Name

动态斜率趋势线交易策略Dynamic-Slope-Trend-Line-Trading-Strategy

Author

ChaoZhang

Strategy Description

本策略的核心思想是利用动态斜率判断价格趋势方向,结合突破判断进行交易信号产生。具体来说,它会实时跟踪价格新高点和新低点,根据不同时间段内价格变化计算动态斜率,再结合价格对趋势线的突破情况判断多空信号。

本策略主要分为以下几个步骤:

-

判断最高价和最低价:跟踪一定周期(如20根K线)内的最高价和最低价,判断是否创新高或新低

-

计算动态斜率:记录创新高或新低的K线编号,计算从创新高低点到一定周期(如9根K线)后的高低点的动态斜率

-

绘制趋势线:根据动态斜率,绘制上升和下降的趋势线

-

延长和更新趋势线:当价格突破趋势线时,会延长和更新趋势线

-

交易信号:结合价格对趋势线的突破,判断做多和做空信号

本策略具有以下优势:

-

动态判断趋势方向,灵活应对市场变化

-

能够合理控制止损,回撤小

-

突破交易信号清晰,实现简单

-

可自定义参数,适应性强

-

代码结构清晰,易于理解和二次开发

本策略也存在一些风险:

-

趋势震荡时多头空,建议加入过滤条件

-

突破假信号可能较多,可适当调整参数或加入过滤条件

-

行情剧烈变动时止损风险,可加大止损幅度

-

优化空间有限,盈利能力受限,适合短线交易

本策略可优化的地方包括:

-

加入更多技术指标判断过滤信号

-

优化参数组合,寻找最佳参数

-

尝试改进止损策略,降低风险

-

增加自动调整入场幅度的功能

-

尝试与其他策略组合,发掘更多机会

本策略整体来说是一个基于动态斜率判断趋势并突破交易的高效短线策略。它判断准确,风险可控,适合用来捕捉市场中的短线机会。通过进一步优化参数和加入过滤条件,可以使策略的胜率和盈利水平得到提高。

||

The core idea of this strategy is to use dynamic slope to determine the price trend direction and generate trading signals in combination with breakout judgment. Specifically, it tracks price highs and lows in real time based on price changes over different time periods to calculate the dynamic slope, and then determines long and short signals according to the breakout of price against trend lines.

The main steps of this strategy are:

-

Judge highest and lowest price: Track the highest and lowest prices over a certain cycle (e.g. 20 bars) to determine whether a new high or low has been reached.

-

Calculate dynamic slope: Record the bar number when a new high or low is reached, and calculate the dynamic slope from the new high/low point to the high/low point after a certain cycle (e.g. 9 bars).

-

Plot trend lines: Plot ascending and descending trend lines based on dynamic slopes.

-

Extend and update trend lines: When price breaks through trend lines, extend and update trend lines.

-

Trading signals: Determine long and short signals based on price breakouts against trend lines.

The advantages of this strategy include:

-

Dynamically determine the trend direction for flexibility in response to market changes.

-

Reasonably control stops and minimize drawdowns.

-

Clear breakthrough trading signals that are easy to implement.

-

Customizable parameters for strong adaptability.

-

Clean code structure that is easy to understand and develop further.

There are also some risks with this strategy:

-

Frequent longs and shorts when trend is range-bound. Add filter conditions.

-

Potentially more false signals on breakouts. Adjust parameters or add filters.

-

Stop loss risks when market moves violently. Expand stop loss range.

-

Limited optimization space and profit potential, suitable for short-term trading.

Areas for optimizing the strategy include:

-

Add more technical indicators as filter signals.

-

Optimize parameter combinations for the best parameters.

-

Try to improve stop loss strategies to lower risks.

-

Add functionality to automatically adjust entry price range.

-

Try combining with other strategies to discover more opportunities.

Overall this is an efficient short-term strategy based on using dynamic slope to determine trends and trading breakouts. It has accurate judgments, controllable risks, and is suitable for capturing short-term opportunities in the market. Further optimizations on parameters and adding filters can improve the win rate and profitability.

[/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_1 | 20 | length1 |

| v_input_2 | 9 | check |

| v_input_3 | 0.2 | Take Profit |

| v_input_4 | 0.2 | Stop Loss |

| v_input_5 | 0 | What trades should be taken : : BOTH |

| v_input_6 | false | Initial Stop Loss Points (zero to disable) |

| v_input_7 | false | Initial Target Profit Points (zero for disable) |

| v_input_8 | 2019 | Backtest Start Year |

| v_input_9 | true | Backtest Start Month |

| v_input_10 | true | Backtest Start Day |

| v_input_11 | 9999 | Backtest Stop Year |

| v_input_12 | 12 | Backtest Stop Month |

| v_input_13 | 31 | Backtest Stop Day |

Source (PineScript)

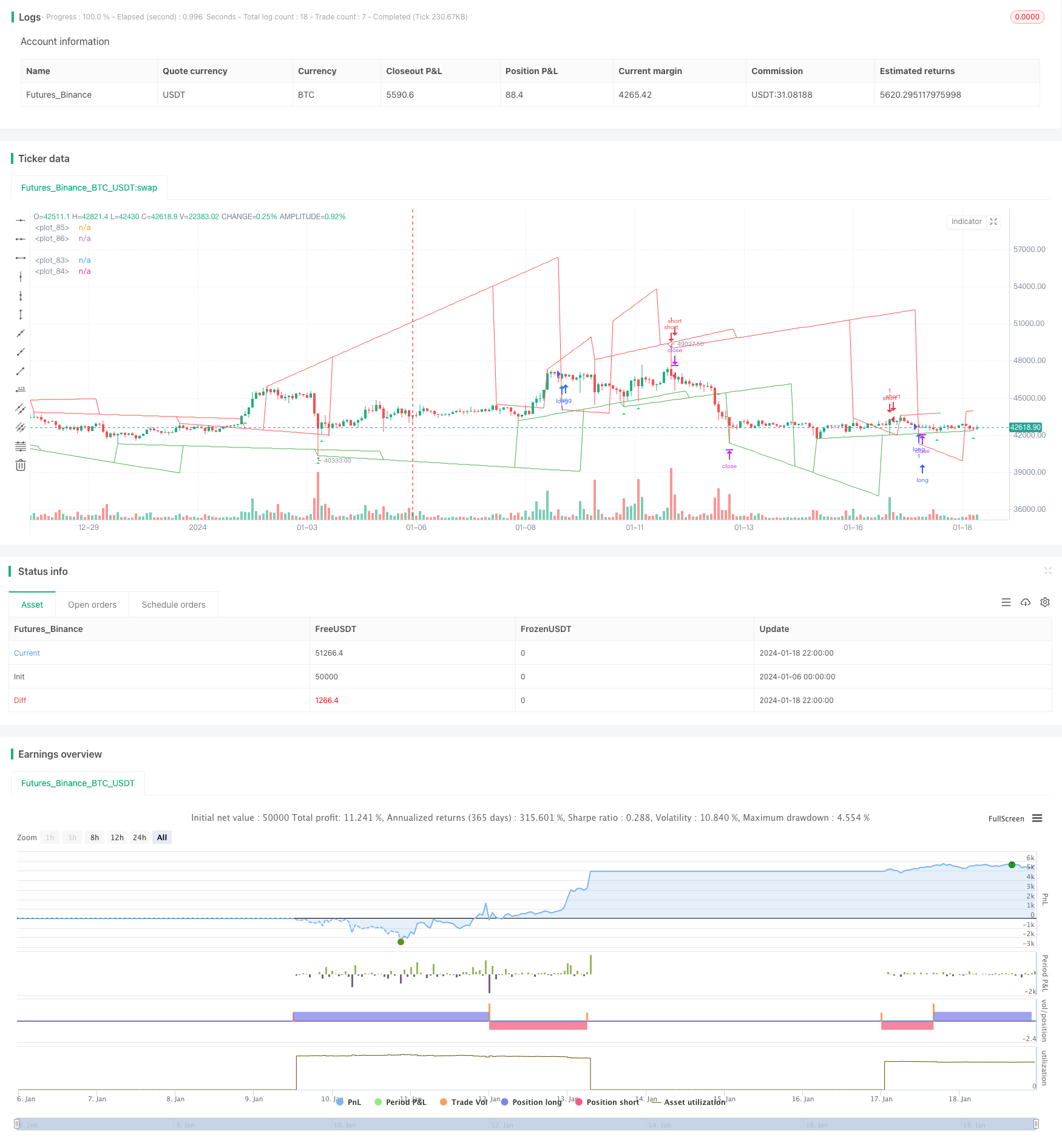

/*backtest

start: 2024-01-06 00:00:00

end: 2024-01-19 00:00:00

period: 2h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © pune3tghai

//Originally posted by matsu_bitmex

//tried adding alerts on plots and cleared the chart for a cleaner view.

//Publishing the script in hope of getting it improved by someone else.

//Added strategy code for easier calculations

//Needs work on TP and SL part.

//P.S - THE ORIGINAL CODE IS MUCH BETTER BUT I have tried to be more usable and understandable.

//@version=4

strategy("TrendLines with Alerts", overlay=true) //study("TrendLines with Alerts", overlay=true)

//update

length1 = input(20)

check = input(9)

//length2 = input(200)

u=0.0

u := u[1]

l=0.0

l := l[1]

y=0.0

y := y[1]

yl=0.0

yl := yl[1]

angle = 0.0

angle := angle[1]

anglel = 0.0

anglel := anglel[1]

if (highest(length1) == high[check] and highest(length1) == highest(length1)[check] and barssince(barstate.isfirst) > check)

u := high[check]

if (lowest(length1) == low[check] and lowest(length1) == lowest(length1)[check] and barssince(barstate.isfirst) > check)

l := low[check]

p = round(barssince(u == high[check]))

pl = round(barssince(l == low[check]))

if p == 0 and barssince(barstate.isfirst) > check

y := high[abs(p[1]+1+check)]

if pl == 0 and barssince(barstate.isfirst) > check

yl := low[abs(pl[1]+1+check)]

if p == 0

angle := (u-y)/p[1]

if pl == 0

anglel := (l-yl)/pl[1]

uppertrend = u+ (p * angle)

lowertrend = l+ (pl * anglel)

extendup = if barssince(barstate.isfirst) > check

uppertrend[check] + angle[check] * check*2

extenddown = if barssince(barstate.isfirst) > check

lowertrend[check] + anglel[check] * check*2

//plot(l[offset]-u,color=red)

//plot(u[offset]-l,color = green )

plot(lowertrend, color = color.green, transp=30,offset = -check)

plot(extenddown, color = color.green, transp=100)

plot(uppertrend, color = color.red, transp=30, offset = -check)

plot(extendup, color = color.red, transp=100)

//plot(l[offset], color = red)

l1 = lowertrend

l2 = extenddown

u1 = uppertrend

u2 = extendup

l2sell = crossunder(high, l2)

u2buy = crossover(low, u2)

buy1 = (low<=lowertrend) and open>lowertrend and high>lowertrend and close>lowertrend

buy2 = (low<=extenddown) and open>extenddown and high>extenddown and close>extenddown

buy = buy1 or buy2 or u2buy

plotshape(series=buy, title="Buy", style=shape.triangleup, size=size.tiny, color=color.lime, location=location.belowbar)

sell1 = (high>=uppertrend) and open<uppertrend and low<uppertrend and close<uppertrend

sell2 = (high>=extendup) and open<extendup and low<extendup and close<extendup

sell = sell1 or sell2 or l2sell

plotshape(series=sell, title="Sell", style=shape.triangledown, size=size.tiny, color=color.red, location=location.abovebar)

longCond = buy

shortCond = sell

tp = input(0.2, title="Take Profit")

tpbuyval = valuewhen(buy, close, 1) + (tp/100)*(valuewhen(buy, close, 1))

tpsellval = valuewhen(sell, close, 1) - (tp/100)*(valuewhen(sell, close, 1))

sl = input(0.2, title="Stop Loss")

slbuyval = valuewhen(buy, close, 0) - (sl/100)*(valuewhen(buy, close, 0))

slsellval = valuewhen(sell, close, 0) + (sl/100)*(valuewhen(sell, close, 0))

// === STRATEGY ===

tradeType = input("BOTH", title="What trades should be taken : ", options=["LONG", "SHORT", "BOTH", "NONE"])

// stop loss

slPoints = input(defval=0, title="Initial Stop Loss Points (zero to disable)", minval=0)

tpPoints = input(defval=0, title="Initial Target Profit Points (zero for disable)", minval=0)

//>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>//

testStartYear = input(2019, "Backtest Start Year", minval=1980)

testStartMonth = input(1, "Backtest Start Month", minval=1, maxval=12)

testStartDay = input(1, "Backtest Start Day", minval=1, maxval=31)

testPeriodStart = timestamp(testStartYear, testStartMonth, testStartDay, 0, 0)

testStopYear = input(9999, "Backtest Stop Year", minval=1980)

testStopMonth = input(12, "Backtest Stop Month", minval=1, maxval=12)

testStopDay = input(31, "Backtest Stop Day", minval=1, maxval=31)

testPeriodStop = timestamp(testStopYear, testStopMonth, testStopDay, 0, 0)

testPeriod() =>

time >= testPeriodStart and time <= testPeriodStop ? true : false

//<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<//

//

//set up exit parameters

TP = tpPoints > 0 ? tpPoints : na

SL = slPoints > 0 ? slPoints : na

// Make sure we are within the bar range, Set up entries and exit conditions

if testPeriod() and tradeType != "NONE"

strategy.entry("long", strategy.long, when=longCond == true and tradeType != "SHORT")

strategy.entry("short", strategy.short, when=shortCond == true and tradeType != "LONG")

strategy.close("long", when=shortCond == true and tradeType == "LONG")

strategy.close("short", when=longCond == true and tradeType == "SHORT")

strategy.exit("XL", from_entry="long", profit=tpbuyval, loss=slbuyval)

strategy.exit("XS", from_entry="short", profit=tpsellval, loss=slsellval)

// === /STRATEGY ===

//EOF

////ALERT SYNTEX

//alertcondition(longCond, title="Long", message="Killer Market")

//alertcondition(shortCond, title="Short", message="Poopy Market")

Detail

https://www.fmz.com/strategy/441159

Last Modified

2024-02-06 11:51:14