略也存在一些风险:

- 双MA区间震荡时,会出现多次小额盈亏。

- 反转K线入场在某些级别时段可能出现胜率不高的情况。

- 加密货币市场波动大,止损被触发概率较高。

- 超跌加仓机会并不多,回报波动性大。

针对这些风险,可从以下几个方面进行优化:

- 增加入场条件,避免无效震荡;

- 调整K线周期或增加其他指标过滤;

- 优化止损算法,追踪中轴附近止损;

- 评估超跌加仓策略的实际效果。

该策略主要可从以下几个方面进行优化:

-

参数优化:通过更系统的回测,优化快慢MA的周期参数组合,提高整体收益风险比。

-

模式识别:增加像KDJ,MACD等其他指标,识别更可靠的反转信号。

-

止损优化:开发浮动止损、追踪止损等算法,降低止损被触发概率。

-

机器学习:收集并标记更多历史数据,使用机器学习方法自动生成交易规则。

-

量化调仓:根据市场状态,自动调整仓位管理策略。

双MA顺势突破策略总体来说是一个比较简单实用的趋势跟踪策略。相比复杂的机器学习算法,该策略更容易解释和掌握,可靠性也较高。随着参数优化、功能扩展与机器学习引入,该策略具有很大的改进潜力,是量化交易的一个很好的起点。

||

The Dual MA Trend Breakout strategy is a quantitative trading strategy that uses two moving averages of different periods to determine the trend and generate entry signals. It mainly judges the overall trend direction through the slow MA and uses the fast MA for entry filtering. When the direction of the larger timeframe trend is consistent, it selects reversal bars to enter, in order to pursue higher win rate and profitability.

The strategy consists of the following main parts:

Trend Judgement: Calculates the 21-period MA, defined as the slow MA. Its position is relatively stable and can be used to judge the overall trend direction. When prices rise close to this MA, it is an upward trend. When prices fall close to this MA, it is a downward trend.

Entry Filtering: Calculates the 5-period MA, defined as the fast MA. Only when the price breaks through both the slow MA and the fast MA, the trading signal is triggered. This design mainly further filters the possibility of false breakouts.

Candle Filtering: The strategy only goes long when the current candle is bearish, or goes short when the current candle is bullish. This considers that using reversal bars for entry can obtain higher success rate. It also combines the fast RSI indicator to avoid entering in overbought or oversold areas.

Pyramiding Filter: For the crypto market, the strategy additionally includes a tripling volatility breakout condition to capture oversold opportunities in significant downtrends.

Stop Loss: The strategy supports moving stop loss. After opening positions, the stop loss will be updated in real-time based on the set percentage.

The advantages of this strategy include:

- The dual MA design is simple and practical, easy to understand and master;

- Reliable trend judgment by combing fast and slow MAs;

- Reversal bar entry improves trading win rate;

- The overall methodology is conservative and stable, suitable for all timeframes;

- Supports moving stop loss to control risks;

- Specially considers the characteristics of the crypto market by adding oversold pyramiding opportunities to obtain excess returns.

The strategy also has some risks:

- During range-bound dual MA periods, there will be multiple small wins and losses.

- Reversal bar entry may have low win rate in some timeframes.

- The crypto market has high volatility and high chance of stop loss being triggered.

- Oversold pyramiding opportunities are not many, with high return volatility.

To address these risks, optimizations can be made in the following aspects:

- Add more entry conditions to avoid ineffective whipsaws;

- Adjust timeframe or add other indicators for filtering;

- Optimize stop loss algorithms to track near midline;

- Evaluate actual performance of oversold pyramiding strategies.

The main aspects to optimize this strategy include:

-

Parameter Optimization: Systematically backtest to find optimal fast and slow MA period combinations to improve risk-adjusted returns.

-

Pattern Recognition: Add other indicators like KDJ, MACD to identify more reliable reversal signals.

-

Stop Loss Optimization: Develop floating or trailing stop loss algorithms to lower chance of being stopped out.

-

Machine Learning: Collect and label more historical data to automatically generate trading rules using ML.

-

Position Sizing: Dynamically adjust position sizing based on market conditions.

The Dual MA Trend Breakout Strategy is generally a simple and practical trend following strategy. Compared to complex machine learning algorithms, this strategy is easier to interpret and master, with higher reliability. With parameter tuning, feature expansion and ML augmentation, this strategy has great potential for improvement and is a great starting point for quantitative trading.

[/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_1 | true | long |

| v_input_2 | true | short |

| v_input_3 | false | stops |

| v_input_4 | 5 | Stop, % |

| v_input_5 | false | Use OHLC4 |

| v_input_6 | true | Use fast MA Filter |

| v_input_7 | 5 | fast MA Period |

| v_input_8 | 21 | slow MA Period |

| v_input_9 | 2 | Bars Q |

| v_input_10 | false | Need trend Background? |

| v_input_11 | false | Need entry arrows? |

| v_input_12 | true | Need extreme? (crypto/fiat only!!!) |

Source (PineScript)

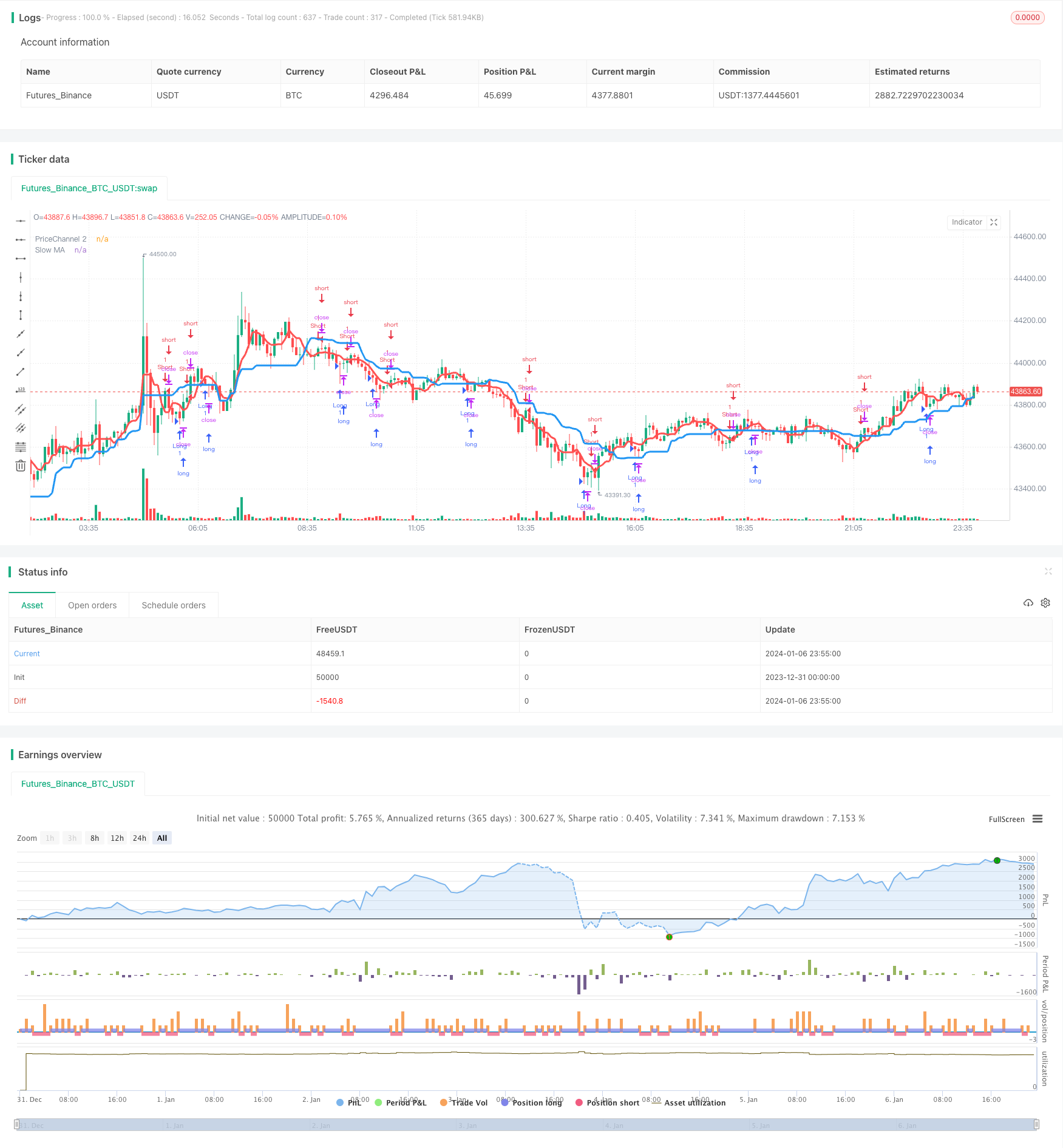

/*backtest

start: 2023-12-31 00:00:00

end: 2024-01-07 00:00:00

period: 5m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=2

strategy(title = "Noro's Trend MAs Strategy v2.0 +CB", shorttitle = "Trend MAs str 2.0", overlay=true, default_qty_type = strategy.percent_of_equity, default_qty_value=100.0, pyramiding=0)

//Settings

needlong = input(true, "long")

needshort = input(true, "short")

needstops = input(false, "stops")

stoppercent = input(5, defval = 5, minval = 1, maxval = 50, title = "Stop, %")

useohlc4 = input(false, defval = false, title = "Use OHLC4")

usefastsma = input(true, "Use fast MA Filter")

fastlen = input(5, defval = 5, minval = 1, maxval = 50, title = "fast MA Period")

slowlen = input(21, defval = 20, minval = 2, maxval = 200, title = "slow MA Period")

bars = input(2, defval = 2, minval = 0, maxval = 3, title = "Bars Q")

needbg = input(false, defval = false, title = "Need trend Background?")

needarr = input(false, defval = false, title = "Need entry arrows?")

needex = input(true, defval = true, title = "Need extreme? (crypto/fiat only!!!)")

src = useohlc4 == true ? ohlc4 : close

//PriceChannel 1

lasthigh = highest(src, slowlen)

lastlow = lowest(src, slowlen)

center = (lasthigh + lastlow) / 2

//PriceChannel 2

lasthigh2 = highest(src, fastlen)

lastlow2 = lowest(src, fastlen)

center2 = (lasthigh2 + lastlow2) / 2

//Trend

trend = low > center and low[1] > center[1] ? 1 : high < center and high[1] < center[1] ? -1 : trend[1]

//Bars

bar = close > open ? 1 : close < open ? -1 : 0

redbars = bars == 0 ? 1 : bars == 1 and bar == -1 ? 1 : bars == 2 and bar == -1 and bar[1] == -1 ? 1 : bars == 3 and bar == -1 and bar[1] == -1 and bar[2] == -1 ? 1 : 0

greenbars = bars == 0 ? 1 : bars == 1 and bar == 1 ? 1 : bars == 2 and bar == 1 and bar[1] == 1 ? 1 : bars == 3 and bar == 1 and bar[1] == 1 and bar[2] == 1 ? 1 : 0

//Fast RSI

fastup = rma(max(change(close), 0), 2)

fastdown = rma(-min(change(close), 0), 2)

fastrsi = fastdown == 0 ? 100 : fastup == 0 ? 0 : 100 - (100 / (1 + fastup / fastdown))

//CryptoBottom

mac = sma(close, 10)

len = abs(close - mac)

sma = sma(len, 100)

max = max(open, close)

min = min(open, close)

up3 = close < open and len > sma * 3 and min < min[1] and fastrsi < 10 ? 1 : 0

//Signals

up = trend == 1 and (low < center2 or usefastsma == false) and (redbars == 1) ? 1 : 0

dn = trend == -1 and (high > center2 or usefastsma == false) and (greenbars == 1) ? 1 : 0

up2 = high < center and high < center2 and bar == -1 ? 1 : 0

dn2 = low > center and low > center2 and bar == 1 ? 0 : 0

//Lines

plot(center, color = blue, linewidth = 3, transp = 0, title = "Slow MA")

plot(center2, color = red, linewidth = 3, transp = 0, title = "PriceChannel 2")

//Arrows

plotarrow(up == 1 and needarr == true ? 1 : 0, colorup = black, colordown = black, transp = 0)

plotarrow(dn == 1 and needarr == true ? -1 : 0, colorup = black, colordown = black, transp = 0)

//Background

col = needbg == false ? na : trend == 1 ? lime : red

bgcolor(col, transp = 90)

//Alerts

alertcondition(up == 1, title='buy', message='Uptrend')

alertcondition(dn == 1, title='sell', message='Downtrend')

//Trading

stoplong = up == 1 and needstops == true ? close - (close / 100 * stoppercent) : stoplong[1]

stopshort = dn == 1 and needstops == true ? close + (close / 100 * stoppercent) : stopshort[1]

longCondition = up == 1 or (up2 == 1 and needex == true) or up3 == 1

if (longCondition)

strategy.entry("Long", strategy.long, needlong == false ? 0 : na)

strategy.exit("Stop Long", "Long", stop = stoplong)

shortCondition = dn == 1

if (shortCondition)

strategy.entry("Short", strategy.short, needshort == false ? 0 : na)

strategy.exit("Stop Short", "Short", stop = stopshort)

Detail

https://www.fmz.com/strategy/438058

Last Modified

2024-01-08 16:43:38