Name

动量平均线交叉优化策略Optimized-Momentum-Moving-Average-Crossover-Strategy

Author

ChaoZhang

Strategy Description

动量平均线交叉优化策略是一种集移动平均线交叉、位置控制、风险管理等多项功能于一体的量化交易策略。该策略运用快速移动平均线和慢速移动平均线的交叉作为买卖信号,并结合持仓规模的动态控制实现风险管理。相较于传统移动平均线交叉策略,本策略进行了多方位的功能优化,可提供更先进、更可靠的量化交易解决方案。

本策略的核心信号来自两个移动平均线的交叉。一个短期快速移动平均线和一个长期慢速移动平均线。具体来说,当快速移动平均线从下方上穿越慢速移动平均线时,产生买入信号;当快速移动平均线从上方向下跌破慢速移动平均线时,产生卖出信号。

移动平均线作为一种趋势跟踪指标,能够有效平滑价格数据,识别出价格趋势的转折点。快速移动平均线对价格变化更为敏感,能够及时捕捉到短期趋势;而慢速移动平均线对价格波动的响应更为缓慢,能反映中长期趋势。两条平均线的交叉因而成为判断趋势转向的有效信号。

当快速移动平均线上穿时,表示短期价格已经反转为上涨,并驱动中长期价格上扬,属于追涨信号;而快速移动平均线下穿时,标志着短期价格开始下跌,中长期也将跟随走低,属于抛压信号。

本策略的另一大亮点在于风险管理。策略允许交易者设置每次交易的风险百分比,并据此动态调整头寸规模。具体来说,每次交易的头寸规模计算公式为:

头寸规模 = (账户权益 × 风险百分比) / (每次交易风险百分比 × 100)

这种根据账户资金状况和可承受风险动态调节仓位的方式,可有效控制交易风险,是本策略的一大优势。

- 结合快慢移动平均线,交易信号更可靠

- 动态头寸控制,有效管理交易风险

- 直观的图形展现,易于操作

- 包含买卖信号警报,操作更及时

- 允许自定义参数,交易更灵活

相较于原始移动平均线交叉策略,本策略在以下几个维度进行了重要优化:

更智能的信号机制。本策略采用快速和慢速两条移动平均线,而不是单一均线,能够同时识别短期和中长期趋势,交叉信号更可靠。

更科学的风险控制。根据账户资金和可承受风险动态计算仓位,既实现盈利,也控制风险,更符合实战需求。

更人性化的操作体验。直观的信号标记、实时警报提示,无需全天盯盘,操作更便利。

更高度的灵活性。用户可以根据个人偏好,自定义移动平均线参数和风险设置,使策略更契合自己。

尽管相对原始移动平均线交叉策略有了长足的改进,本策略在实际运用中仍可能面临以下风险:

错过价格反转点:移动平均线属于趋势跟踪型指标,对突发性的价格反转不足够敏感,可能错过关键的买卖点,无法及时止损或止盈。

不适用于盘整市:当市场处于长时间横盘整理状态时,移动平均线信号容易产生误导,应降低仓位规模,或考虑使用其他类型策略。

参数设置不当:如果移动平均线参数设置得不恰当,会产生错误信号,这需要通过反复测试来获取最佳参数。

风险配置过大:如果风险百分比设置过高,账户每次交易风险过大,极易爆仓。这需要根据自己的实际承受能力谨慎配置。

针对上述风险,我们可以从以下几个维度进行风险管理:

-

结合其他指标过滤信号,如成交量,KD指标等,避免错过价格转折。

-

根据不同市场情况切换策略或降低仓位,如使用震荡型策略。

-

充分回测寻找最优参数,或根据不同品种分段设置参数。

-

保守配置风险参数,分批建仓,控制单笔损失。

本策略还存在可扩展的优化空间,主要包括以下几个方面:

-

信号过滤优化:可引入其他指标进行信号过滤,如KM指标、布林带等,使信号更加可靠。

-

参数自适应:通过机器学习方法,实现移动平均线参数的动态优化,使其能自动适应市场变化。

-

止损止盈策略:增加移动止损、固定比例止盈等功能,能够把握确定利润,有效控制亏损。

-

复合策略:将移动平均线策略与其他类型策略,如粘合水平面、震荡策略组合使用,能够获得更稳定的超额收益。

-

跨市场套利:结合不同市场的价格关系,进行 Statistical Arbitrage,以获得无风险套利。

通过不断测试与优化,我们有信心将本策略打造成一个可靠、可控、超额收益的量化交易解决方案。

动量平均线交叉优化策略通过快慢均线交叉形成交易信号,并使用动态头寸调整实现风险控制,是一种功能颇为完善的量化交易策略。相较于传统移动均线策略,本策略在信号判断、风险管理、使用体验等方面都有了很大进步。随着参数优化、信号过滤、止损止盈、复合组合等方面的继续完善,本策略有望成为零售交易者盈利且可控的理想策略之一。

||

The Optimized Momentum Moving Average Crossover Strategy is a quantitative trading strategy that incorporates moving average crossover signals, position sizing, and risk management. It uses fast and slow moving average crossovers to generate trading signals and dynamically adjusts position sizes for risk control. Compared to traditional moving average crossover strategies, this strategy has undergone multi-dimensional optimizations to provide more advanced and reliable algo trading solutions.

The core trading signals of this strategy come from the crossover between two moving averages - a faster, short-term one and a slower, long-term one. Specifically, when the faster moving average crosses above the slower moving average from below, a buy signal is triggered. And when the faster moving average crosses below the slower one from above, a sell signal is generated.

As a trend-following indicator, moving averages can effectively smooth out price fluctuations and identify trend reversals. The fast moving average reacts better to short-term price changes while the slow one reflects long-term trends. The crossover between the two averages thus serves as an effective way to determine trend direction shifts.

When the fast MA crosses above the slow MA, it signals prices have reversed upward in the short run and are pushing long-term prices higher. This is a chase-up signal. And when the fast MA crosses below, it indicates short-term prices have started to decline which will also drag long-term prices down. This is a dumping signal.

Another highlight of this strategy is its risk management. It allows traders to define the risk percentage per trade and dynamically adjusts position sizes accordingly. Specifically, the position size is calculated as:

Position Size = (Account Equity × Risk Percentage) / (Risk Percentage per Trade × 100)

This way of flexibly scaling positions based on account status and acceptable risk levels enables effective risk control, a big plus of this strategy.

- More reliable signals combining fast and slow MAs

- Dynamic position sizing for better risk management

- Intuitive graphical representation, easy to use

- Includes signal alerts for timely actions

- Customizable parameters for flexibility

Compared to the plain moving average crossover system, this strategy has gone through some key optimizations:

Smarter Signal Logic. The dual fast and slow moving averages, instead of a single MA line, can identify both short-term and long-term trends, making crossover signals more reliable.

More Scientific Risk Control. Dynamically adjusting positions based on capital and acceptable risk realizes both profitability and risk management aligning with practical needs.

Better User Experience. Visual signal markers and real-time alerts enable convenient operations without staring at the screen all day.

Higher Flexibility. Customizable MA lengths and risk settings allow traders to tailor the strategy to their personal preferences and trading style.

Despite significant improvements over the basic moving average crossover system, some risks may still exist in practical applications:

Missing Price Reversals: Moving averages are trend trackers unable to catch sharp, sudden price reversals, potentially missing critical long/short entries and exits.

Sideway Markets: During prolonged sideways consolidations, MA signals tend to produce false signals so position sizes should be reduced or other strategy types considered.

Poor Parameter Choices: Inappropriate MA parameter selections lead to bad signals, requiring iterative optimization through backtesting.

Excessive Risk AppConfig: Overly aggressive risk percentage settings run the risk of overleveraging and blowups so conservative configurations aligned with personal risk tolerance are preferred.

To mitigate the above risks, some tactics can be adopted:

-

Adding filters like trading volumes and KD indicators to avoid missing reversals.

-

Switching to oscillation-type strats or reducing positions in certain market regimes.

-

Thoroughly backtesting to find optimal parameters or segmented settings across products.

-

Carefully configuring risk parameters, pyramiding positions, limiting per trade loss.

Further optimizations can be explored across the following dimensions:

-

Signal Filtering: Additional filters like KDJ, Bollinger Bands to enhance signal reliability.

-

Adaptive Parameters: Using machine learning techniques to dynamically optimize MA lengths based on changing market conditions.

-

Profit Take & Stop Loss: Incorporating trailing stops, fixed ratio profit-taking to lock in profits and control losses.

-

Strategy Composition: Composing with other strats like sticky levels, oscillators to obtain more steady and substantial alpha.

-

Cross-Market Arbitrage: Exploiting price relationships across different markets for risk-free arbitrage.

With continuous efforts in testing and enhancing, we are confident in developing this strategy into a reliable, controllable, alpha-generating algo trading solution.

The Optimized Momentum Moving Average Crossover Strategy delivers trading signals through fast and slow MA crossovers and manages risk via dynamic position adjustment, making it a fairly comprehensive algo trading system. Compared to traditional MA strats, this optimized version marks major upgrades in signal efficacy, risk control, user experience and more. As further improvements proceed in fine-tuning parameters, filtering signals, integrating stop runs, and strategy composition, it shows great promise in becoming an ideal profitable yet risk-defined strategy for retail traders.

[/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_1 | 10 | Fast MA Length |

| v_input_2 | 20 | Slow MA Length |

| v_input_3 | true | Risk Percentage |

| v_input_4 | 2 | Risk Per Trade (%) |

Source (PineScript)

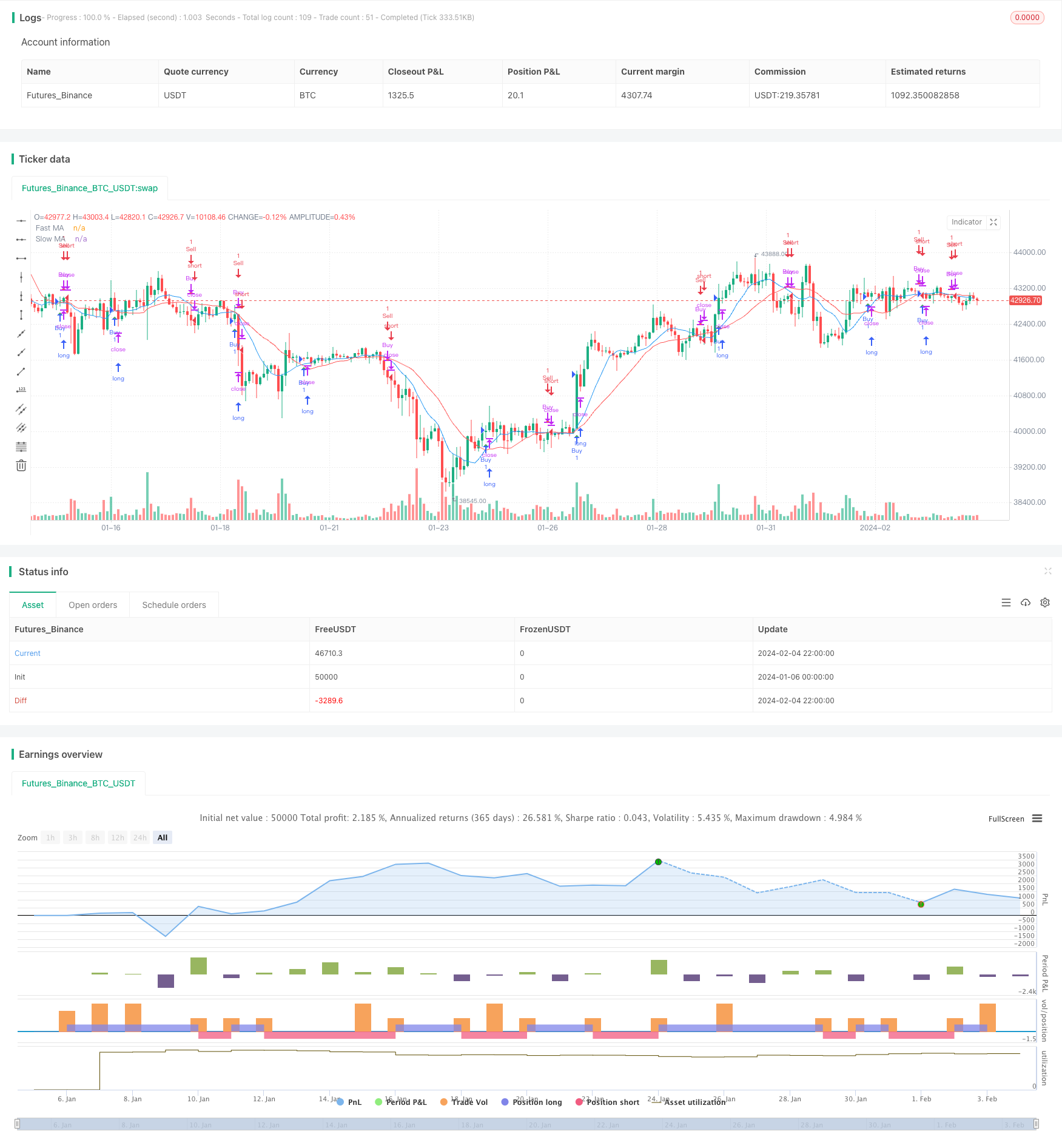

/*backtest

start: 2024-01-06 00:00:00

end: 2024-02-05 00:00:00

period: 2h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy("Improved Moving Average Crossover", overlay=true)

// Input parameters

fastLength = input(10, title="Fast MA Length")

slowLength = input(20, title="Slow MA Length")

riskPercentage = input(1, title="Risk Percentage", minval=0.1, maxval=5, step=0.1)

// Calculate moving averages

fastMA = sma(close, fastLength)

slowMA = sma(close, slowLength)

// Plot moving averages on the chart

plot(fastMA, color=color.blue, title="Fast MA")

plot(slowMA, color=color.red, title="Slow MA")

// Trading signals

longCondition = crossover(fastMA, slowMA)

shortCondition = crossunder(fastMA, slowMA)

// Position sizing based on percentage risk

riskPerTrade = input(2, title="Risk Per Trade (%)", minval=1, maxval=10, step=0.5)

equity = strategy.equity

lotSize = (equity * riskPercentage) / (riskPerTrade * 100)

strategy.entry("Buy", strategy.long, when=longCondition)

strategy.close("Buy", when=shortCondition)

strategy.entry("Sell", strategy.short, when=shortCondition)

strategy.close("Sell", when=longCondition)

// Plot trades on the chart using plotshape

plotshape(series=longCondition, color=color.green, style=shape.triangleup, location=location.belowbar, size=size.small, title="Buy Signal")

plotshape(series=shortCondition, color=color.red, style=shape.triangledown, location=location.abovebar, size=size.small, title="Sell Signal")

// Alerts

alertcondition(longCondition, title="Buy Signal", message="Buy Signal!")

alertcondition(shortCondition, title="Sell Signal", message="Sell Signal!")

Detail

https://www.fmz.com/strategy/441144

Last Modified

2024-02-06 10:27:56