Name

动量均线信封交易策略Moving-Average-Envelopes-Trading-Strategy

Author

ChaoZhang

Strategy Description

动量均线信封交易策略是一种趋势跟踪策略。它通过设置移动均线以及上下两个百分比区间作为买卖信号。当价格突破上行或下行区间时产生交易信号。该策略既可以用于趋势跟踪,也可以用于识别超买超卖的市场状态。

该策略基于长度为14的简单移动均线。上行百分比区间计算为:移动均线 + 移动均线 × 输入的百分比数值。下行百分比区间计算为:移动均线 - 移动均线 × 输入的百分比数值。这样就形成了上下平行的交易区间带。

当收盘价格大于上行区间时,做多;当收盘价格小于下行区间时,做空。否则保持空仓。输入参数“reverse”可实现反向操作。

该策略使用了3个指标:

-

xSMA - 14周期的简单移动均线,代表中线。

-

xHighBand - 上行百分比区间。

-

xLowBand - 下行百分比区间。

该策略具有以下优势:

-

规则清晰,容易理解和实现。

-

可用于趋势跟踪,也可用于识别超买超卖。避免在震荡行情中错失方向。

-

通过调整百分比区间参数,可以控制交易频率。降低交易风险。

-

可灵活选择移动均线周期,适用于不同周期和市场品种。

-

反向输入参数增加策略灵活性。可顺势操作,也可逆势操作。

该策略也存在一些风险:

-

在强势趋势中,有可能出现超过区间范围的深度拉升或回落。导致错过部分利润。可通过降低百分比区间控制风险。

-

在震荡行情中,可能出现频繁的错误交易信号。可通过增加移动均线周期来过滤信号。

-

区间范围较小时,价格可能出现频繁触及上下区间的情况。交易频率过高增加交易成本和滑点损失。可适当扩大区间范围。

-

快速变化的突发事件可能导致策略亏损。建议结合止损来管理风险。

该策略可从以下几个方面进行优化:

-

测试不同长度周期的移动均线,选择产生信号最佳的周期参数。

-

优化上下百分比区间参数,找到最大化盈利且风险可控的组合参数。

-

添加其他技术指标作为过滤器,避免在震荡和复杂行情中产生错误信号。例如MACD,KD等。

-

结合趋势判断指标,改进入场timing。例如ADX,中断等。

-

测试不同品种参数实效性。调整参数适应不同交易品种。

-

结合止损策略,限制单笔亏损风险。

动量均线信封交易策略整体来说是一个典型的趋势跟踪策略。它参数设置简单,易于理解和回测。同时也可用于判断超买超卖的复杂行情。通过参数优化和指标组合,可以大幅提高策略实盘效果。该策略值得进一步研究和应用。

||

The Moving Average Envelopes trading strategy is a trend following strategy. It sets up percentage envelopes above and below a moving average line as trading signals when price breaks out the envelopes. The strategy can be used for both trend following and identifying overbought/oversold market conditions.

The strategy is based on a 14-period simple moving average (SMA). The upper envelope is calculated as: SMA + SMA × input percentage. The lower envelope is calculated as: SMA - SMA × input percentage. This forms up and down trading bands parallel to the SMA.

When close price goes above the upper band, a long position is taken. When close price goes below the lower band, a short position is taken. Otherwise, maintain a flat position. The input parameter "reverse" allows reverse trading.

The strategy uses 3 indicators:

-

xSMA - 14-period simple moving average, the midline.

-

xHighBand - Upper percentage envelope.

-

xLowBand - Lower percentage envelope.

The advantages of this strategy include:

-

Simple logic, easy to understand and implement.

-

Can be used for both trend following and identifying overbought/oversold levels. Avoids missing trends in rangy markets.

-

Trade frequency can be controlled by adjusting the percentage envelopes parameters. Lowers trading risk.

-

Flexibility in choosing moving average periods for different timeframes and instruments.

-

The reverse input parameter adds flexibility. Can trade with or against the trend.

There are some risks to the strategy:

-

Deep pullbacks beyond the envelope range can happen in strong trends, missing some profits. Can lower percentage parameters to control risk.

-

Frequent false signals may occur in choppy/ranging markets. Can increase moving average period to filter signals.

-

Too narrow envelopes may trigger excessive whipsaws. Can wisely widen envelope range.

-

Sudden volatility from news events can cause losses. Using stop loss helps manage risk.

The strategy can be optimized:

-

Test moving averages of different periods and find optimal parameters with best signals.

-

Optimize percentage envelopes for maximum profitability and controllable risk.

-

Adding filters like MACD and KD to avoid bad signals in choppy/complex market conditions.

-

Combine with trend strength indicators like ADX to improve entry timing.

-

Test effectiveness across different instruments. Customize parameters per product.

-

Incorporate stop loss strategy to limit downside risk per trade.

Overall this is a typical trend following strategy with easy backtesting parameters. It can also identify overbought/oversold levels. Further parameter optimization and combination with other indicators can significantly improve its practical effectiveness for trading. This is a valuable strategy worthy of further research and application.

[/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_1 | 14 | Length |

| v_input_2 | true | PercentShift |

| v_input_3 | false | Trade reverse |

Source (PineScript)

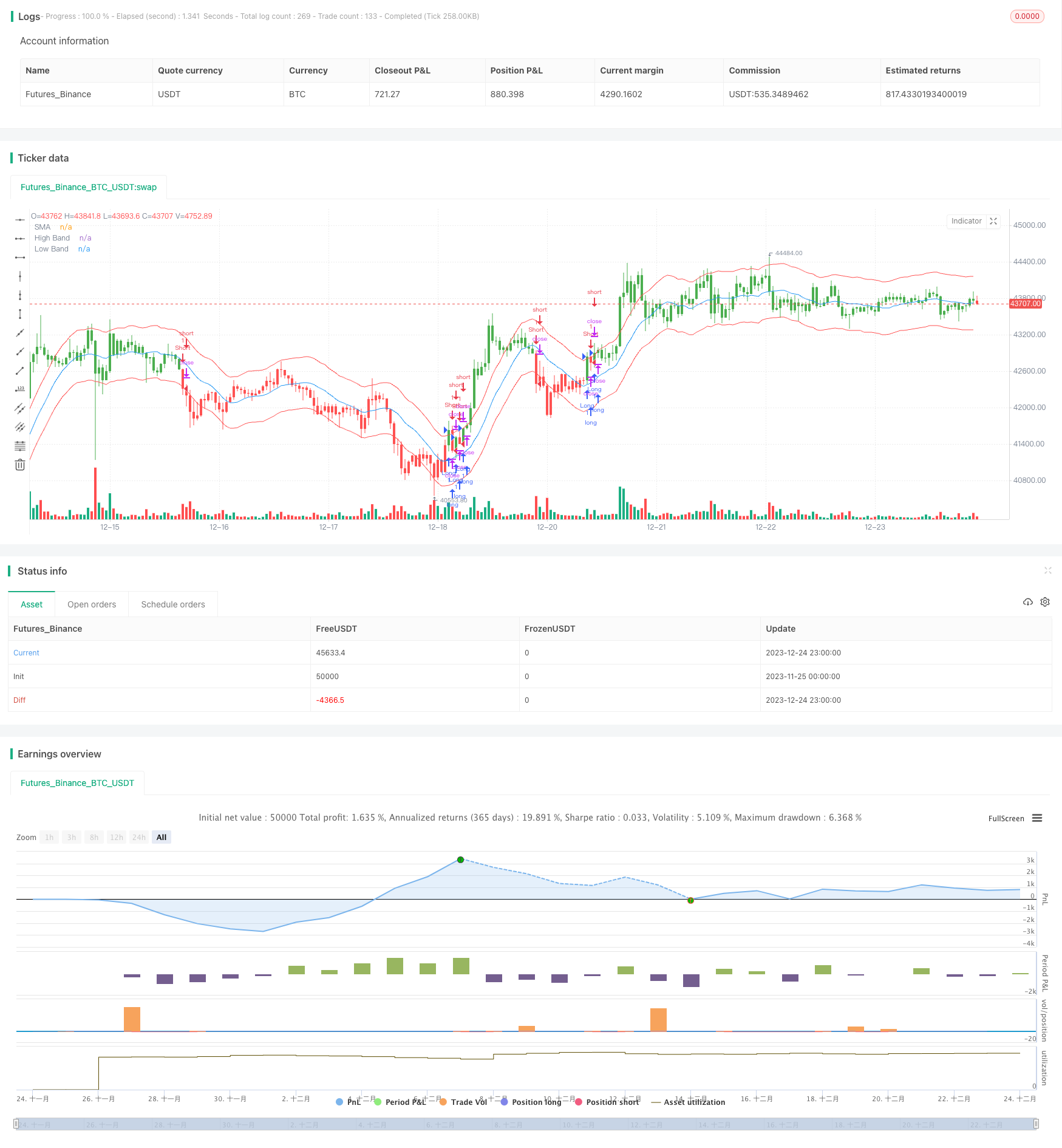

/*backtest

start: 2023-11-25 00:00:00

end: 2023-12-25 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=2

////////////////////////////////////////////////////////////

// Copyright by HPotter v1.0 04/03/2018

// Moving Average Envelopes are percentage-based envelopes set above and

// below a moving average. The moving average, which forms the base for

// this indicator, can be a simple or exponential moving average. Each

// envelope is then set the same percentage above or below the moving average.

// This creates parallel bands that follow price action. With a moving average

// as the base, Moving Average Envelopes can be used as a trend following indicator.

// However, this indicator is not limited to just trend following. The envelopes

// can also be used to identify overbought and oversold levels when the trend is

// relatively flat.

//

// You can change long to short in the Input Settings

// WARNING:

// - For purpose educate only

// - This script to change bars colors.

////////////////////////////////////////////////////////////

strategy(title="Moving Average Envelopes", overlay = true)

Length = input(14, minval=1)

PercentShift = input(1, minval = 0.01, step = 0.01)

reverse = input(false, title="Trade reverse")

xSMA = sma(close, Length)

xHighBand = xSMA + (xSMA * PercentShift / 100)

xLowBand = xSMA - (xSMA * PercentShift / 100)

pos = iff(close > xHighBand, 1,

iff(close <xLowBand, -1, nz(pos[1], 0)))

possig = iff(reverse and pos == 1, -1,

iff(reverse and pos == -1, 1, pos))

if (possig == 1)

strategy.entry("Long", strategy.long)

if (possig == -1)

strategy.entry("Short", strategy.short)

barcolor(possig == -1 ? red: possig == 1 ? green : blue )

plot(xSMA, color=blue, title="SMA")

plot(xHighBand, color=red, title="High Band")

plot(xLowBand, color=red, title="Low Band")

Detail

https://www.fmz.com/strategy/436647

Last Modified

2023-12-26 15:55:43